SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

yalgaar

Mem_C-

Posts

209 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by yalgaar

-

Been doing a lot of study lately about developing my own edge to invest/trade the markets. While doing this I wondered why a Option contact was designed to be 100 units of underlying! Have anyone here wondered about this as well? Why not allow a trader to choose whatever size! This might only help the overall trading community as well as brokers. This would allow many traders to trade Option contracts who are not able to trade currently merely for not having enough capital to cover the margin for 1 contact (100 units of undelying) I wonder if there was a broker who allowed this? I do know Robinhood allows you to do this for stock buy/sell but would be nice to have it for Options as well. Thoughts?

-

@DubMcDub Thanks for sharing. I totally understand you not being an investment advisor but I value the information you share. Now if you don't mind to share how you allocate to these various funds and your reasoning for the same. Bottom line, what are your expectations from this on annual basis? What kind of drawdowns do you expect to see on this and are comfortable to accept it?

-

Thanks for your concerns. I appreciate it. Where would you invest your retirement funds?

-

@DubMcDub Thanks for your replies. Helped me a lot. I do have several 401K accounts with my previous employed that I intend to transfer the funds into 1 or more IRA accounts with TD Ameritrade. Would you be concerns about anything doing this? You are right UPRO and SSO are 3x and 2x leveraged ETFs. I understand the risk in it...but I would be having hedges accordingly. I am still working on things. But what I wanted to know is if those ETFs were overall secured. I mean if it was possible to lose all my money because of the fund manager institution going bankrupt. These are retirement funds we are talking about so just trying to ensure everything. I meant TD Ameritrade as a company. What is my safety/security for my funds with them? I know very little understanding of these things so doing my diligence before commitment of substantial (for me at least) retirement funds.

-

I am considering long term passive investments Options and had a few concerns about the same. I was wondering if any of the members here had the following same/similar challenges: 1) If I want to just invest some amount of my capital in an Index fund. Lets say "SPY" what is the best way to do so? The only way I know of is to have an account with broker like TD Ameritrade and just but whatever quantity of SPY I want to invest and that is it. Are there any other better ways to do this? 2) Besides SPY there are many other funds that I am interested in. e.g. UPRO, TMF, TYD, SSO, UBT, UST. I want to know if you would be concerned about anything investing in any of these funds? 3) Do I ever need to worry about my money with TD Ameritrade while buying any of the above funds?

-

Thank you. Will sure be back soon. Want to have my mindset and expectations right.

-

Good Morning SO Members I have decided to take a break for now from SO. I realized I am not able to invest enough time and effort that is needed to learn the SO strategies and make it my own. My wrong expectation about just following the official trades did create a lot of frustration as well and make my learning curve even more steeper. I have decided to just take a break for now until I can come back with a clean mind and with right attitude of just learning. I wanted to thank all of you for all the guidance and knowledge you shared with me during my journey. I sure have learnt a lot during this time I spent here. Take care and happy trading. Regards Yalgaar

-

Can someone suggest me where can I get Historic Data of any assets in Excel format? Basically I need the Open, High, Low, Close data on a "daily" timeframe. I am able to get this from "finance.yahoo.com" But I am not able to go more than 2 years. I need at the least starting from 2005. Any help appreciated.

-

@Kim @cwelsh Trying to understand more about Anchor system. So have following specific questions: 1) Let's say I want to start Anchor today. What is the recommended capital to start. 2) What exact trades I would be taking tomorrow morning to start? 3) Are there any challenges with fills for doing this system? 4) Can you explain me a situation when you would lose money in Anchor? 5) Can you explain a situation when you would under perform SPX?

-

Agreed. It helps you understand basics of how strategy works. The dynamics of how all different greeks impact the P&L. I agree anyone and everyone should do it. I am not denying that. But being told you should paper trade when you are losing money following official trades does not make sense!

-

@Kim Seems like you have misunderstood my statement about Paper Trading. So let me clarify. I agree paper trading is of immense value for a beginner to learn basics of Options Trading and understand your broker platform and how to use it. But to me that's about it. I personally know all that since over 8-10 years. As far as SO trades are concerned for someone like me who already knows all the basics of Options trading....I still believe Paper trading is useless. I say this because there is nothing more to learn from it....as a matter of fact it could be quite dangerous since it would give you a false sense of profit expectations since there are no real fills. I respectfully disagree with you here. I do believe there are people, companies that provide you services that you can follow their trades and make consistent income. It does require a good amount of due diligence to find out if they are real. Too much CRAP out there. I am all ears to listen to all you experts. I am not giving up so easy. I never do. I do understand now I had wrong expectations. I did believe I can follow the Official trades and make at the least 50-70% of its performance and it would all be good. But I now understand the dynamics of this and that it cannot be achieved the way I thought it could be. But I still do believe if you can do it, Yowster can do it....many members here can do it......and I am getting the privilege to ask you all how you do it....then I can't think of any reason why I will not be able to do it in time.

-

I very quickly realized paper trading means nothing at all. It is completely useless and waste of time. There might be some value of paper trading to only someone who is complete beginner and still trying to learn very basics of trade, the platform and how Options trading overall works. Getting proper fills for the trades enter is everything. I can completely relate. I am glad there is at least 1 more person with similar experience. Like I have mentioned in my posts, I have concluded following trades will not make you money. Most likely you will lose money. I know many members do not agree with me but I don't conclude things without thorough testing. Just like you my expectations were also to just follow the official trades and make at least 50% of returns of official trades while I learn and gradually make 100% of better of the official trades. But I realized we cannot make the same returns as official trades by following it. These were my expectations as well. I wanted to just execute the trades make money from it while gradually learning and get even better at it. But that really didn't happen for me. About learning the techniques of the SO trades and make it our own. What still impresses me about SO is Kim's integrity and honesty. He is a very smart guy and have amazing business sense and he is doing a great work with this service and the most important thing is he is honest......While reporting each and every trade honestly with real fills and still generating the kind of returns is amazing! Even though I am not able to generate the same performance, not even close....who is stopping me from doing that!!! I will it's just me....Kim and Yowster and so many members here are willing to and happy to share every logic in detail about why a certain trade is taken....why it's closed! It may all be difficult but who is stopping us from learning that? They are willing to teach and are very happy to....why not put in our time and effort to learn it.

-

100% agree on that. I have witnessed several of them myself. I was super skeptical about SO as well for many reasons but everything checked out fine for me. I still would like to make similar performance as official Trades. I do know I have the aptitude for it. I just need to to a better job to ask better question which I will going forward.

-

Great respect if this is the case. But this is also a smart business decision for longevity in any business.

-

Very well said @Ringandpinion I am sure going to grab a beer in a few! Cheers to you! 🙂 Maybe we should have zoom meeting setup and talk about these things. I am sure a lot of things that has been said the way it was said about be quite different and would beinterpretedd in a more positive way.

-

@Kim I am not new to trading nor to Options trading. I just didn't find a way to consistently profit from what I have been doing all these years. I have a very long background in risk management and position sizing due to my Forex trading experience. I just feel intentionally or not the official trade performance page just suggests same/similar or better performance can be achieved by the members and still being suggested. But that is really far from truth due to many reasons. I am not criticizing you personally, I am just stating my experience here so far. I have sure learnt a lot and still intend to learn much more from here as time permit me from my super crazy schedule. All I ask is better disclaimers so no new members get a false expectations like me. I also think some improvements can be made in the current format. I will put something together as soon as I get more time. I mean I notice there are many many questions just being repeated from many members including me about why certain trade was taken in certain way. I believe this is due to the some of the pages where the original strategy is described is either outdated or needs more details. Even thought it has been described very well but due to the dynamics and complexities of each trade, it sure needs improvements.

-

Thanks for many members for your suggestions and your opinions. It's sad how my thread is taken a very wrong direction of what it was intended for. I am amazed at all the wealth of information SO has offered me and thankful to Kim. I sure have learnt a lot. Not sure why my thoughts and my opinions have been taken negatively instead of being thanked for. I believe I am only helping Kim and SO to make this even better for all current and future members. I am sorry if Kim or anyone does not like me expressing my results, opinions and my thoughts. The fact does not change that I have lost money and do feel mislead due to the the way SO is marketed. Now that I realized the performance page is not something that can be achieved by following the official trades....I have some deep thinking to do about the educational value of SO and the cost to pay for it. If I go 3-4 months back, had I been told clearly that I would lose money following official trades for no fault of errors on my part....I would evaluate SO in a totally different way. I am sure no one can deny the juicy carrot being dangled luring you into this.

-

@Kim you are downvoting my posts for suggesting things that would make me value this service more? You are down voting me for speaking up that I felt mislead? About the disclaimers: "Start with paper trading, start small" This means nothing in Options trading on the context I am referring to. Every strategy and every trade mentioned here will out perform the official performance giving a false idea of profiting to an inexperienced trader. "Learn the strategies and make them your own" This is very good, I really like it. But again I am saying there should be a disclaimer suggesting that following official trades will not make you money. I and I believe most people are misinformed based on the performance page.

-

@Kim Reading some of your posts directed to me, I want to clarify I have no inclinations to argue and waste my or anyone's time. All I wanted is to share my thoughts about my last 3+ months here and my challenges. I wanted to find out how and what I need to further improve. But I find this being not taken in the positive way. I wanted to share my conclusions and learn from community opinions. I don't expect anyone to agree with me. We all have right to our own testing and our opinions about things. I saw value in SO in the following ways when I subscribed: 1) The performance page showed amazing returns. I hoped I could make some % of it in a consistent manner. After following official trades, I realized one just cannot make money just following the official trades. I understand this has been told many time but I wish there were a few more disclaimers in bold about this. I find being mislead and misinformed about this. Why not have 1 page article as will along with 1000s of pages that describes how following official trades here will not make you money with details of all the dynamics about it? 2) The other value is the education of Options trading. I sure realized there is an ocean of knowledge and information that will help me learn. I was amazed at the wealth of information I found here....the whole format of official trade being taken and all the member discussions is really of so much value. I cannot put a price tag to this. You keep comparing what is being offered here with Medical degree and Engineering degree and reasonable expectations from it. I don't think this can be compared. Very wrong comparison! I would like to conclude that I find this service being not marketed as Options education service.....it is being marketed as "Alert service" even though you don't a say it that way. I believe with respect to Options Education, this is an amazing place to be. My suggestions: 1) In the "Must Read" articles, have a page with a disclaimer that the performance showed in the official trades will most likely not be realized by the members and the reasons for it. This will set expectations right. 2) Have a weekly / monthly poll from existing members if they were able to match the official performance. This will further keep things transparent. 3) I have asked this before but still wondering why not disclose number of members. This is vital for the members taking the official trades. As a matter of fact 1 of the reasons why many members are not getting good fills. Don't all members need to know how many estimated orders we are competing with to get a fill at a reasonable price? 4) Change "Performance Page" available to members only. This way a new member is joining this service for education expectation and not make money in 3 months expectation.

-

I hear this all the time when a person trying to learn a skill and willing to put in all the hard work and still not making progress. This usually comes from the person who continues to make money while the person trying to learn and master is the one spending it. 🙂 On the contrary to what you say, most successful traders who make consistent good returns use a very simple system that is easy to follow. You must really be kidding comparing a University degree and what is offered here! I have noticed you have mentioned this multiple times. I am not going to be the one telling you the differences. Granted, there is amazing content here related to understanding Options trading. But I will have to say in the end anything and everything boils down to how to make money out of this. I and I am sure almost 100% of the members subscribed based on seeing the juicy performance data of this and not for "Leaning Options trading. I personally found wealth of learning here but I still continue to wonder if I can make money from this. Based on everything that I see here I am skeptical and only sharing my concerns and trying to learn how I can do better if there is still something lacking. Not sure about everyone but I will speak for myself. Your statement is very generalized and quite insulting to me personally since I am all about knowledge and work. But it is very important to spend time and energy on the right education that is sustainable. That said in your opinion is a reasonable expectation from SO subscription? You use works like "years" I don't want to assume anything but are you suggesting it would take years to become profitable while being subscribed here? Again I feel like my post is being taken as a complain while I am just trying to find out what I am missing. Go read the description....go read this and that is really not helping me much. I am not new to trading and the dynamics of it.

-

I wanted to start this thread to discuss what and if I am doing something wrong and maybe even suggest some positive improvements that can be made. I will first start this with declaring I am not making any money using Steady Options so far. As a matter of face I am down around 10-15% of my funds since I started. This is absolutely not intended to criticize this service. The intention is to get to the root of the problem and understand what could be going on. That said, I am going to list the following observations and would love your thoughts about the same: 1) So we all understand this is not an alert service and should not be used that way. I would like to confirm this again since when used as an alert service, it's very unlikely to make money from it. My P&L confirms this. My understanding is that when you are following official trades....you are not getting the same fills as the official trades. In order to get a fill, you end up giving away more money so you end up never matching the performance of official trades. If/when you choose not to offer more money to get the fills, you will more often not get filled at all. I have raised this concern few times but I have been told there is enough liquidy for the underlying that we should be able to get filled at official prices or better.....but it evens out. I personally do not believe this. I have attempted to take every single official trades within reasonable time of it being announced and either do not get filled at all at official price or I just end up spending more to get filled. This happens for over 70% of official trades (my best guess) I am just emphasizing the importance of setting up expectations that Steady Options just cannot be used as a "Alert Service" It will not make you any money. Most likely you will lose money. 2) Ongoing Cost: I find it quite frustrating to have an ongoing cost of closer to $300 a month for the service itself and bare minimum tools required to understand the trades and the dynamics of those trades. That spend would be justified if you could even create returns close to it by investing/risking 10K. But I have not been able to even create ROI for a 10K account even to be able to break even with the cost involved. 3) Learning: I sure have learnt a lot in last 3 months of being on this. I have spent countless hours going through hundreds of articles and thousands of posts here but honestly I still don't find myself having an edge to create a positive returns for my capital. I sure do understand a lot of things better about Options trading before I had joined. But I believe I still can't convert this acquired knowledge into money even with decent funds to invest. 4) Continuing the last point....is it really so difficult to make money Options trading? I mean with 100s of members here with all the great knowledge, why am I not able to still make money? Is it just me? I am really curious how many members here are able to make decent returns. What are they doing differently? I don't claim to be the smartest person....but I do have basic sense to judge what I am capable of and what my weaknesses are. Why do I still not make money here? @Kim Again I would like to clarify that this post is not intended as a complain but an attempt to understand what I could be doing wrong and how I can improve on it. I still believe that by making some changes somewhere (I don't know) any and all members here can achieve same or even better performance than the official trades. I would like to achieve that but I am still not able to figure out how.

-

@borgia Like most people here I only have very good things to say about SO. Following are few things I would like to further add. 1) I have not come across anyone, any service that would publish all past performance data like SO does. This data is based on real fills. I was skeptical about this for a long time and thought like most service SO might also be just cooking these reports to make it look pretty and shiny. I was very wrong! I have personally verified nothing fishy going on over here. I have evaluated more than a dozen of similar services and they all failed my expectation of some basic genuine reporting. Without reporting to me, you have nothing. 2) This is an amazing community of very smart people. Kim and Yowser understand the core dynamics of Options trading. I have not come across anyone with this level of knowledge. 3) You will not come across any service where you can learn so much about the trading. The knowledge you get from here is yours forever. You can use this knowledge in any markets and will always have positive edge. 4. 5. 6. I want to add more to this. But ran out of time. I will update this later.

-

Thanks @Kim & @cwelsh I am considering to invest in the Anchor Strategy and still have the following questions: 1) Which broker do you recommend for this strategy? 2) Just so I understand the dynamics of this strategy I also would like to understand what kind of ROI is expected for the following scenarios. a) SPY performed 25% annually. b) SPY performed 50% annually. c) SPY performed 5% annually d) SPY performed 10% annually. e) SPY lost 25% annually. f) SPY lost 50% annually. g) SPY lost 5% annually h) SPY lost 10% annually. 3) I have read too much information about this and find myself in information overload mode at this point. I was a bit confused about minimum funds for this strategy. I read somewhere around 50K, but I have also read 100K.....as well as like 140K to be fully diversified. Can you please explain the differences? 4) Is there a good time or not so good time to invest in this strategy? I am concerned if this is the worst time to invest?

-

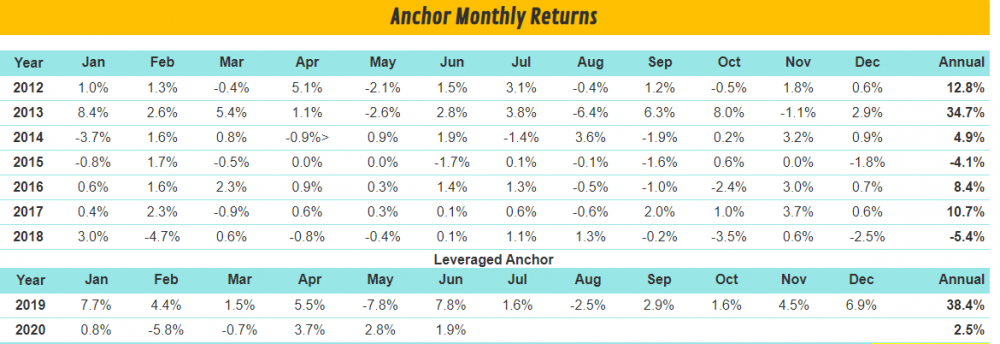

Thanks Kim for your super quick reply on the topic. The leveraged anchor implemented since 2019 sure seems to have outperformed SPX performance. It has also done very well in 2020 like you mentioned. I will check out the links you have sent me.

-

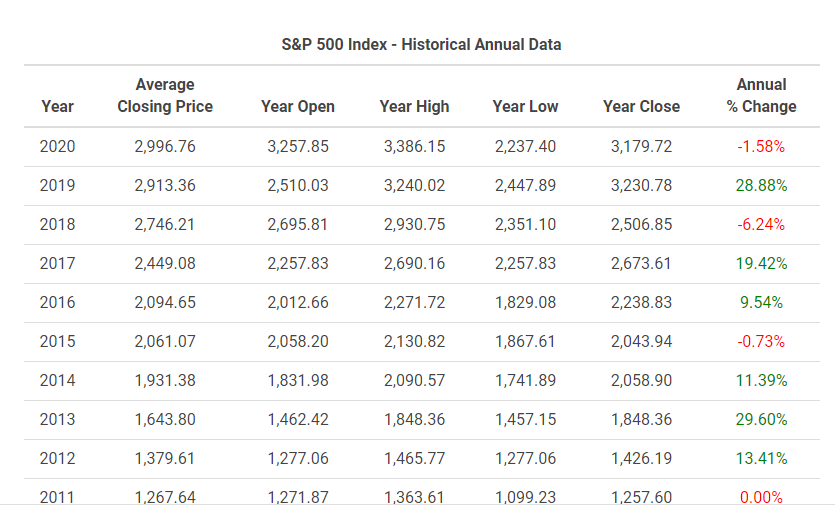

I was just looking at the Anchor Trade performance and comparing it with SPX performance. Seems like SPX has performed better almost every single year. It also has performed better on an Average for the last 10 years. Can someone explain why would one want to trade the anchor strategy as opposed to just invest in SPX? For reference: