SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

OptionsEnthusiast™

Mem_C-

Posts

426 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by OptionsEnthusiast™

-

"Understanding VIX futures and options" By Dennis Dzekounoff August 18, 2010 http://www.futuresmag.com/2010/08/17/understanding-vix-futures-and-options?page=1

-

"Strategies with VIX and VSTOXX Futures" "Identifying suitable models for statistical arbitrage" SILVIA STANESCU and RADU TUNARU, KENT BUSINESS SCHOOL, UNIVERSITY OF KENT First published 11 Feb 2014 - See more at: http://www.thehedgefundjournal.com/node/9182#sthash.ZKgUhCli.dpuf

-

The Relationship of Prices of VIX® Futures contracts to the VIX® Index Prices of VIX futures contracts have unique characteristics, because they may be either higher or lower than the underlying VIX index. This occurs because market expectations of volatility in the future may vary from month to month. Assume, for example that today is August 10 and the VIX index is 20. If market expectations are for 30-day implied volatility to be higher than 20 in October and lower than 20 in December, then October VIX futures will be trading at a level above 20 and December VIX futures will be trading below 20. This pricing relationship of the VIX futures relative to the underlying "spot" index is unique. Most futures contracts are based on a "cost of carry" relationship to the underlying instrument, by which the futures contract replicates the performance of the underlying instrument. Replication of an underlying instrument may be as easy as taking a position in a U.S. treasury security or as complex as buying a portfolio of stocks that mirror the performance of the SPX. If a trader has the ability to replicate the performance of the underlying instrument, then he may also take advantage of a "mispricing" between a futures contract and the underlying market. Arbitrage trading firms attempt to take advantage of such "out-of-line pricing" when it occurs. This sort of market activity causes futures contracts to trade within a narrow range "close" to the price of the underlying instrument. In contrast to the arbitrage trading discussed above, the ability to replicate the performance of the VIX index does not exist in the same manner as other financial products or indexes. The VIX index is calculated using the mid-point between the bid and offer of the SPX option contracts, and this mid-point pricing does not necessarily represent a market price where a VIX futures contract may be readily traded. The result is an inability of traders to quickly trade SPX option contracts to lock in a 30-day implied volatility versus the VIX index. With the inability to arbitrage between the VIX index and VIX futures, there is no arbitrage value relationship between the two instruments. The chart below shows the price relationship between the VIX index and the August 2011 VIX futures contract over the last six weeks leading up to August VIX index expiration. The blue line shows the August contract's closing prices and the red line represents the VIX index. Note that, at different times, the futures contract trades at both a premium and a discount to the index during this time period. VIX® Futures (blue) compared to the VIX® Index (red) http://www.cboe.com/strategies/vix/futuresintro/part4.aspx

-

"What Options Are Saying About A Possible September Rate Hike" Submitted by Tyler Durden on 08/17/2015 18:40 -0400 http://www.zerohedge.com/news/2015-08-17/what-options-are-saying-about-possible-september-rate-hike

-

LOLume Lifts Stock; Bonds Bid As Crude, Copper, & Credit Crumble Submitted by Tyler Durden on 08/17/2015 16:05 -0400 http://www.zerohedge.com/news/2015-08-17/lolume-lifts-stock-bonds-bid-crude-copper-credit-crumble

-

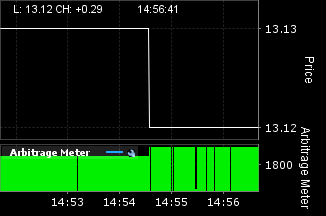

End of Day VIX Arbitrage Meter Continues to Flash Green as Aug VIX options approach expiration: Source: IB

-

High Beta Hammered Amid August Angst, "More Volatility Lies Ahead" Submitted by Tyler Durden on 08/17/2015 14:55 -0400 http://www.zerohedge.com/news/2015-08-17/high-beta-hammered-amid-august-angst-more-volatility-lies-ahead

-

Volume Crash Sparks Monday Meltup In Stocks Submitted by Tyler Durden on 08/17/2015 10:27 -0400 http://www.zerohedge.com/news/2015-08-17/volume-crash-sparks-monday-meltup-stocks

-

This Alarming Indicator Is Back At A Level Last Seen 10 Days Before The Bear Stearns Collapse Submitted by Tyler Durden on 08/14/2015 21:50 -0400 http://www.zerohedge.com/news/2015-08-14/alarming-indicator-back-level-last-seen-10-days-bear-stearns-collapse

-

One-In-A-Billion "Hiccups" Are Happening All The Time, Citi Warns Something Is Wrong Submitted by Tyler Durden on 08/14/2015 23:40 -0400 http://www.zerohedge.com/news/2015-08-14/one-billion-hiccups-are-happening-all-time-citi-warns-something-wrong

-

Bull Market? Half The S&P 500 Are In The "Death Zone" Submitted by Tyler Durden on 08/15/2015 11:16 -0400 http://www.zerohedge.com/news/2015-08-15/bull-market-half-sp-500-are-death-zone

-

The HFT "Treasure Map" - Presenting The Rigged Stock Market's Full "Latency Arbitrage" In One Chart Submitted by Tyler Durden on 08/16/2015 08:55 -0400 http://www.zerohedge.com/news/2015-08-16/hft-treasure-map-presenting-rigged-stock-markets-full-latency-abritrage-one-chart

-

Goldman's 4 Reasons Why The S&P Will Remain Unchanged For The Rest Of 2015 Submitted by Tyler Durden on 08/16/2015 19:04 -0400 http://www.zerohedge.com/news/2015-08-16/goldmans-4-reasons-why-sp-will-remain-unchanged-rest-2015

-

Bouts Of Extreme Volatility Have "Little Obvious Explanation," Citi Warns Submitted by Tyler Durden on 08/16/2015 19:30 -0400 http://www.zerohedge.com/news/2015-08-16/bouts-extreme-volatility-have-little-obvious-explanation-citi-warns

-

-

Key Events In The Coming Week: FOMC, Housing Starts, CPI, TIC Data Submitted by Tyler Durden on 08/17/2015 08:10 -0400 http://www.zerohedge.com/news/2015-08-17/key-events-tthe-coming-week-fomc-housing-starts-cpi-tic-data

-

Bonds & Bullion Surge, Stocks & USD Purge As Fed Credibility Questioned Submitted by Tyler Durden on 08/17/2015 08:48 -0400 http://www.zerohedge.com/news/2015-08-17/bonds-bullion-surge-stocks-usd-purge-fed-credibility-questioned

-

8 Reasons Why The Telegraph Thinks The Market Doomsday Clock Is One Minute To Midnight Submitted by Tyler Durden on 08/17/2015 09:13 -0400 http://www.zerohedge.com/news/2015-08-17/8-reasons-why-telegraph-thinks-market-doomsday-clock-one-minute-midnight

-

-

One-In-A-Billion "Hiccups" Are Happening All The Time, Citi Warns Something Is Wrong Submitted by Tyler Durden on 08/14/2015 18:20 -0400 http://www.zerohedge.com/news/2015-08-14/one-billion-hiccups-are-happening-all-time-citi-warns-something-wrong

-

This Alarming Indicator Is Back At A Level Last Seen 10 Days Before The Bear Stearns Collapse Submitted by Tyler Durden on 08/14/2015 18:50 -0400 http://www.zerohedge.com/news/2015-08-14/alarming-indicator-back-level-last-seen-10-days-bear-stearns-collapse

-

-

Ringing the VIX register this morning.

-

"Something's Happened To Investor Sentiment Since The Financial Crisis" Submitted by Tyler Durden on 08/10/2015 14:26 -0400 http://www.zerohedge.com/news/2015-08-10/somethings-happened-investor-sentiment-financial-crisis

-

"This Wasn't Supposed To Happen: Household Spending Expectations Crash" Submitted by Tyler Durden on 08/10/2015 16:27 -0400 http://www.zerohedge.com/news/2015-08-10/wasnt-supposed-happen-household-spending-expectations-crash