SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

650 -

Joined

-

Last visited

-

Days Won

12

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Mikael

-

Paul would you mind sharing how has the returns been using that strategy?

-

oh i meant on expiration week. technically we would collect a bit more if we let it expire if the shorts are OTM right?

-

chris/max, if the market stays flat, come friday should we just let the short expire or still buy it back? for instance, instead of closing the short and selling at the same time on friday, would it be a bit better to let the short expire and sell to open on monday? or does this not really matter.

-

http://www.zerohedge.com/news/2013-07-24/kfc-china-ice-cubes-are-dirtier-toilet-water This can't be good for YUMs bottom line. Having worked in China for 3 years I can tell you CCTV has a powerful effect on the Chinese population. You know what to do for the next cycle on YUM

-

I am not dutch but i would have no problem moving down there if they are interested in hiring me after i finish! I have good friends down there

-

but then how are we ever going to realize the x% profit target per week? technically the trade will never end?

-

hi kim, what kind of charting software is that?

-

Chris/Max, what will happen when we get close to expiration on the long put. do we unwind early to avoid the theta decay on it? or do we unwind it at the same time as the last batch of weeklies we sell?

-

Yes yowster you are right. The trades I have done are all selling way otm strikes to minimize chances of loss but I can see why the 1 to 3 ratio is better in case of a black swan event! Thanks. Chanson you can always close the trade before it hits your BE. In fact that means you got the direction right. You just don't want the SPY to gap downwards 15 dollars then you would be in trouble.

-

yeah, i wanted to hear what other members thought as well. the main reason is the SO portolfio always have alot of margin available so you can use it this way. it's relatively safe and you can stand to make a good profit if your directional bet is right. If it's wrong... well you still get to keep the credit

-

oh one more thing. a big risk is if the underlying gaps down alot (or the price drops like a rock very quickly) then it'd cost alot more to buy back the shorts. but the idea is to put these on for shorter time spans (in this case less than a month), so you can take advantage of the big theta on your shorts, and hopefully your long moves in the right direction. also don't think the SPY will gap down alot unless there's a blackswan event or something.

-

the reason the credit is so low right now it's because SPY on has been on a huge rally. If you do the trade on a down day you can get more credit. you are also taking advantage of the volatility smirk on index options (OTM options have higher IV than ATM options). bad thing is the return on margin on these type of trades are not great. But most of the time i have alot of free margin on the SO portfolio because we usually don't have 6 or 7 trades open at once.

-

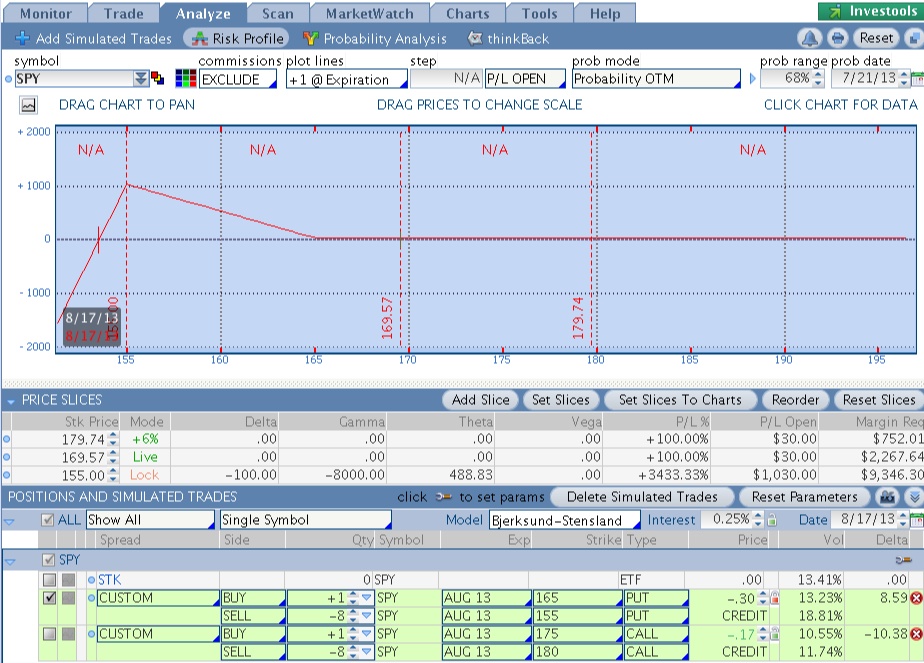

Hey guys, I have done a few of these trades (very small allocations) recently and gotten pretty good results. Just wanted to share and hear about what you guys think. So basically the idea is to buy and sell OTM puts or calls in a ratio which gives you credit. For ex. a put credit ratio spread i was thinking about putting on is Buy to open 1x Aug 165 SPY Put Sell to open 8x Aug 155 SPY Put 0.3 Credits If by expiration (Aug 17) SPY settles beyond 165 you get the keep the $30 credit per spread BE is at 153.50, you take on unlimited loss beyond 153.50 Max profit is if SPY settles at 155 on expiration, which gives you about 3400% return on credit or about 50% on margin. Obviously that's very unlikely but you will start seeing profit if SPY drops to any point between 165 and 155. You can adjust your ratio or strikes to take on more risk (and thus higher credit). Probability of SPY being below 155 by Aug is basically 0% according to ToS. Margin is a bit high on the trade so it's about 2k per spread. If you have portfolio margin it would be lower. If your bullish you can take on the opposite side (or even put on both side). Such as Buying 1X 175 call Selling 8 X 180 call for 0.2 credit. The thing i like about this type of trade is you can be wrong on direction and still make a profit. If you can sell enough OTM your downside is pretty much negligible. Only thing is you need a larger account because of the margin requirements. What do you guys think?

-

Marco, go to ToS, Trade Tab, Today's Options Statistics Drop down tab. It provides alot of useful information including current IV percentile.

-

Paul that's a good point. I thought the IV spiked up because of Goldman giving it a price target of 85. However, the stock does seem to be very resilient and bounced back almost immediately. Ice i didn't realize earnings is coming Aug 7. perhaps there's a play here for a regular SO strat? A couple of cycles ago i looked at TSLA as well but there wasn't enough volume on the options, now it's a different story.

-

Maybe a good opportunity to do a butterfly? Same idea as Kim's AAPL post on Seeking alpha: http://seekingalpha.com/article/455021-apple-dissecting-the-butterfly-trade

-

Paul why not use ToS analytics, it has everything in there. you can do simulated trades, adjust the price and it'll calculate the option pricing and everything for you.

-

TJ, let me try to explain this to you from my understanding, if there are any errors in my explanation perhaps Max and Chris can clarify. If something isn't clear, you can ask me. The thesis of the trade is this: You believe GLD is on an overall downward trend, you buy a long put and believes by expiration GLD price should settle below your long put strike price (this is the best case scenario), you collect extrinsic value by shorting GLD puts each week until the expiration of the long put to reach your profit target. There two components to this trade. LONG PUT: You buy an ATM put for x number of weeks into the future, you believe the price will settle somewhere at or below the strike of the long put you purchased by expiration. You set an profit traget (eg. 5% per week for X # of weeks) and calculate how much extrinsic value you need to acquire each week off your shorts to achieve that target. SHORT PUTs: You sell the # of contracts each week to achieve that target you set (the strike you sell at should be the strike that gives you exactly the amount if extrinsic you need, why? because if you sell a strike with more extrinsic you need, the strike is usually further away to the underlying price, so more OTM, in case of a upwards rally on GLD, you will get to keep less intrinsic. Keeping more intrinsic help you offset losses due to the difference in deltas between your long and short position, i explain it further below), when you short the puts 1 of 3 scenarios can occur by the time you need to buy to close and sell to open for the following week: scenario 1: GLD price does not move and is equal to your strike price by week's end: well that's great, you just collect the extrinsic value because theta is negative and vega is positive. since GLD price didn't move, theta has decayed away most of the value and you don't pay more to close because vega probably didn't really move much since the GLD price didn't decrease. scenario 2: GLD price settled above your strike price by week's end: well that's even better, you collect the extrinsic and even a bit more because now when you buy to close, your GLD strike is further OTM, making it even cheaper. scenario 3: GLD price settled below your strike price by week's end: well that sucks, you see a paper loss. it cost more to buy to close because now your short put has intrinsic value in it because it's ITM. but wait maybe you didn't lose money at all? how? well your long put is now further ITM, all the paper loss you see on your short put maybe covered by the gains on your long put! However this is not always the case. Why? a. The deltas on your long and short puts are not the same. Usually gamma on options closer to expiration are much greater than longer dated options. So in the scenario where the price of GLD all of a sudden drops $2 dollars in one day, or even worse, drops 2 dollars on the day you are suppose to close (usually a friday), your short delta is going to be 1. whereas your long put delta maybe less than 1. so in that case, the gains on your longs will not sufficiently cover your paper loss on the short. b. if the price drops on your short, because you have to buy to close, vega maybe pretty high, so you are paying more to close your position. if vega increased alot, it may even offset the negative theta you have been collecting. which means you got hit by a double negative. you gains on your short from time decay got offset by the increasing vega. and your delta on your long is less than the delta on your short, so your intrinsic loss wasn't covered by your long put either. and the above two reasons is why you never roll your long put if it's DITM, because the delta will be close to 1. if both deltas are 1, you have eliminated all your gamma risk, and you can be sure that any paper loss on your short positions will be covered by your DITM long put. All you have to do is sell at your extrinsic every week and make your profit target. this is also why Chris suggested to do a ratio in the beginning. Because when your long put is not yet DITM, you have that difference in delta between your long and short. If you short in a smaller ratio than your long, and if the price drops substantially as in what i described in a. and b. then that ratio will partially offset your delta difference. when your long is sufficiently DITM where both deltas are 1,then you can forget the ratio and do 1:1 long:short. Since you have 2 ways to win on your short vs. 1 way to lose, and if your long put is DITM, you pretty much have no way to lose. In summary, I believe It is an excellent trade if you believe GLD will not have a big rally anytime soon. If you look at the overall economic conditions - Fed is beginning to taper their bond buyback - This will drive up long term interest rates - This will give bonds and other debt instruments more yield - this will lead to a decrease in gold prices because it makes gold, which yields nothing, an less attractive investment option. - so I don't believe there will be a BIG rally in gold prices soon. In general based on overall economic conditions and the thesis of this trade, I believe it will be profitable if executed correctly.

-

Chris, i was just thinking about the risks on this type of trade. What happens if 1 day before expiration or even on the day of expiration of the short put, there is a drastic move against our short position (i.e GLD all of sudden experiences a large drop in price). It's my understanding that gamma is at it's most extreme when it's close to expiration. so in that case, our long position cannot cover the losses incurred (since we must buy to close our short position to avoid assignment) correct?

-

Hi Chris when we initiate this kind of trade do we always long the ATM put?

-

Chris/Max a couple of questions: 1. If we are looking to start with a ratio, how should we decide on the ratio? are we trying to be delta neutral? so we add up the deltas of the long put side, and see how many short contracts are required to make it 0? 2. I think GLD is on a rally looking at the technical charts, so buying the long put at 119 is not good idea right now? Shouldn't i buy a higher put right now to prevent me from having to roll it really soon? 3. As per your discussion above, are we always selling ITM puts with JUST ENOUGH extrinsic value to cover our extrinsic needed/week? I'm just thinking if the long put delta is really close to 1, we can take a bit more risk and sell OTM puts to capture more extrinsic/week? Thanks guys.

-

Hi Mike, yeah i looked into it. Basically in Canada if you want to be registered as a portfolio manager, you need to hold either a CFA OR a CIM (chartered investment manager). Unfortunately, CIM isn't recognized worldwide like the CFA so if you want a bit more flexibility i think the CFA would be a superior "charter" to hold.

-

You mean prolonged run up of GLD right? not SPY? So it's kinda of like the anchor trade, the long put is our hedge and we are paying the hedge back through selling short. the general thesis is we think GLD will not have a large rally in 12 weeks so can continuously sell short to pay back our "hedge"and earn a profit until our long put expiration. Since this works on GLD and SPY, Would this work on other underlyings like DIA? seems to me an important criteria is the underlying should have experienced recent increases in volatility because it will allow us to get more credits on the shorts.

-

chris is it too late to get into this?

-

To be honest, i'm just trying to build up my credentials right now. I'm still relatively young, turned 25 in Feb of this year. I worked as a junior analyst in a private equity fund in Asia for 2 years after i graduated, but i felt like i need more schooling. I got really interested in securities and corporate law so i'm actually going to law school next year for that. But i have this one year in between, so i thought it would be a productive use of time to try to do the level 1 CFA exam. Of course, everyone i talked to at the investment banks and the PE funds all encouraged me to go for it, because for them there is no better starting qualification. But i'm not sure if there's any point in holding a CFA and a JD, I'm not sure if its feasible to even go into both fields (though they are related), well i guess it is possible. Chris from this forum is a great example. But there are so many smart people here so i just wanted to get opinion from you guys as well.