SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Maji

Mem_C-

Posts

713 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Maji

-

I just came across this site that is offering commissions free options trading! https://about.robinhood.com/options/ Any experience with it? Is it a bucket shop or a genuine brokerage with a different business model than usual? I am not a shill for them and don't even have an account there. Just trying to figure it out as I am usually worried when I am offered anything for free... what is the CATCH?

-

Orcl was also a loser!

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Are these members of SO that post here or are they posting in other forums? Thank you for the info.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I think the markets are gyrating while waiting for the FOMC meeting outcome.. the announcement is at 2pm on 12/13/2017. I am hoping that the markets take off after that... before the so called correction that all the pundits are talking about

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I checked Adobe's website... https://www.adobe.com/investor-relations/calendar.html and it indeed states that the earnings data is 12/14. Strangely, it also states that Last updated: October 24, 2017. So I wonder why there was such a confusion about its date... or maybe that date was not updated.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

You are right... I am not sure what I saw to think that it was triggered ... any way, the premise that the system cannot be traded with calls with 15 DTE due to low OI remains true...

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I got that update and was able to look at it after the markets were closed. As NFLX was closing above the trigger indicated in the article, the bull squeeze has been initiated. However, looking at the Dec 22 options (15 DTE), and the 90-40 deltas, it appears that the investment will be about $1278 for a profit of (187.5-170)*100-1278 = $472 - costs. I believe that it cannot be traded in any significant numbers... the OI for the 90 delta calls is 3!! The only way to trade is to go out to the Jan 19, 2018, calls. The investment will be around $2885 for $1115 return minus expenses. Percentage wise it is almost the same but I think can be traded. The 15 DTE options can't really be traded here. Most importantly, with just an OI of 3, I think even the CMLviz people did not participate in any significant volume in their own dance!

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

The last couple of weeks saw corrections in the market and the bullish trades mostly suffered. No surprise... The thing to watch is whether today is a dead cat bounce or is it a reversal... too bad we can only find that out in hindsight. Good luck everyone with your trades.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

@NikTam Thank you for highlighting those put credit spreads done post earnings... If one is bullish in the medium term, then these corrections provide a great opportunity to enter those bullish put credits at better prices. A few more for possible entry tomorrow... HUM 11-0 http://tm.cmlviz.com/index.php?share_key=s_0_20171108181514_65Qx9zgBHv8o4lB8 LVNTA 10-1 http://tm.cmlviz.com/index.php?share_key=s_0_20171108094135_RPoHsjCzwyGkaJqY SYY 10 -1 (Changed entry 3 days after earnings, and it still works) http://tm.cmlviz.com/index.php?share_key=20171109235953_AK2aeYiEih0iIeTs TM 10 -1 ( I changed the entry and exit days, and it still works) http://tm.cmlviz.com/index.php?share_key=20171110000253_80Gwmc7NZjQG8zF7 Even look at NVDA... even though it PE call trade was a bust... (entry a couple of days later) http://tm.cmlviz.com/index.php?share_key=20171109000648_cfX53QgCvNwGEkAf I am tempted...

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

The few straddles I have are a hedge but I am net delta positive. If you consider my IRA and 401K, I am almost 100 positive delta... as is most of the investing public

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I took the bait... a very small allocation for Nov 17 57 Calls at 1.15... I waited to see the MACD crossover in the intraday charts and rolled the dice...

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I believe the basic premise that Opheir offered for the bullish earnings trades was that the overall market is bullish and some of these stocks noticeably exhibit bullish behavior running up to the earnings. However, this week has been filled with corrections and that is showing up on the the various bullish positions that had perfect records over the last couple of years. I am on the fence on whether to get long calls for AMAT or not... anyway, I have till just before end of trading today... which is really the official entry point for the cmlviz trades. Thank you again for starting this thread and sharing your ideas.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Yes, the entry is for tomorrow at the close. I believe it is 7 days before earnings...

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I am going to wait a few more weeks before I jump into the squeeze trades.. CML is still working on them... I jumped into a trade only to find out that it did not appear in the scan next day because they are still tinkering around. I had a small position and I got out with a small loss, so I chalk it to tuition. SEE calls lost money for me too but that is the name of the game... I agree with @NikTam ... it is a numbers game and got to keep at it.

- 1716 replies

-

- 1

-

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I use Tastytrades and chose them because of their low commissions for trading a few lots at a time. As stated earlier, their web based platform is easy to learn. However, they don't have the analytical tools that TOS offers.

-

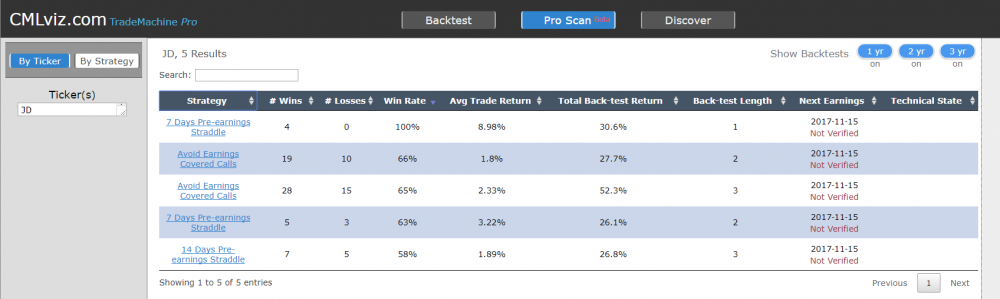

I see that Djtux already replied, so I won't post that. If you look a couple of rows down, you will see that the two year performance of the Ticker in the pre-earnings haven't been that great. However, I will take a look at the RV charts and see if it is a trade worth stalking. Thank you for bringing up the ticker.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I am in the official SO HD earnings trade. Will have to use a very small position so that I don't overload on a single stock. Today's pullback would have been a good time to enter the straight call. Also, if I am not using any stop loss, a small position is good for risk control. The Nov 17 has good OI. Thank you for the heads up.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Look at the charts of BIDU and BABA... moving down towards EA date... BIDU had a nasty downward gap... made the day for many long earnings straddle/strangle holders. Thinking of a small allocation towards a BABA earnings strangle... not sure yet.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

This is a good tip for me to remember... do not get into too volatile stocks where the Option prices move around >40% a day. Not sure how I can determine that... maybe someone here has some suggestions. Thank you Nik for starting this thread.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

@NikTam Thank you for starting this thread... Have you traded the after earnings Short Iron Condor and Long Straddles that some of the CML searches come up with?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

More tools to analyze the earnings trades: www.art-of.trading

Maji replied to Christof+'s topic in General Board

@Christof+ Found it this morning... maybe I did not see properly last night or maybe a glitch... Thank you for your help and enjoy the wilderness... maybe more enjoyable there than the wilderness in the markets -

More tools to analyze the earnings trades: www.art-of.trading

Maji replied to Christof+'s topic in General Board

I can't seem to find MSFT (EA on 10/26/2017) in the earnings tables. Am I missing something or some symbols are not included? Thank you. -

I signed up yesterday and believe that this is a great tool to mine interesting options trading ideas. I watched a few of the very well made training videos and wanted to try one by myself. It is the AMZN 6 days pre earning. volatility scalp. Here is what I get when I do a scan of the ticker and then back test the idea with default settings. AMZN: qa Long Short Straddle2 Expiration: Custom Risked: $6073 Total Return: $2825 % Return:46.5% Commissions: $20 % Wins:100% Wins: 4Losses: 0 Gain: $2825 Loss: - Great results. However, now if I set the execution at halfway prices to account for some slippage, suddenly it doesn't look that invincible. AMZN: qa Long Short Straddle2 Expiration: Custom Risked: $1430 Total Return: $206 % Return:14.4% Commissions: $4 % Wins:75% Wins: 3Losses: 1 Gain: $221Loss: ‑$15 In fact, one of the winners became losers. I find this is true for many of the scans. They are profitable in a very narrow range. Is that what others noticed too? Thank you.

-

More tools to analyze the earnings trades: www.art-of.trading

Maji replied to Christof+'s topic in General Board

Thank you @Christof+ Really appreciate your hard work. Maji