SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

greenspan76

Mem_ALL-

Posts

926 -

Joined

-

Last visited

-

Days Won

35

greenspan76 last won the day on September 10 2023

greenspan76 had the most liked content!

Recent Profile Visitors

1274 profile views

greenspan76's Achievements

Hero Member (5/5)

350

Reputation

-

PBJ started following greenspan76

-

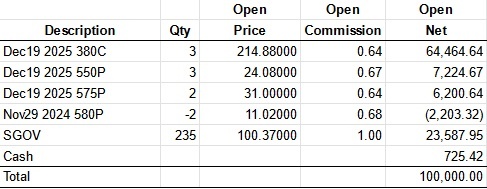

How to get started: https://steadyoptions.com/forums/forum/topic/7144-how-to-start-a-leveraged-anchor-portfolio/ (jump to a member's recent summary of the "rules": https://steadyoptions.com/forums/forum/topic/7144-how-to-start-a-leveraged-anchor-portfolio/?do=findComment&comment=203589) Current portfolio (updated 10/9/24): https://steadyoptions.com/forums/forum/topic/9891-anchor-current-portfolio/ (missing one update - see link below) (transactions since 10/9/24 not yet showing on Current Portfolio: https://steadyoptions.com/forums/forum/topic/4564-spy-portfolio-and-roll/?do=findComment&comment=203058) Possible new model portfolio today: I can't give you advice, but if I were starting a portfolio right now with $100k, it would look similar to this: Notes: This is based on midpoint pricing as of a few minutes before this post with SPY at about 575.80 The commission is about what I typically would pay I chose roughly 95 delta long calls and the "rules" say 90-95 delta I chose to hedge 5% out of the money, but hedging is cheap enough you could justify an at the money hedge right now I don't think its crazy to only have 1 diagonal with this setup instead of 2, but I would personally chose 2.

-

I've avoided RH because of the issues they had during the Gamestop frenzy a few years ago, but I noticed they currently have a 3% match with no limit on ACATS from IRAs and I'm seriously considering moving my IRA assets there for that deal. You have to maintain RH Gold for 1 year, but that's just $60 total, so if you have substantial IRA assets, the only problem I see is the 5 year earn-out period. But for me, the IRA is just buy-and-hold investments in stocks/ETFs, so I may do it anyway. On that note, they're also doing a 2% match on ACATS when your transfer includes a $10k+ margin balance, which I don't normally mess with, but could do a few weeks just to get a bigger bonus on the transfer. I don't think that's enough to tempt me to move my option trading to RH, but it might be for some so I thought I'd mention it.

-

The way I understand it, if your statement shows $0 in the "COMM" field, that means Tradier isn't charging you anything. All the fees in the "Tran Fee" and "Add'l Fees" columns are pass-thru regulatory fees that are the exact same fee every broker pays to the regulators, whether they charge you a commission or not. Tradier lists all the fees on their website, but you can go to each agency and verify the fees yourself if you want. The fees are: $0.0775 / contract (max $15) Clearing fee paid to CME/ICE $0.00279 / contract Trading Activity Fee paid to FINRA $0.02815 / contract Option Regulatory Fee paid to the exchanges (but collected by OCC) $0.0000278 / $ on sales only SEC regulatory fee The only thing I don't understand is it appears the clearing fee is sometimes less than $0.0775, but I have been assuming it has something to do with spreads being charged differently

-

Suggestion Needed on getting started with anchor trades

greenspan76 replied to Reachnikhil123's topic in General Board

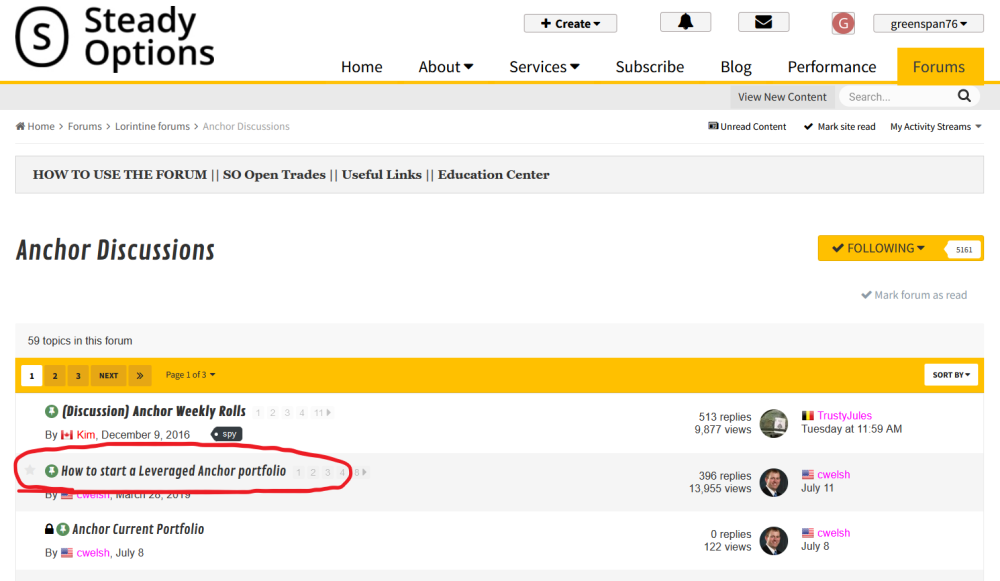

As an Anchor Trades subscriber, you have access to both the Anchor Discussions and Anchor Trades forums. If you look in Anchor Discussions forum, the pinned topic second from the top is titled "How to start a Leveraged Anchor Portfolio". The first post in that topic lays out step-by-step exactly how to start a new Anchor portfolio. I think Kim is trying to politely say that your question suggests you didn't really even look around before asking (See screenshot). -

I don’t recall a specific discussion on the forum about this and am not really bothered too much by one year’s result since this is intended to be a long-term strategy, but my own personal analysis was this: 1) the market whipsawed enough to yield near-worst case results, and 2) the puts underperformed expectations, despite market conditions. On my trade, I know there were 3-4 times that the short puts from the diagonal nearly reached their target gain to roll, but the market quickly reversed and they turned into a large loss, so that alone was probably 5% loss on account just due to poor timing/random noise. Lastly, I personally concluded that it was better to roll up the longs of the diagonal more frequently to avoid a large spread in the long and short. I believe this was discussed briefly somewhere in the forum.

-

Total costs for trading VIX options at IB: $0.65 IB commission $0.02685 regulatory fees $0.02 OCC clearing fees $0.45 CBOE fee for VIX options -------- $1.14685 total cost per contract + $0.000008 * aggregate value SEC transaction fee + $0.00279 x qty sold FINRA trading activity fee I split my SteadyVol portfolio between IB and Tradier from November 2022 through August 2023 and my average commission per contract on all IB trades was $1.16xx https://www.interactivebrokers.com/en/pricing/commissions-options.php?re=amer https://www.interactivebrokers.com/en/accounts/fees/CBOEoptfee.php

-

You mean $0.42 per open + $0.42 per close for $0.84 round-trip? Because using Tradier in 2023, I opened 318 total VIX option contracts + closed all 318 of those contracts and my total commissions/pass-thru fees was $525.10. That $525.10 / 636 total contracts = $0.825 per contract traded. And according to Tradier's website, they charge: $0.35/contract Commission $0.045/contract Clearing fees $0.40/contract Single listed option index fee --------------- $0.795/contract total cost (+ ORF regulatory fees which Tradier says are $0.02905/contract but they change periodically

-

I have no idea on what your friend said, but I’ve been trading with IB for years and with Tradier since January. I regularly place an order on Tradier that doesn’t show up as the bid/ask, even when it should. Most of the time it shows up within 5-10 seconds and there will occasionally be a 15-30 second delay, but beyond that is rare. That doesn’t happen for me at IB, though. I’ve tested it numerous times by submitting orders simultaneously on both platforms and also trying one before the other and always get quicker fills at IB for the same order. However, in my observation, the price I eventually get is only occasionally better at IB, but then the commissions/fees are always higher at IB. For reference, my average commissions costs is 1.0% of my trade at IB, while it is 0.2% at Tradier. But I’m not sure that’s a great comparison on its own since it depends on the style of trading one does. Also, it doesn't directly compare when/if fills are better at IB vs Tradier and I don't have data on that - only personal observation which could easily be biased. I am just trading options on these platforms and as long as I avoid thinly traded options and times with unusually quick price movement on the underlying, I doubt there’s enough of a difference to overcome the savings on commissions. so bottom line for me is that Tradier annoys me more, but I still use them.

-

brownrc started following greenspan76

-

The margin requirements (whether you have Reg T or Portfolio Margin) only determine how much you are allowed to borrow. Regardless of the type of margin account you have, you pay interest on the actual amount you borrow. So if you buy $200,000 of equities and your account has a value of $100,000, you're borrowing $100,000. But if you buy $2,000,000 of equities and your account has a value of $100,000 you are borrowing $1,900,000.

-

Yes, I had a position in GSG where the K-3 box was checked and no K-3 was attached. I tried to look at the IRS instructions for K-3s and when they're issued (requirements and timing) and came away more confused than when I started. In my case, the position size was small, so I don't think it will make much difference to my taxes due, regardless of what info is in the K-3. I was already planning to file an extension, I'll probably just pay a small amount more than I calculated to make sure I don't underpay and then not worry about it until just before the deadline for the extension when I get around to finally filing my taxes. Sorry - not much help for your situation probably.

-

boneill started following greenspan76

-

Well, I'm not an expert by any means and there are way smarter people than me on this forum, so another opinion would be useful. I was agreeing with your answers and not your friend's, but I misread #5 the first time. It should be B. However, #7 I disagree with your friend. Even though the test doesn't show a negative symbol, the delta of puts is always negative. When the underlying price goes down $1, delta (theoretically) decreases by the amount of gamma, so -0.50 minus 0.03 = -0.53. You can also think of it as the more the put is in the money (or in this case, less out of the money), the higher the delta will be; it just will be negative for a put and that's the part that is tricky about this question. I agree with you on #11 and #13.

-

I agree with answers 1-14, and 17-20. I don't disagree with 15-16; I just don't know the answers. On #5, you are short the call, so it wouldn't make any sense for your option value to increase when the position moves against you. On #7, you are short the 0.50 delta put and the underlying price goes down. Firstly, its a put so it is actually -0.50 delta. Secondly, a drop in price of the underlying causes a decrease in delta (of both puts and calls), so -0.50 - 0.03 = -0.53. On #11, just remember that delta is supposed to represent the % chance of the trade finishing in the money. So as time passes, the % chance that an ITM option will finish ITM increases and conversely the % chance an OTM option finishes ITM decreases. On #13, if you're short stock, selling calls doesn't hedge the position. A drop in (stock) price would help both trades and an increase in price would hurt both trades.

-

Unusual options activity (someone knows something)

greenspan76 replied to zxcv64's topic in General Board

What the? I thought earnings were last night. That is a bit odd. I don't really care enough about the issue to research it, but it looked to me like there were 13k+ $130 puts traded. If you assume they all traded at $0.71 (which is what the one sweep of 3k+ contracts was at), thats about $1MM. I just generally think that all the claims of some sort of insider trading are bs and for some reason felt the need to respond. I'll climb back in my hole now -

Unusual options activity (someone knows something)

greenspan76 replied to zxcv64's topic in General Board

Ya'll are certainly welcome to believe conspiracy theories, but when a company with a market cap of $362BB has somewhere around $1MM in option volume on ATM puts going into earnings when their last earnings led to a 20% drop in stock price, that doesn't seem particularly odd to me. Now I haven't looked back at prior cycles, but in the largest trades you can see a 3k+ contract sweep on the ask, which could easily be a $39MM position hedging risk for 0.5% cost. I think this is a nothingburger. -

IgorG started following greenspan76

-

Jarrrod88 started following greenspan76

-

It must be on your end, because it is loading quickly for me on a laptop. I use Firefox normally, but tried Edge and Chrome just to check and it was the same. I'm accessing from Italy, but tried a New York and Dallas VPN just to check and it's loading normally, which is pretty quick.

.thumb.jpg.d6b01d90f3f2890cb8dfe3be15a1d460.jpg)