SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

blackice

Mem_SO-

Posts

86 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by blackice

-

Hi managers, I'm currently in an one-month subscription, and want to switch to quarterly, may I know how to do that please? Thank you!

-

Partially executed HD calendar (-Feb17 +Mar17 $140 call)

blackice replied to blackice's topic in General Board

Thanks for the advice, yes, I chose the wrong option exp date.. And by your advice of "one custom order", can I combine stock position with option position in one order in IB? -

Partially executed HD calendar (-Feb17 +Mar17 $140 call)

blackice replied to blackice's topic in General Board

Thanks for the reply! You're right, I opened the wrong option. My intention was to hold it through earning, but chose wrong option exp date. For the strike price, when I bought it, HD was around $140 and the option was ATM. Later in the day it went to $143. -

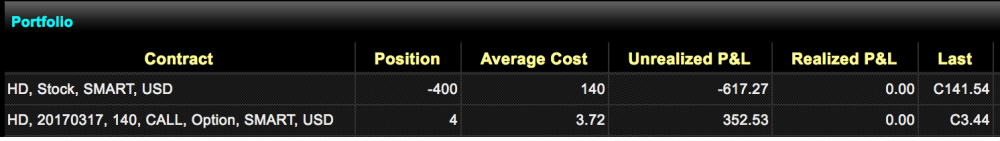

Hi everyone, I'm in an interesting situation: last Friday (2/17) I bought 4 HD calendar (short Feb17 140 call & long Mar17 140 call) to keep it post earning. At end of Friday, HD price was $143, and my short Feb17 call was executed. Therefore right now I'm holding short 400 HD stocks and long 4 Mar17 calls, as shown here: I never met this before, and here is my analysis to this interesting situation: Max loss is still the same as no execution happened: the premium I paid for calendar. Reason: I can execute my Mar17 call options anytime, as a result I have zero P/L from the actual stock transactions. If I do this, the only loss is the value of my call options, minus the premium collected from selling Feb17 calls, which is equal to the total premium I paid for the calendar Unlike holding both calendar legs, the potential profit is huge, because if HD stock drops a lot (much below $140), my Mar17 call options' value drops to $0, but I earn much more from 400 short stocks Be more realistic, what if HD price is moderately above or below $140? Delta will help. The stock position's delta is plain 1, while Mar17 call's delta is currently -0.32. This means if stock price increases $1, my short stock position loses $1 but call gains $0.32, total loss = $0.68. While if stock price drops $1, short stock gains $1 and call loses $0.32, total gain = $0.68. This $0.68 gain/loss per $1 stock change is only true when stock price is around $140, since otherwise call option delta will change significantly The whole game was changed. If I hold both legs, I'd expect stock price sticks to $140, where the calendar shows max profit. Now with my short leg executed, I'd expect stock price drops as much as possible, where my potential max profit would be higher than calendar max profit A more interesting question: what stock price in current situation (one leg executed) will make me the same max profit in complete calendar? Probably need to resolve some equations. Welcome any ideas Lastly, the most piratical question from me: how to close this position (short stocks + long call options) properly? I guess I can just open two separate limit orders. Please let me know if there's better idea @Kim to comment on above thoughts. I'd imagine this situation could happen to other forum members some day, if they play this post earning calendars. So Kim's education is much appreciated here. Thanks.

-

Very interesting. Thanks, Yowster. Any work has been done to quantify this kind of position for hedging VXX diagonal/calendar?

-

@Yowster Thanks a lot for the info, Yowster! I do see VIX strangle / VIX risk reversal trades open now on SO. Are these trades set up as hedge for VXX calendar on SO? I looked at their discussion posts and didn't find info about hedging.

-

Hi everyone, Learned a lot from this forum, I'm wondering if such strategy would be possible: During VIX low period (like now), VIX futures are usually in Contango, which means the futures price is higher than VIX index and this extra amount is reducing as time goes Build position with VIX options (essentially it's the option on VIX futures) to short VIX futures. Suppose VIX index does not move, this position will have more and more profit since VIX futures price is dropping due to Contango Build position with SPX options to short SPX, with the goal to neutralize the P/L impact to position in (2) when VIX index moves. Basically, if SPX goes down, VIX index goes up, and position in (2) shows loss, but position in (3) is short SPX, so it will show gain. If we could build a good position in (3) so that it will just neutralize the P/L impact from SPX move in (2), then we are actually making stable profit from VIX futures contango Of course we need to consider time decay, so we want the theta of (2) and (3) be neutral or positive. Just a random and raw idea, so would welcome any comments.

-

Hi guys, I'm writing program to do analysis and filtering on option historical data. I have a few questions: 1. where to find historical earning dates for a stock? Nasdaq website has 4-5 previous earning dates but that's it, I want for about 5 years. 2. what's the reliable source to find incoming earning date? 3. why would companies disclose earning date before head? why not just disclose a date range (like a week) and publish their earning on an arbitrary day within that week? 4. how often do companies disclose earning date but actually publish earning on different day (which is misleading)? Thank you all.

-

Hi Kim/forum friends, I have been wondering a simple strategy to long VIX, especially when VIX is low recently. I wonder is just selling VIX put (nearest expiration) a good idea? I know there is VIX future calendar strategy, but a simpler strategy is still good. please educate what's the pros and cons for selling VIX PUT, thanks! And also, since VIX is around 12 recently, is it good time to sell put now?

-

Some fundamental questions about option trading

blackice replied to blackice's topic in General Board

Thank you. So firstly I guess what I described (how MMs work and why their bid/ask prices seem like setting price) is kind of correct. Secondly, I could imagine MMs must talk behind scene to coordinate things. But how, I'm curious. MMs' bid/ask prices are changing pretty fast too, since the underlying asset price is changing fast. If two of them talked on the phone and agreed on some price, next second they might need another phone call again. Is there some automatic system they use for coordination? -

Some fundamental questions about option trading

blackice replied to blackice's topic in General Board

Thank you again, Kim, for the generous offering of knowledge. Based on some more research, here is my understanding of Market Makers and bid/ask prices, please see if it's correct: First, MMs are not any special than retail traders like you and me; they obey the same rules as us and do no more than sending orders to exchanges with certain prices set. Second, their orders are usually large and therefore stay longer on quoting board (unless they change their orders). This is because, 1) orders with prices off their bid/ask prices are comparably small, and get filled quickly, so those prices show (if there's a chance) on quoting board for a short while, 2) orders with prices equal to their bid/ask prices are usually smaller than their orders, so their orders are usually partially filled, so quoting board still remains showing their prices. This seems like "setting prices", but not because they have special power, rather, because their orders are large enough. Third, our (retail traaders) orders can be filled at/around mid price, is because our orders get filled with other retail traders' orders, who are trying to buy/sell options with fair price (which is mid price). But again, since our orders are small, and get filled quickly, their prices are not staying long on quoting board. Fourth, MMs set their bid/ask prices based on some complicated hedging strategies (since their portfolio is large and complicated) that limit their risk and guarantee some profit. Their orders are filled usually when some party (trader or institute) send a large order at or close to their bid/ask prices, since these orders cannot get fully filled around mid-price due to their large sizes. Please point out if I'm misunderstanding any part. Again, I'm so happy to learn knowledge so fast on this forum. This made me much happier than get some gains blindly. I'm recommending it to my friends. -

Some fundamental questions about option trading

blackice replied to blackice's topic in General Board

Hi Kim, I thank you sincerely for the answers! A few more points to clarify: Does term "market makers" you use in (2) and (3) refer to the same? In (2) it sounds like brokers, but in (3), I thought bid/ask prices are purely based on participating traders' orders; can brokers affect it? DTE is calendar days, then that means, if we fill a +theta and -delta position (like iron condor) on Friday morning, then on Monday morning, the time passed for three days but trading was only one day. This is good for such position since we want time to pass without much price move. Is my understanding correct? For "Market makers usually adjust the prices intraday especially when the options are close to expiration", is there any way to find out the DTE parameter that market makers are using for current moment? If orders usually get filled at or around mid prices, then the bid/ask should reflect that (since there are many limit orders at or around mid price). But why that's not the case... Again, I truly appreciate your fast answering to my beginner questions! -

Hi Kim/everyone, I have some fundamental questions about how option price is calculated in CBOE quotes, would you please help? Does "Days To Expire (DTE)" only count trading days, or it counts every calendar day (including weekends and holidays)? When option price is calculated within the SAME trading day, is DTE an unchanged integer number, or it changes with time goes forward (a float number changing as time goes)? Where to find interest rate (risk-free rate) that I can use in option calculator to generate the same price as our trading platform does? For SPX option, what condition(s) will cause bid/ask diff to enlarge, and vice versa? For SPX option, why mid price can always make the deal succeed, but slight different price won't? Thank you!

-

This is reasonable.. election is so rare and we don't know their patterns well enough. Anything can happen. It's wise not to touch its vol now.

-

Thank you, Kim. I will explore.

-

Thanks for the comment, Kim, you're right. And where to get historical IV (or price) to back test? Thank you!

-

Kim, thank you a lot for your fast response! I'm so glad my first post here was replied by you so quickly. I just adjust my strategy based on your suggestion, but changed it combine Butterfly and Calendar, which results in Theta/Delta neutral. Please see the edited post. Thank you.

-

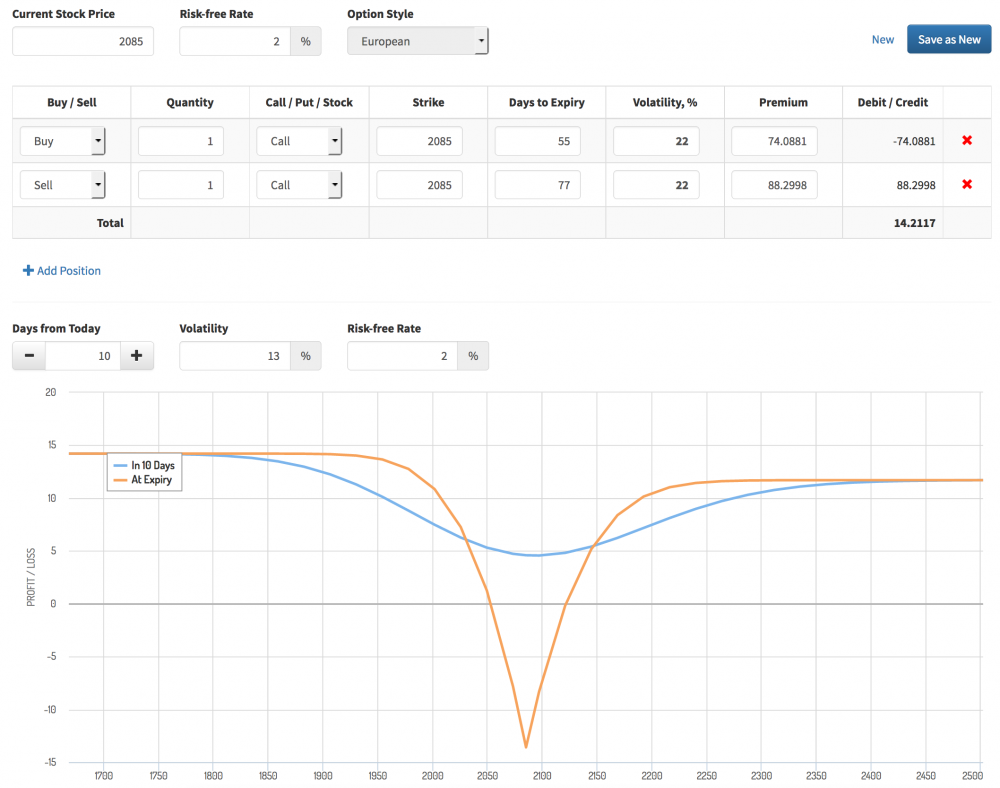

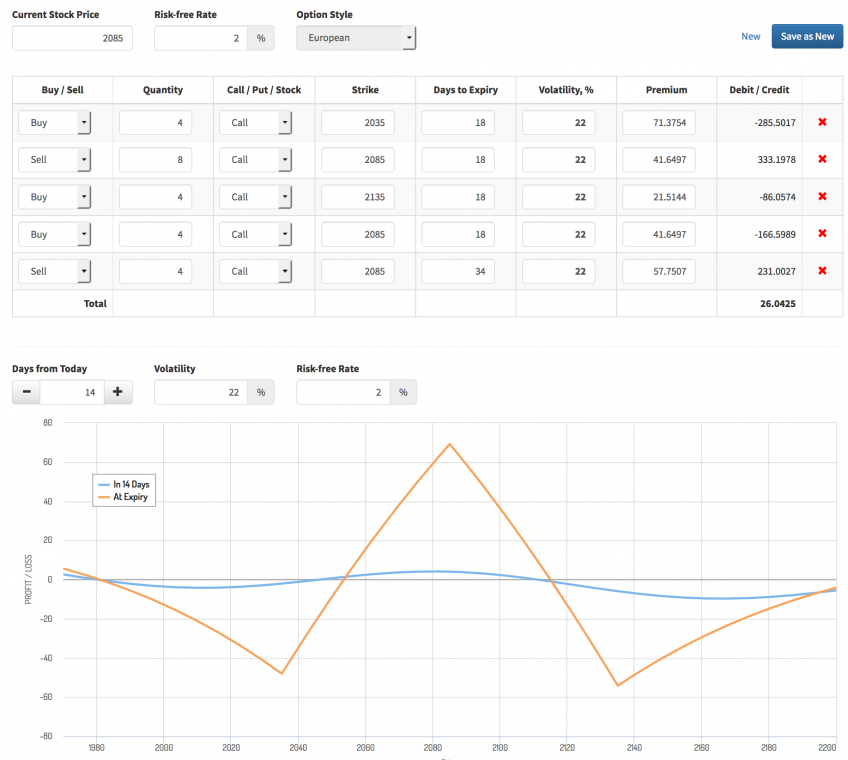

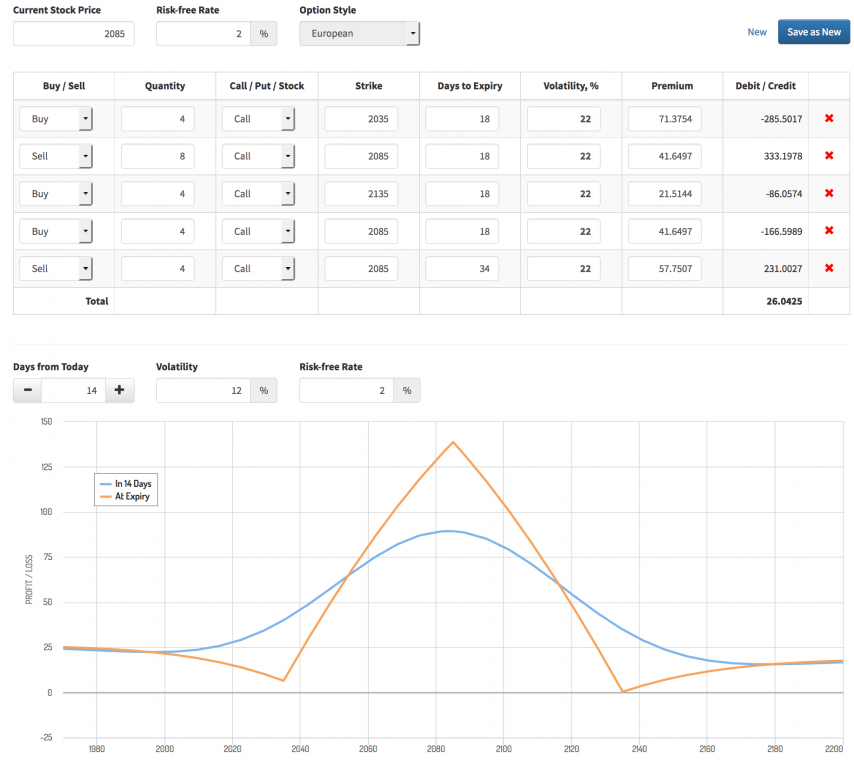

Hi Everyone, Now SPX Vol is around 22% (much higher than usual 10%-13%), which is because the Presidential Election is coming and people are buying a lot of options to bet the result. I think it's reasonable assumption that after Election results comes out, the Vol will decrease. Based on this, here's a net credit calendar plan (suppose I build this position next Monday 11/7): The strategy has small Delta but huge positive Vega. The blue line is PnL 10 days later (T+10), even if price does not move, there's around 30% profit, supposing Vol drops back to normal at 13%. Please share your thoughts and let's discuss. Thank you! ******** Adjusted Strategy ********** **************** ********** Thanks to Kim of reminding me using Butterfly! I have another idea, which is combining Butterfly with Calendar. Since the theta and delta of these two can be neutral out, we can then focus on waiting for vol to decease, without disturbed by other factors. Here is the position: Please notice that, the blue line is 14 days later (with Vol not changed), it's very flat, indicating the Theta and Delta are pretty neutral. But let's see if Vol back to 12% (still T+20): The profit is very good. This means we can just wait for Vol to drop and safe from other factor changes. Thoughts?