SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

mglaezer

Mem_C-

Posts

35 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by mglaezer

-

The API they provide is very good: https://developer.tradier.com/documentation If you call/email them, they will give you your personal key, so that you do not need to worry about oath 2.0 authentication, which would be necessary if you developed software for somebody else. It is an important point, and will save a lot of time. Then you can use their /positions and /quotes API to get what you currently have open and the current prices (both underlying and options). Then you will need to use some heuristics to combine the legs into positions (date/time mostly). If the straddles are rolled, it gets complicated, as the positions need to be combined differently and the cost basis changes. But even without those complications with rolls, the information you get is already good enough and not less helpful than what, for example, TOS mobile provides.

-

Taxes - not yet, I need to wait till April for various reasons. I trade using their web interface now, however I liked using ONE. Unfortunately, besides being windows-only program (and me using a mac laptop these days and not liking using ONE under Parallels windows emulator), ONE is not mobile (and I am getting Kim's notifications often during commutes). If any of these 2 conditions were not true, I would continue using ONE.

-

I had the same issue with them: did 2 transfers within 2 day to overcome this 25K/day limit. They emailed me and offered to reimburse the wire transfer fee if I want to do it in one shot. My suggestion is to ask if they can do the same for you.

-

Let's see, I just closed 6 AMZN calendars and paid $0.67 total fee. This translates to $0.055 per contract.

-

It is their business model: provide API and attract developers to create tools or integrate existing trading tools with this brokerage. Once the trade is started in ONE, it is possible to save the real fill price later on in ONE. So the inconvenience is only minor, one copy-paste. I tried several other tools they list on their site and could not find anything as decent as ONE. It is possible that I missed something. In any case, it should be a matter of time till more good trading tools appear for Tradier.

-

They are in the alphabetic order, however I do not find it very manageable. They do not show the cost basis per spread or even per contract, so the constant mental math is inevitable. ONE is a good solution. Another solution is to program something custom using Tradier API.

-

So far it has been 40+ days since I started using Tradier. Comparing them with IB - I found that liquidity is better on IB, placing orders side by side in both brokers. However, taking the advantage of $40/mo flat rate, sometimes placing order more aggressively in Tradier (1-2 cents per spread) when necessary and still matching Kim's performance after commission, I found that I prefer Tradier. ONE+Tradier is a very decent combo, however I currently just use Tradier web UI on my computer and phone.

-

After you enter the order in ONE, it opens Tradier web site in the browser with the order pre-populated in the form. Once you place the order, it does not necessarily get executed at the price you want. Or it can be partially executed. This means that the order price and size should be adjusted in ONE. They are not able at the moment to do it automatically. The way I found it less disturbing is described in my post above.

-

I put some preliminary observations in this thread: https://steadyoptions.com/forums/forum/topic/3318-tradier-brokerage-special-offer/#comment-62192

-

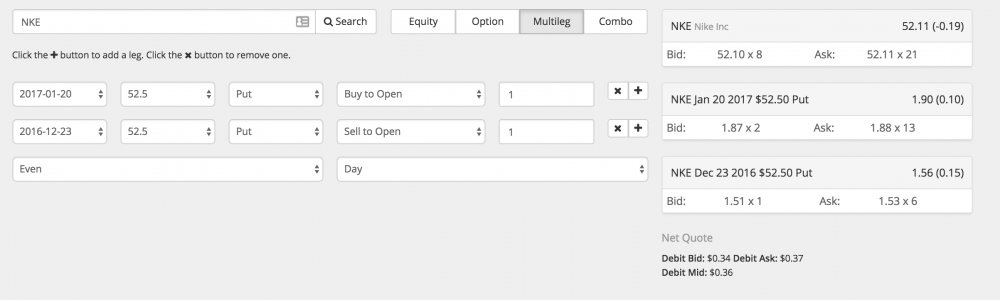

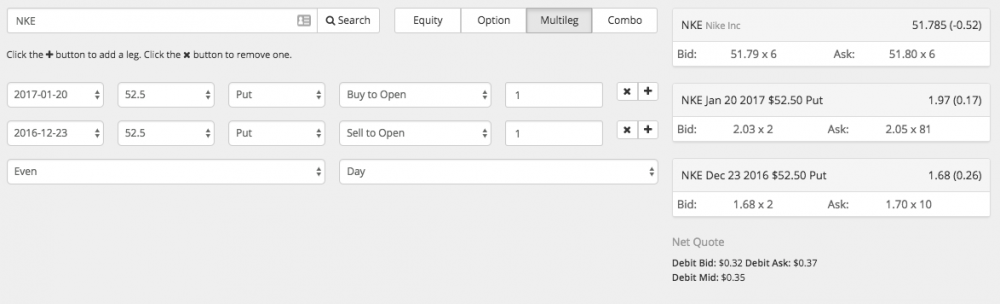

I would like to write about my impression of Tradier after using them for a couple of weeks. 0. The promo $40/mo flat fee is great. It allows to be 1 cent per spread with 2 legs more agressive and still 'outperform' those who place trades in IB. 1. They do care and reply emails very fast. I asked all sorts of questions about transfers, reimbursement of wire transfers, why bid-ask is different from IB, etc. Personal attention, very good feeling regarding their support. 2. The tools they list at https://brokerage.tradier.com/platforms are either expensive to try or just suck for options. I tried several. The notable exception is ONE (option net explorer, Kim posted a discount to that tool somewhere in forums.). ONE integrates well with Tradier, but I need to adjust the fill prices in ONE after the order is filled if the price changed after playing with the order in Tradier. But there is a way to push the trade to Tradier from ONE without 'commit', which allows to wait and enter the real price, and do it only once. (ONE's support is also awesome, by the way. They are working on a tighter integration, they told me. Judging by their progress so far, it might happen in a couple of years... They are a small company.) One nice thing about ONE-Tradier compared to ONE-IB integration is that you do not need to keep the 2nd client open besides ONE. The Tradier's api is much more contemporary and does not require any client like IB demands. 3. Tradier's own web site is decent. Even on the go, in a horizontal layout on a larger phone, it is possible to enter spread orders, and it is MUCH more straightforward process than, for example, in IB TWS Mobile app. Monitoring open positions on Tradier's web site is hard, they do not combine legs into spreads in that particular view. If you are a programmer, their API is nice and clean. I wrote a python script that combines legs for me. Monitoring the open positions in ONE is a pleasure, unless they go south, of course. 4. Liquidity (part 1). There is no statistical significance yet in my observations. The first reason for that is that I did not place enough trades with them to be able to make conclusions. The second reason is that I was unaware of the different way IB presents bid/ask values from how it is done in Tradier, and that confused me for a while. Judging by few trades, I would say that fills in IB are faster. However, since the promo 40/mo flat allows to be more agressive, I will experiment with that more. No real conclusions yet. 5. Liquidity (part 2). The first 2 snapshots below are for the same trade in ToS Mobile (vertical) and Tradier. I see that the numbers are the same, including the size values. If those numbers would directly translate to fills, then one might expect similar fills in Tradier and ToS. The last 2 snapshots below are for the same trade in IB and Tradier. The bid-ask numbers for individual legs are the same, BUT the bid-ask values for the whole spread are calculated differently in IB. I do not know how they come up with those numbers in IB (weighted average?), but of course it is much easier to enter the position at IB's calculated mid! I was not aware of that for a while and thought the liquidity of something is not right in Tradier, until I started placing trades side by side. Besides that, the sizes are slightly better in IB (check the last 2 pics), which probably should translate to some added liquidity. (Tradier routes their orders through Citadel Securities and Knight Securities, if you are interested.) Overall, for the unsuspecting traders like myself, IB's way of calculating whole spread bid-asks (and mids) makes an impression that it is easier to fill orders in IB, because their mids are higher than in ToS and Tradier, and (can you imagine) it is easier to get the fill for the higher price. ------- I will try to place some more trades side by side and report back. So far, I like Tradier a lot. I hope their business model, open API etc will keep them competitive.

-

I am evaluating Tradier now. The $40/mo flat rate for steadyoptions members is good. Paying $1.40 less per straddle (2 * 0.70) than with IB - translates to being able to pay for example 1.87 instead of 1.86 for the recent ORCL straddle and still match Kim's entry. However it seems that I am unable to get those straddles anyway with Tradier, even overpaying 1-2c for them. Will try IB and Tradier side by side to check if I am not making that up. Tradier's own web interface is ok to enter the trades but useless for monitoring. The list of disparate option legs becomes a mess pretty soon. ONE's integration with Tradier is good, the worst thing is that after the trade is placed with Tradier I need to enter the real fill price if I changed it in the process of placing the order. They told me they are working on a tighter integration. But the rest is great. I tried many tools listed on Tradier's site and some more, and found that for my taste ONE is the best among them. The people I contacted in Tradier are very helpful, answering my emails the same day.