SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

OptionsEnthusiast™

Mem_C-

Posts

426 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by OptionsEnthusiast™

-

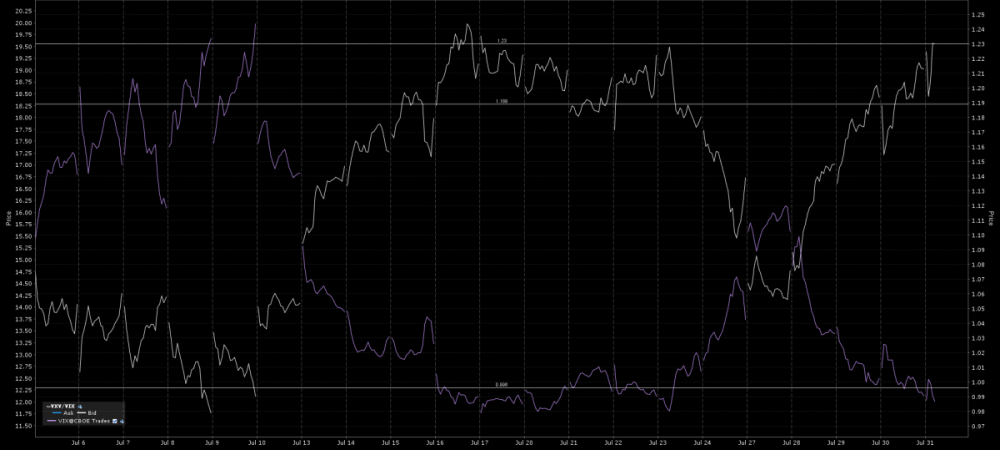

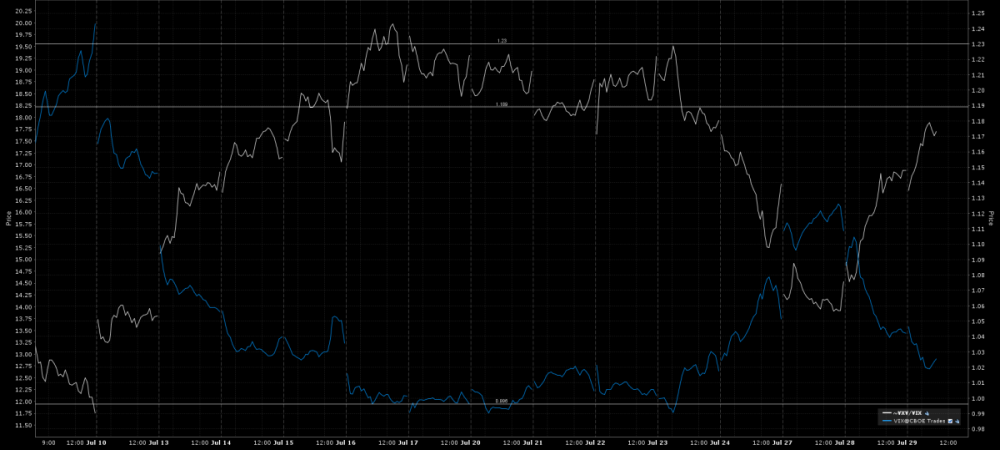

2015.07.31 Intra-day 10.55 EDT VXV/VIX hits 1.23 while VIX breaks below 12! (One Month Chart). Source: IB

-

Worst Wage Growth In History Sparks Bond & Stock Buying Frenzy, Rate Hike Expectations Crater Submitted by Tyler Durden on 07/31/2015 08:49 -0400 http://www.zerohedge.com/news/2015-07-31/worst-wage-growth-history-sparks-bond-stocks-buying-frenzy

-

2015.07.30 The Morning-After Fed Announcement: VIX comparison to the VXV/VIX over the past month. GDP data made the markets flop. The VXV/VIX ratio dipped then recovered back into the "Average-In" range closing tje day between 1.21 and 1.22. VXX closed near record lows @ 16.05 with an after-hours drop down to as low as 15.94. VIX popped then dropped back down into the low 12's. Source: IB

-

Another Day, Another V-Shaped Manic-Melt-Up Recovery In Stocks (To Unchanged) Submitted by Tyler Durden on 07/30/2015 16:04 -0400 http://www.zerohedge.com/news/2015-07-30/another-day-another-v-shaped-manic-melt-recovery-stocks-unchanged Bad language warning!

-

"Timing The VIX: A Lesson In Context" Jul. 30, 2015 12:27 AM Nathan Buehler http://seekingalpha.com/article/3372925-timing-the-vix-a-lesson-in-context?source=intbrokers_regular

-

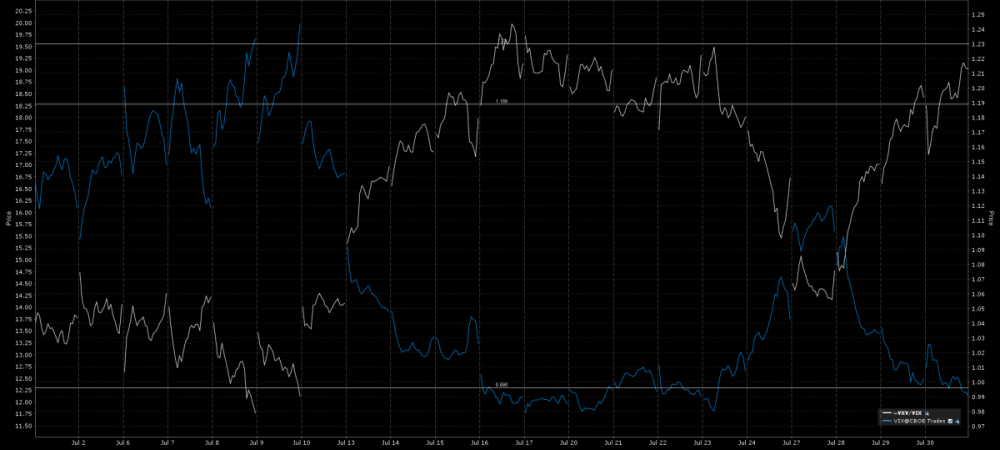

2015.07.29 Post-Fed Announcement, VIX comparison to the VXV/VIX last three weeks includes Greece pre-kick-the-can-down-the-road-bailout spike. Fed announcement propelled the VXV/VIX ratio into the "Average-In" range of bull VIX and VXX positions, but not into the >= 1.23 strong buy-signal range. Source: IB

-

The VXV/VIX ratio remains at or below the 1.20 level as the markets are bought up. At 35 minutes to market close, 'investors' ramp-up purchases popping the VXV/ViX ratio above 1.20 where it remains in a holding pattern. Yawn. -.-

-

VIX "Flash-Crashes" To 11 Handle After Dovish Fed Statement Submitted by Tyler Durden on 07/29/2015 14:46 -0400 http://www.zerohedge.com/news/2015-07-29/vix-flash-crashes-11-handle-after-dovish-fed-statement

-

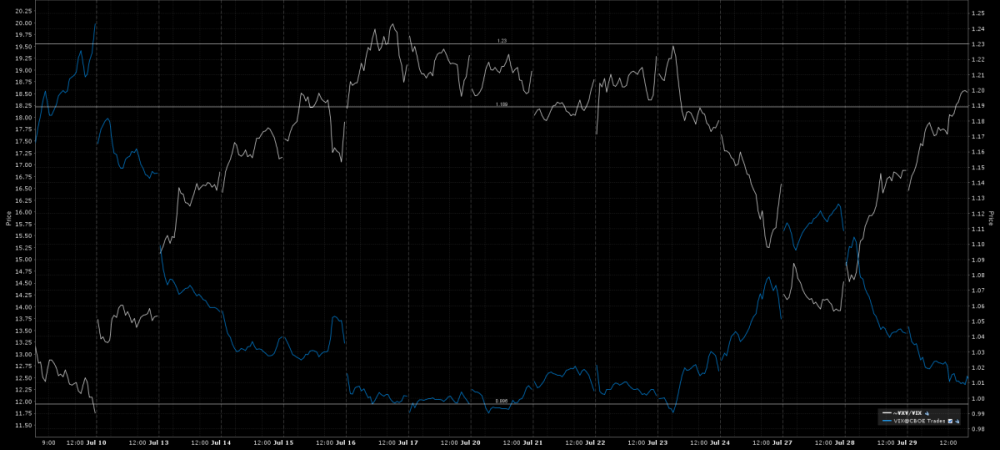

Post Fed Announcement: VXV/VIX spikes momentarily above 1.23, VXX spikes down to 16.06, VIX spikes down to 11.85. Volatility drop tempers out of the market quite quickly. No change in interest rates, and mum on rate hike. "Everything is Awesome" meme confirmed. Some selling into the ramp. Lack of a Fed press conference keeps volatility levels range-bound and constrained after the initial reaction making it difficult to trade. VIX holding around the 12.5 range VXX holding just over 16. Very anti-climatic.

-

"The Most Important Market Trendline Since 2009 Was Just Broken" Submitted by Tyler Durden on 07/27/2015 23:40 -0400 http://www.zerohedge.com/news/2015-07-27/most-important-market-trendline-2009-was-just-broken This is from Monday, but it illustrates the S&P 500 advancing on declining volume, and that an important trend line was broken on Monday before the 'investor' ramp-up on Tuesday.

-

The "Everything is Awesome" meme is picking up steam Pre-FED Announcement INDU +101 +0.57%, SPX +10.0 +0.48% COMP +8.62 +.19% RUT +2.70 +0.22% VIX 12.81 -0.62 -4.61% VXX 16.24 -0.22 -1.33%.

-

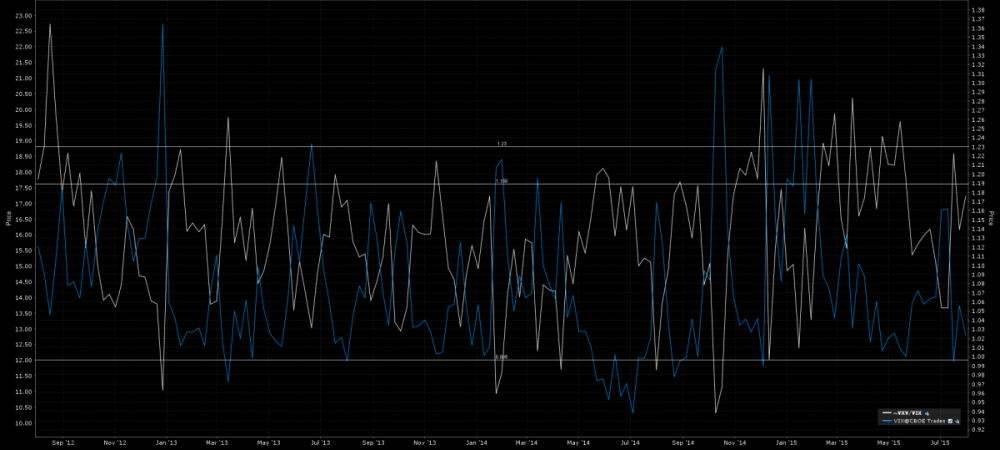

If we see the VIX drop below 12 and the VXV/VIX ratio skyrocket above the 1.20 level again, it may be a good time to consider averaging into your bull VIX and VXX positions. During the past three years, when the VXV/VIX ratio broke above the 1.23 level, it has been an excellent buy-signal for bull VIX and VXX positions. 7/29/2015 Pre-Fed Announcement 3 Year Comparison of VIX to the VXV/VIX ratio: Source: IB

-

Before Fed Announcement, VIX comparison to the VXV/VIX last three weeks includes Greece pre-kick-the-can-down-the-road-bailout spike: Source: IB

-

VIX Vanquished To 12 Handle Ahead Of FOMC Submitted by Tyler Durden on 07/29/2015 10:41 -0400 http://www.zerohedge.com/news/2015-07-29/vix-vanquished-12-handle-ahead-fomc

-

"Supply And Demand In The Gold And Silver Futures Markets" Submitted by Tyler Durden on 07/28/2015 23:15 -0400 http://www.zerohedge.com/news/2015-07-28/supply-and-demand-gold-and-silver-futures-markets

-

"Sometimes They Do Ring The Bell At The Top" Submitted by Tyler Durden on 07/28/2015 10:49 -0400 http://www.zerohedge.com/news/2015-07-28/sometimes-they-do-ring-bell-top

-

"VIX Crashes To 13 Handle" Submitted by Tyler Durden on 07/28/2015 12:23 -0400 http://www.zerohedge.com/news/2015-07-28/vix-crashes-13-handle

-

"Potential outcomes from the upcoming FOMC rate decision..." Submitted by RANSquawk Video on 07/28/2015 15:48 -0400 http://www.zerohedge.com/news/2015-07-28/potential-outcomes-upcoming-fomc-rate-decision

-

"'Investors' Panic-Buy Stocks After Confidence Collapse Sparks Biggest Short-Squeeze In 6 Months" Submitted by Tyler Durden on 07/28/2015 16:03 -0400 http://www.zerohedge.com/news/2015-07-28/investors-panic-buy-stocks-after-confidence-collapse-sparks-biggest-short-squeeze-6-

-

Mad Money Recap mentions VIX and S&P 500 levels and charts in relation to Greece volatility and what will happen if FED holds off on rate increases. http://www.thestreet.com/story/13200171/1/jim-cramers-mad-money-recap-bulls-rout-the-bears-but-will-it-last.html

-

tiktok: Wow, VIX under 11 would mean central bank panic intervention for sure. What was the source of the talking head's optimism?

-

EZASLOW, there is a member discussion forum for August VIX trades. See: https://steadyoptions.com/forum/topic/2745-discussion-vix-august-2015-put-spread/?view=getnewpost

-

TOS has backtesting data on options trades. There are other sources besides TOS for backtesting options trades.

-

It always helps to have backtesting data before you engage in any VIX or VXX trade. However, even if you have all the backtesting information, in a market environment where central banks are heavily manipulating the markets even your best made plans can be destroyed by excessive government intervention.

-

"It's Settled: Central Banks Trade S&P500 Futures" Submitted by Tyler Durden on 09/01/2014 09:02 -0400 http://www.zerohedge.com/news/2014-08-30/its-settled-central-banks-trade-sp500-futures