SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

OptionsEnthusiast™

Mem_C-

Posts

426 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by OptionsEnthusiast™

-

"Santelli: 'We Used To Think Plunge Protection Was Heresy, Now If You Don't Have It, It's Heresy'" Submitted by Tyler Durden on 07/14/2015 13:19 -0400 http://www.zerohedge.com/news/2015-07-14/santelli-we-used-think-plunge-protection-was-heresy-now-if-you-dont-have-it-its-here

-

"Ex-Plunge Protection Team Whistleblower: 'Governments Control Markets; There Is No Price Discovery Anymore'" http://www.zerohedge.com/news/2015-02-23/ex-plunge-protection-team-whistleblower-governments-control-markets-there-no-price-d

-

In a longer term context: "You Are Here" VIX Seasonality. See: http://www.zerohedge...21/you-are-here

-

"China's "Manipulated" Market To Plunge Another 14%, DeMark Predicts" http://www.zerohedge.com/news/2015-07-28/chinas-manipulated-market-plunge-another-14-demark-predicts The degree of preemptive central bank intervention may be greater now because of how fast China's manipulated markets became unglued. The old adage "Never Fight the Fed" is interesting in this context. As ZeroHedge points out in the linked article "although it's not wise to bet against a central bank, it might be even more dangerous to bet against millions of angry housewives determined to cash out." China's gloomy situation may exacerbate the level of central bank intervention in the U.S. to unprecedented levels increasing the likelihood of losses in bull VIX and VXX positions.

-

My guess is that the FED may state in its own words that "Everything is Awesome" and is "getting better" all the time. The markets will strike higher on that meme. However, the markets will then realize that everything is awesome and on schedule for the FED to begin tightening monetary policy starting in September. At that point, the markets will turn over as institutions will sell into the ramp because the markets are forward looking. Institutions will continue to take long-term profits and increase their cash positions. Central banks will attempt to mitigate the effects of their tightening stance by purchasing eMini futures today and overnight. Central bank intervention is distorting the true impacts of its change in policy. The real action will likely be seen in the bond markets especially at the long end of the yield curve. On Thursday, annualized GDP may show some slowing, but will still come in around 3% which will support the FED meme from Wednesday and the markets will continue to sell off because it will be interpreted as the last chance to get out before the ramp up in interest rates. In retrospect, it would have been best to take gains in VIX positions Monday morning. Wait for the central bank intervention to ramp-up the equity markets today to begin averaging back into VIX positions. VIX is back down in the mid-13s and the VXX is back down in the mid-16s. Overnight, central bank intervention in the eMini markets may reduce volatility even more. This may allow you to enter at even better prices tomorrow morning before the FOMC announcement at 2PM EDT tomorrow afternoon when volatility is likely to spike again barring continued and extreme central banking intervention to mitigate volatility associated with its change in policy. However, the bond markets are likely to see the biggest pullback especially at the long end of the curve. TBT is currently around $46/share and TLT is currently around $121.50/share. Everything Is AWESOME!!! -- The LEGO® Movie The Beatles - Getting Better

-

http://www.zerohedge.com/news/2015-07-24/dear-cftc-here-todays-illegal-spoofing-gold-futures "Dear CFTC: Here Is Today's Illegal "Spoofing" In Gold Futures" Submitted by Tyler Durden on 07/24/2015 15:23 -0400

-

SATURDAY, SEPTEMBER 14, 2013 Revisiting the VIX:VXV Ratiohttp://vixandmore.blogspot.com/2013/09/revisiting-vixvxv-ratio.html

-

Take a Longer View on Volatility The VXV has a three-month window, three times that of the VIX. By BILL LUBY Updated July 2, 2009 12:01 a.m. ET http://online.barrons.com/articles/SB124648899704482887

-

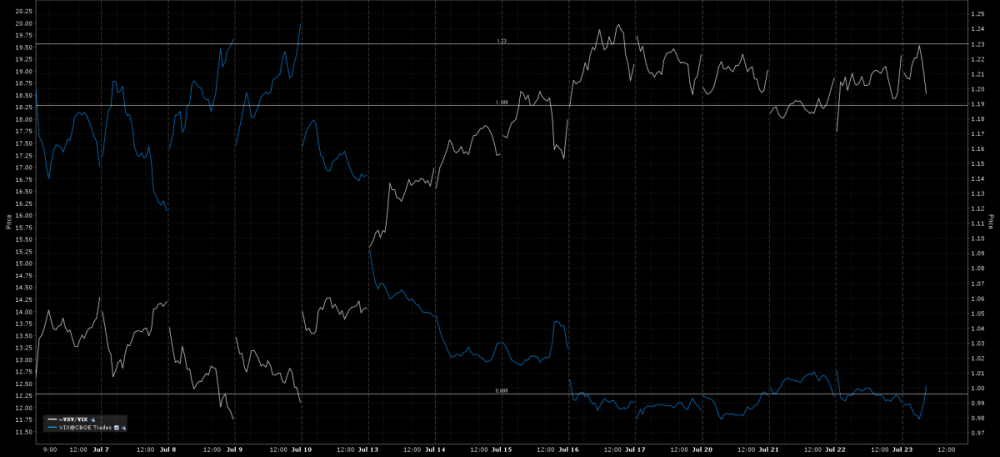

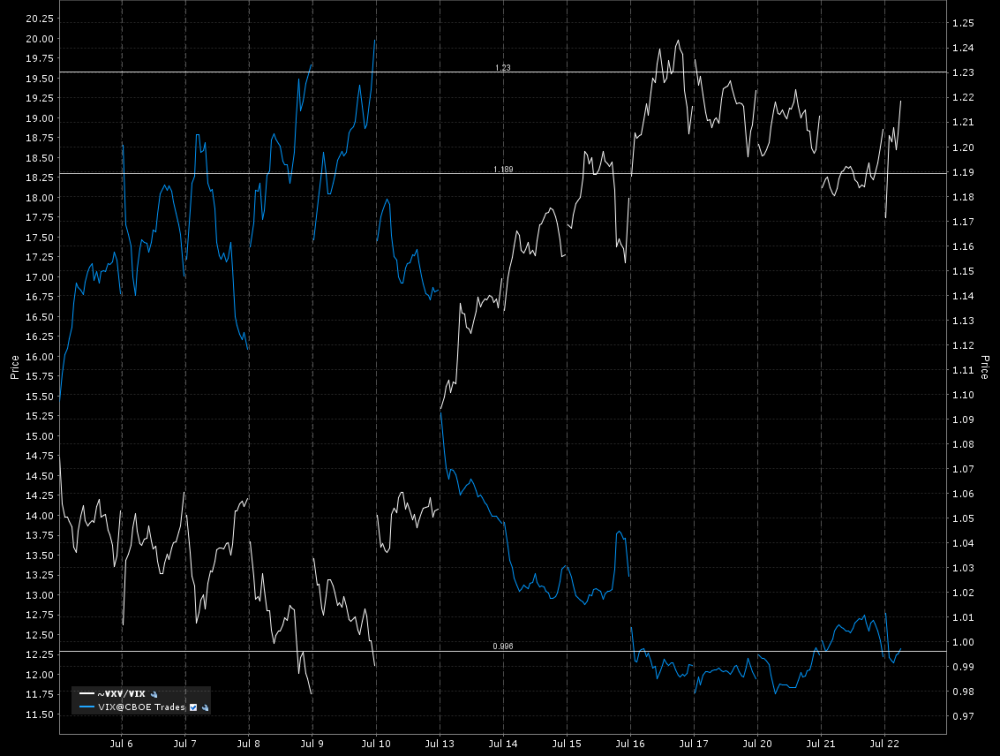

Previous 14 days illustrating the VIX in comparison to the VXV/VIX, and the VXV/VIX bouncing off the 1.23 level today. Source: IB

-

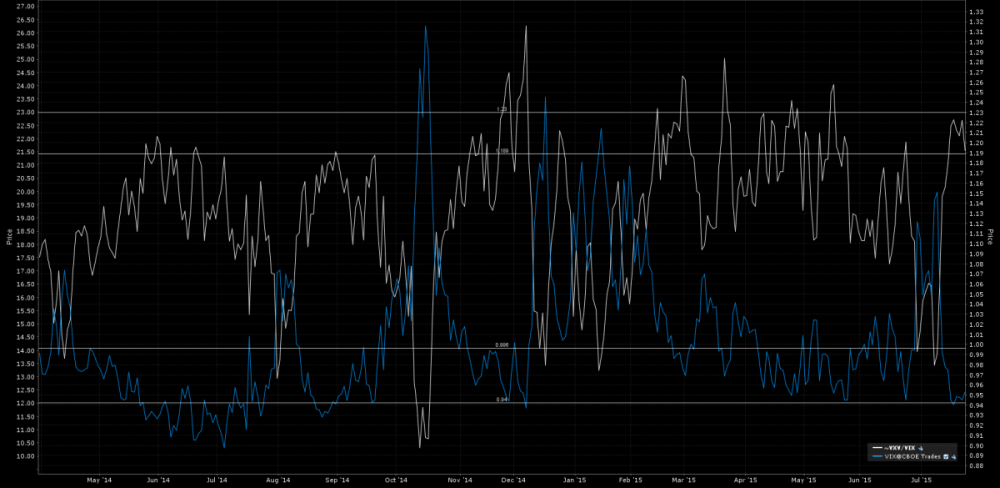

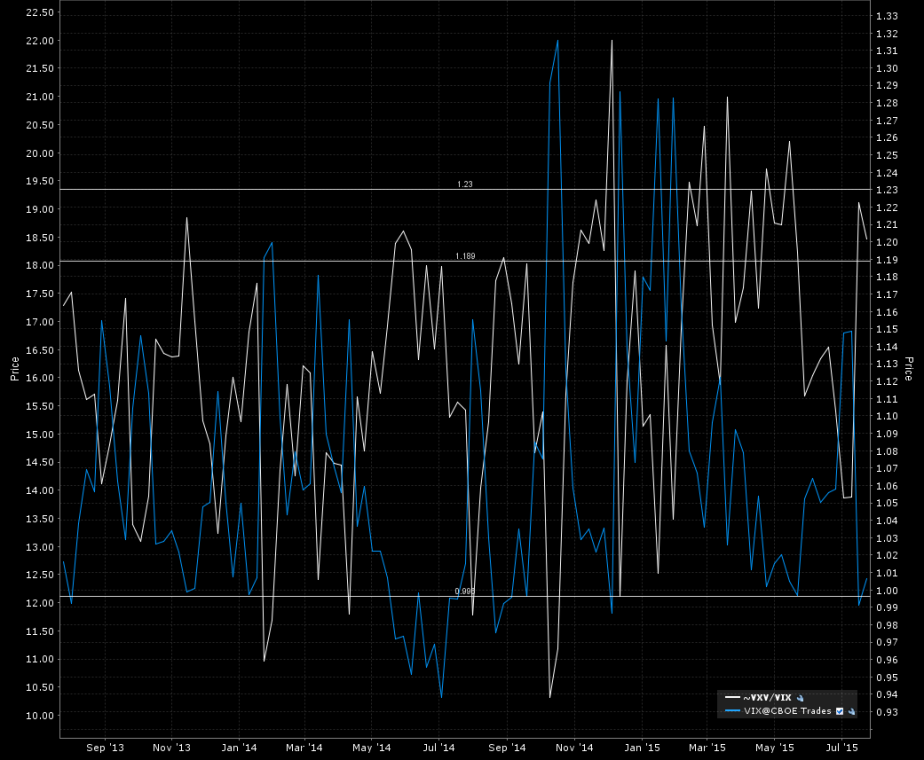

Previous 16 months illustrating the VIX in comparison to the VXV/VIX, and the two month period that the VIX was below 12 in 2014. Source: IB

-

-

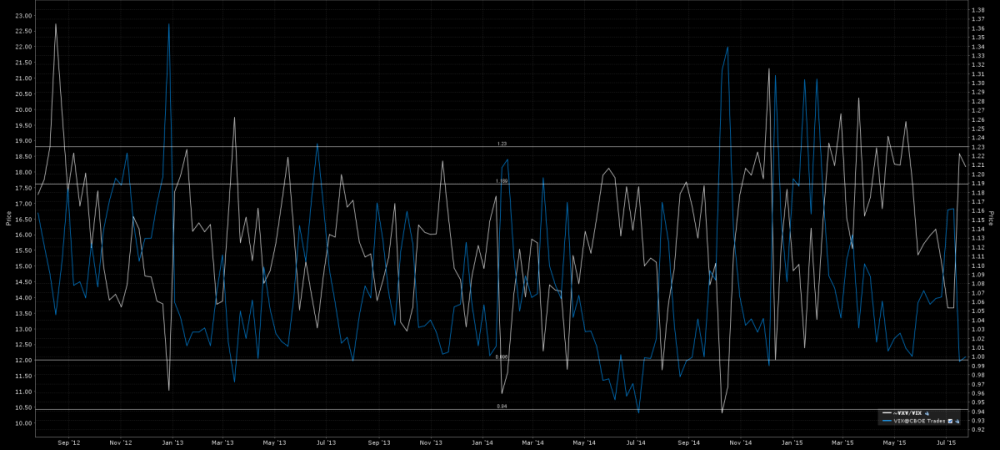

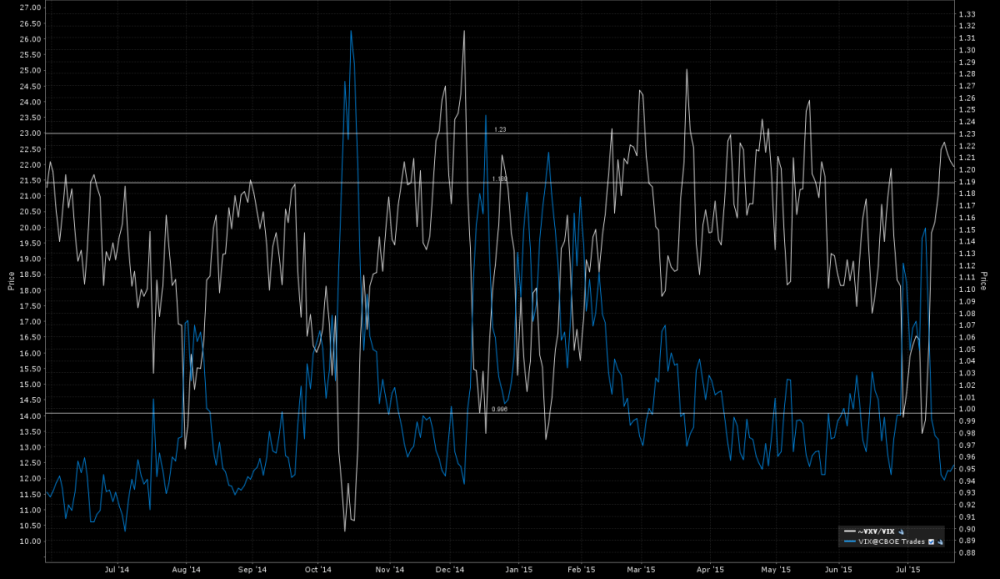

Compare the recent history of the VXV/VIX to pullbacks in the equity markets. When it comes to predicting market corrections over the past year, the VXV/VIX indicator combined with other indicators predicted pullbacks in the equity markets to within a month or so.

-

"BofA Is 'Growing Concerned,' Options Are Signalling A Stock Market Correction Looms" Submitted by Tyler Durden on 11/15/2014 17:25 -0400 http://www.zerohedge.com/news/2014-11-15/bofa-growing-concerned-options-are-signalling-stock-market-correction-looms

-

"BofA Technician Watching 1750 S&P Support: 'Below Here Is Trouble'" Submitted by Tyler Durden on 01/31/2014 13:57 -0400 http://www.zerohedge.com/news/2014-01-31/bofa-technician-watching-1750-sp-support-below-here-trouble

-

"This obscure indicator is a ‘significant concern’" Alex Rosenberg | @CNBCAlex Wednesday, 15 Apr 2015 | 7:23 AM ET http://www.cnbc.com/2015/04/15/this-obscure-indicator-is-a-significant-concern-for-the-market.html

-

http://www.zerohedge.com/news/2015-07-20/case-china%E2%80%99s-missing-gold "The Case Of China’s Missing Gold" Submitted by Tyler Durden on 07/20/2015 19:04 -0400

-

-

-

Previous 14 days illustrating the record-breaking, collapse in the VIX in comparison to the VXV/VIX after the Greek kick-the-can-down-the-road-again bailout. Source: IB

-

"You Are Here" Submitted by Tyler Durden on 07/21/2015 15:31 -0400 http://www.zerohedge.com/news/2015-07-21/you-are-here

-

"The Greatest Collapse In The History Of The VIX Index" Submitted by Tyler Durden on 07/18/2015 15:15 -0400 http://www.zerohedge.com/news/2015-07-18/greatest-collapse-history-vix-index

-

I would expect the bid-asked spread on weekly VIX options to narrow at both higher call deltas and at lower put deltas because option volume in the weekly VIX option contracts should be strong.

-

Weekly VIX options will cause the VIX call deltas to rise to higher strike prices and put deltas will drop to lower strike prices like a monthly VIX option that is one week or less from expiration. Weekly VIX options are primed for hedging short-term event driven volatility spikes and drops. With VIX at 12.00 with just two days left to the July VIX option expiration, the VIX 11.50 call has a delta over .90 while the VIX 16 put has a delta less than -.9 The VIX 14 Put has a delta less than -.75

-

VIX® WeeklysSM Futures and Options http://www.cboe.com/micro/vix-weeklys/default.aspx www.cboe.com/VIXWeeklys CBOE Holdings plans to list weekly expirations for VIX futures and options. VIX Weeklys futures are expected to begin trading at CBOE Futures Exchange (CFE®) in July, subject to regulatory review. VIX Weeklys options are expected to begin trading at Chicago Board Options Exchange® shortly thereafter, also subject to regulatory approval. In 2005, CBOE® pioneered the short term options space by introducing the first weekly expiring options contract. Except for more frequent expiration dates, Weeklys generally have the same contract specifications as monthly expiring contracts. Weekly options traded on CBOE have become extremely popular with investors. For example, SPX Weeklys currently represent approximately 30% of all SPX options volume. New weekly expirations for VIX futures and options will be listed on Thursdays (excluding holidays) and expire on Wednesdays. CBOE and CFE may list up to six consecutive weekly expirations for VIX futures and options. The addition of weekly expirations to standard monthly futures and options expirations offers volatility exposures that more precisely track the performance of the VIX Index. The closer VIX futures and options are to expiration, the more closely they generally track the VIX Index. By 'filling the gaps' between monthly expirations, investors may obtain new opportunities to establish short-term VIX positions, and fine-tune the timing of their hedging and trading activities. Weeklys VIX futures and options on VIX are a different product from previously listed futures and options on the VXSTSMIndex, the CBOE Short-Term Volatility IndexSM. The VIX Index measures a 30-day period of implied volatility while the VXST Index provides a gauge of 9-day implied volatility. CBOE expects that margin and capital requirements for VIX futures and options with weekly expirations will be lower than the margin and capital requirements were for VXST futures and options. Importantly, CBOE expects that quotes on VIX Weeklys will be listed within VIX futures and options chains. VIX Futures Beta Data Contract Expirations and Ticker Symbols The Exchange may list for trading up to six near-term expiration weeks, nine near-term serial months and five months on the February quarterly cycle for the VX futures contract. VX futures that have a "VX" ticker are not counted as part of the six near-term expiration weeks. For example, if 4 near-term VX expiration weeks, 3 near-term serial VX months and 1 VX month on the February quarterly cycle were listed as of April 7, 2016, these expirations would have the following ticker symbols: VX15 (expiring Wednesday, April 13, 2016) VX (expiring Wednesday, April 20, 2016) VX17 (expiring Wednesday, April 27, 2016) VX18 (expiring Wednesday May 4, 2016) VX19 (expiring Wednesday, May 11, 2016) VX (expiring Wednesday, May 18, 2016) VX (expiring Wednesday, June 15, 2016) VX (expiring Wednesday, July 20, 2016) Click here for a link to Quote Vendor Ticker Symbols for CBOE Volatility Index® (VIX®) Futures. Key Links VIX Weeklys Fact Sheet Draft VIX Futures Specifications Including Weeklys Draft VIX Options Specifications Including Weeklys Press Release on VIX Weeklys – May 1, 2015 Term Structure Data Extended Trading Hours

-

Weekly VIX options will be available shortly. This may change how you structure and approach VIX Put calendars and vertical, bull Put spreads.