SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

siddharth

Mem_C-

Posts

963 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by siddharth

-

What I was confused by was the timing of the entry since his recommendation was not to enter this early. I see also, that you don't follow the recommendations directly. You take it as a guideline and then adjust it based on your expertise, Correct ? Does Ophir suggest entering this early anywhere ? The article (http://www.cmlviz.com/cmld3b/index.php?number=11657&app=news&cml_article_id=20170817_swing-trading-earnings-bullish-momentum-with-options-in-dave--busters-entertainment-inc) says to enter 3 days before. I am still trying to figure out the best way to use the services.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Where do you see Ophir alert them ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

They were in the newsletter from last earnings in August and continued their trend. Much like the Palo trade

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Just for education, What would you consider bullish price action ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Is there any reason you avoided amba and wday as mentioned in the newsletter ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

@NikTam @cuegis are the charts for wday or amba suggesting anything positive. They are getting hammered when the market is up and so wondering whether to bail.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

From their newsletter, anyone in WDAY and AMBA or have thoughts about those ? They are not doing too well.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Could you explain why ? I’m trying to determine using cml as a backdrop whether I should enter the trades.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

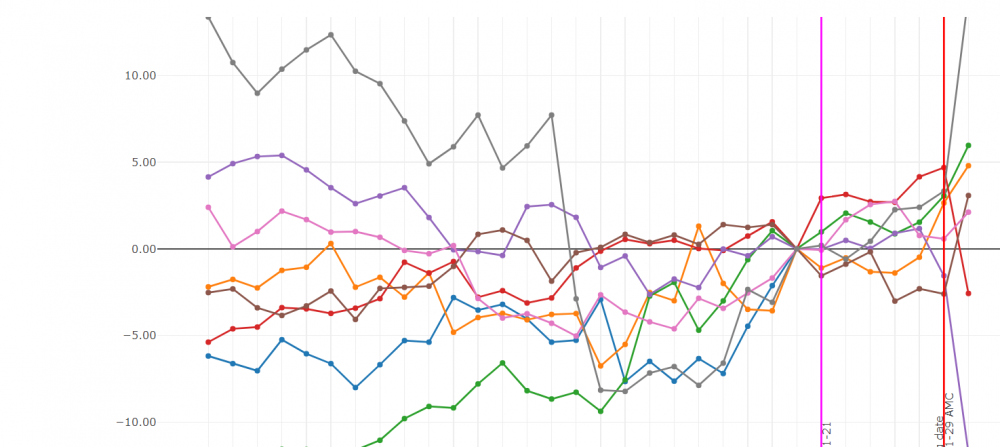

Below are the charts for absolute stock price change for wday. @krisbee, would you get into this trade now because the stock price is trending up for the next few days ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I did tho But regardless, I. Always be happy to exit because my profit target is reached. No complaints here

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Can you tell me what price you will set the vertical at. That’s the part I struggle with and I’m not sure how to determine

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

How did you find the marvel trade ? And what made you pull the trigger on the tho trade before the specified entry date ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

What delta's did you use. From your back test, it looks like none of them have a very high win %. Most have 7-4/ Did you buy21 and sell 22 calls ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

What price would you buy at now ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Nice trade. How did you select your limit prices

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

How long are people keeping adi and intu

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

One thing that might be interesting is looking at the chart to see what day from earnings there is an uptick on. For example, I looked at DE (whose earnings are coming back) and at t-7 to t-6 (t being earnings), there has been an increase in stock price 7/8 times even though around that, its been fairly up/down. CML confirms this with a backtest. I don't know if this is overfitting but it may help determine some candidates to look at which may not have a multi day trade. I see from your spreadsheet, some trades are 1-2 days anyways. I am not sure if this will work but can keep an eye out and let you know in the future.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

@NikTam I can look into this when the site is back up. However, for a 40 delta call, won't you expect the results to be inline. The way that goes up is is the stock price increases and if CML says the trade has been successful in the last 6/8 cycles, I would expect this to be in line with that. They just would be different views on the same data. He is using this instead of CML but I don't see anything here that would be a further confirmation needed for a trade that pops up in CML. What do you think ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

So you are looking only for stock price increase, not decrease right. A decrease would help straddle but would hurt 40 delta calls. How do you use it for RV as the second check ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Doesn't it do ATM RV of straddles though ? Some of these are 40 delta calls. what do you mean by 2. Do you compare gamma gains to RV increase ? @NikTam, is volatilityhq only $5 a month. I thought it was 50.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

How do you validate through volatilityhq ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Yeah. I messed up the delta. It’s 57. Didn’t your backrest via cml show it had good results though. To buy today and sell on Monday.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Ignore This. I was having a moment. INTU: I bought the 155 calls, whose delta is now about 100. Does it make sense to close the profites out for this one and then buy the 50 delta calls. Thanks, Sid

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Intu is up quite a bit today. Should we close the trade ?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

What made you go in yesterday ? 7 days before would be 11/20. With the market down, this is still up. Did you see anything that made you get in ? Still learning so hope to see it nex time wonder if it’s too late to enter now.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with: