SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

370 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by drcruz

-

How to get better fills. Steady Options strategy rules for: - calendars - ratio spreads - straddles - butterflies

-

Why do options writer have better chance of earning

drcruz replied to bycfly's topic in General Board

EXACTLY! As one with a smaller account, I've got enough headache with the rules that are meant to "protect" me. It was SUCH A HASSLE to allow my 401K to trade naked puts and I KNOW I have to be fully cash secured. -

Why do options writer have better chance of earning

drcruz replied to bycfly's topic in General Board

Nothing special, just mechanically selling the 15 delta puts. Not getting much credit may be 129 per contract, close out at 50% profit, rinse and repeat. Estimate 4% per year because no margin, but like I said this is the safe-ish cash part of the account. If I get put the shares, then I'll sell calls until called away -

Why do options writer have better chance of earning

drcruz replied to bycfly's topic in General Board

Yes I got permission to sell fully cash secured puts w/ my work's Fidelity 401K account. The riskier portion is in SPY and I'm selling calls against that -

Why do options writer have better chance of earning

drcruz replied to bycfly's topic in General Board

I'm writing naked IWM puts in my 401K, but it's fully cash secured AND if the market dips to my 10% price target, it won't be that bad of a buy. Seems conservative enough. I'm not getting rich, but the stable part of the portfolio is earning a little money -

Why do options writer have better chance of earning

drcruz replied to bycfly's topic in General Board

I've lost 100% and more on a few positions since trying to learn option strategies. After blowing up a small account the 1st half of 2017 (not my first blowup BTW), it finally sunk in the importance of position sizing. So when I lost more than 100% on a recent BIIB position, I wanted to kick the cat, but I didn't want to jump out the window either AND I survived to trade another day. -

I like the Option Alpha podcasts but they are for beginners and mostly selling premium. He also has some mindset episodes There are some Heavy videos on Tastytrade. The one that comes to mind is, "The Skinny on Options Math". I imagine the rest of the Skinny series might also be heavy, but I haven't got to them yet

-

I'm also new here and I'm unsure if my thinking is correct, but one thing that's nice about the official trades are that Kim posts the target RV. If the price of the stock moves higher, I've used the target RV % as a multiple of current stock price and have gotten my order filled that way by buying the higher strike price.

-

@Djtux, @Christof+ or Anybody else out there who's an expert on RV charts, Since recently added weekly contracts to a stock's options table (is that the correct term?) affects the RV chart, how do we determine how far back weeklies have been added? Thanks for any help you can provide

-

I only started 1st week of Jan. 2018 and SO is allowing me to bring my trading to the next level. After becoming extremely annoyed that I was hardly getting filled with any of the official trades with the exception of the losing trades like UAL and a couple of the SVXY trades (down $1600 at one point) I took matters into my own hands and thanks to @Kim documenting all his trades and @Christof+ with AOT I was able to reverse engineer a basic set of rules for the straddles and calendars. And thanks to @Yowster, @RapperT, @Djtuxand @Maji I've been able to continuously fine tuning my rules. I think I'm only down about $500 at this point. A big *Thank You* to Kim, the mentors and the community making comments while I stick my neck out making my own trades.

-

SPX Credit Spreads with downside collapse protection.

drcruz replied to Maji's topic in General Board

Yeah, I took the same amount of credit, I increased my probability of success, but the ROI is < 10% -

SPX Credit Spreads with downside collapse protection.

drcruz replied to Maji's topic in General Board

I took the concept and sold a naked SPY 283 May 4 Call (42 DTE) collected about $28 credit (5 delta) w/ limit stop order @ $56. I figure markets don't crash up may be 10% chance of touching my strike. Poor ROC though ~$3100 in margin (2 positions >$6200). I'll sell one 2 weeks from now so every 2 weeks eventually one position will close and one will open. Hopefully a little income generator while learning SO concepts -

SPX Credit Spreads with downside collapse protection.

drcruz replied to Maji's topic in General Board

Maji , Did the presenter explain why the trade was entered every 35 days? -

SPX Credit Spreads with downside collapse protection.

drcruz replied to Maji's topic in General Board

@Maji what is the capital requirement to keep 3 SPX trades on? If I'm thinking correctly the max number of trades on at once will be 3. Also, I was fooling around with the TW platform and I was able to get your target credit around 20 deltas and not 80 deltas (which would make the position ITM). 20 deltas would be OTM -

@Kim I hope you have time to answer. With regards to the pre-earnings double calendars what type of win rates from experience and back testing are you seeing? I only took a small sample of the trades you have posted (may be 6 months max) and calendars seem like a 50-50 bet. My experience w/ selling options is limited, it's even more limited when it comes to calendars. Thanks for your time

-

@greenspan76 Thanks. I thought I saw one of the double calendar Pre-Earnings articles mention something about a full position's RV being 2x a half position in an example

-

Excellent - Thanks guys

-

I don't have a subscription to some of the cool back testing tools. So if the Steady Options group is monitoring for entry into a Pre-earnings DOUBLE Calendar Spread AND we are looking to enter the first half of the position is the RV for the trade candidate for each 1/2 or a full position. The reason I'm asking is that the articles explaining the pre-earnings double calendar spreads are based on full positions and it's related RV, but I think you have to divide the full position RV by 2 to enter a half position. Is that right? Thanks for the help

-

@craigsmith Thanks. Is it $200 per year? Sorry I'm too lazy to look it up again. Don't be too harsh on me I'm working on taxes

-

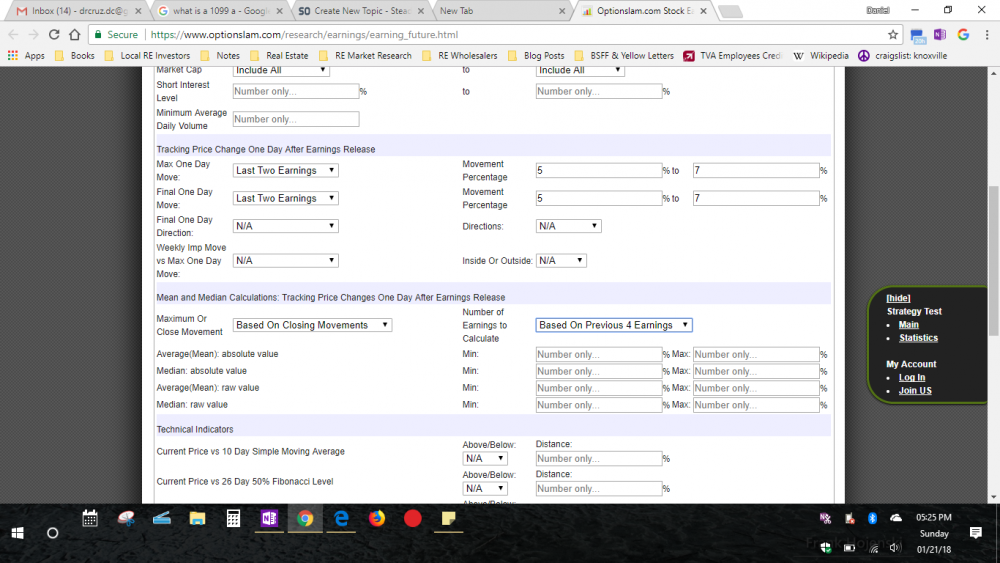

I tried to put in 5% to 7% earnings move for the last 2 cycles and the buttons remain grayed out. Do I have to register? Thanks for your help.

-

AWESOME, AWESOME, AWESOME - THANKS!!! I TOTALLY get this

-

@Yowster LAST QUESTION: Any rules of thumb for the magnitude IV spike / movement pre-earnings? Thanks SO much for the help

-

Okay, In general the previous cycle will have more weight as predictor of the current cycle move IF the previous cycle's stock move was bigger than the expected move.