We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

650 -

Joined

-

Last visited

-

Days Won

12

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Mikael

-

Trading and getting fills with Interactive Brokers

Mikael replied to cwerdna's topic in General Board

Hi Marco, haven't really looked into that but here is what it says on IB: In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you1 IB's Cost Plus commission models are not guaranteed to be a direct pass-through of exchange and third-party fees and rebates. Costs passed on to customers in IB’s Cost Plus commission schedule may be greater than the costs paid by IB to the relevant exchange, regulator, clearinghouse or third party. For example, IB may receive volume discounts that are not passed on to customers. Likewise, rebates passed on to customers by IB may be less than the rebates IB receives from the relevant market. Some or All means anything from greater than 0% to 100% rebate IB got. It is at their discretion so technically they can pass on 0.000000000001% of the rebate back to you and this statement would still stand. I think the main advantage for livevol is #1 their platform, #2 they are 5 cents cheaper than IB's 70c commission on option premiums >10c, so it should cover whatever rebate they decide to withhold most of the time. however, i don't know if they will match IB's policy on < 10c contracts for 50c. Probably will email them about that. you can keep your IB account open and just transfer whatever % of money you want directly form IB to your livevol IB account. then you can just use TWS and livevol at the same time. -

Trading and getting fills with Interactive Brokers

Mikael replied to cwerdna's topic in General Board

no you can't, you have to sign up for a new account. BUT you can do a position transfer or cash transfer from IB to IB account. so it's not so complicated actually. going through the process myself and the livevol people have been very helpful. check out their demo video here: http://www.livevol.com/movies/lvx-demo/lvx-demo-movie.html -

Trading and getting fills with Interactive Brokers

Mikael replied to cwerdna's topic in General Board

If you guys are sick of IB but want to keep using their order routing and smart execution check out Livevol (but need to have over 35k in your account). it's really awesome and they charge 65c a contract. all the money/execution is handled by IB but the platform is very powerful and customisable. backtesting and charts suck but that's what you have free ToS paper accounts for -

I wish they would redesign the stupid GUI on IB. seriously they can just literally copy ToS and they would gain so many more customers.

-

by the same token, i guess they would adjust their clocks forward one day prior to the close on other trading days as well to eliminate the edge traders have by trying to sell premium right at 3:59. so i guess a general rule would be it's better to sell in the mornings.

-

interesting. seems like what that particular MM does (marco's link) is just set his software's clock forward one day thursday midday (11EST) onwards. so essentially if you sell a premium to him after thursday midday the price would be the same as (if everything else held constant) friday midday (+1 day in theta decay) and by Friday morning it would be already saturday morning, and by friday close it would already be sunday 4:00pm. so theoretically if you want to take advantage of the weekend decay it would be best to sell premium thursday morning before 11EST. although it might be a small edge, but if you are trading large lots it could squeeze out that extra % of performance.

-

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

yeah that's true. might just keep on rising into the FOMC meeting. regardless i think there's gotta be a spike +- a few days around the 17th. so i'm kind of hesitant to short vol right now. but yes, good advice on using long ditm puts for shorting vol rather than selling calls or something where you might get destroyed in a blackswan event like 2008. -

Hi, Just wondering, when we sell an option, is it better to sell near the end of the trading day? (ie. does the negative theta we see get deducted at the end of the trading day or right before open the following trading day?) thanks

-

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

yeah, hopefully it spikes sooner rather than later. don't really want to hold it through the september 17th FOMC meeting. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

guys RVX is @ 21.82. it's a 6 months high. ICs or credit spreads looking tempting. but might wait until thursday to see if they actually starts bombing syria or not. could be an catalyst for higher vol. yay -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

i think the BWB will be a bit better in terms of commissions if VXX was higher. this sustained rally really sucks -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

i meant the UVXY calendar not the BWB i made a mistake. that's fine because there's no risk to the upside. UVXY 38 put calendar is still fine with the spike? last i checked it was at 44 already :S -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

marco i added your link. mica your link is already in the additional resources part (just the main link not all the separate links, post will be too long) -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

haven't looked into the calendars but on first glance isn't it risky to put calendars on products that are designed to a) consistently decay at a high risk of spiking upwards c) especially doing a calendar on UVXY which is a 2X version of VXX? the only viable way of doing a calendar is opening 1 or 2 strike OTM puts and hope it decays there slowly but what if it spikes? just saying it's not that stable to do a calendar on IMO. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

isn't it kinda of risky with syria war possibly coming up and the fed meeting on sept 17? -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

thanks, i'll post that up in the link. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

added VXV/VIX Ratio Strategy -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

Be careful with calendars on the vix (see first post). The 16 p and 17 c are good ones for sure. Those expiration trades is just gambling. Like I said instead of playing roulette or blackjack you can do one of those trades a month. Technically you have better odds than any game in Vegas since the event is random and you don't have a negative edge the odds of winning are also much greater than any lottery ticket you can purchase as well -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

Paul, you are doing it with calls because it's more expensive correct? (less commissions) -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

If you guys have any more links please posted it, i'll slowly move it to the first post. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

i'll edit that first thread into real strategies tonight lol please don't do that crazy trade i posted. -

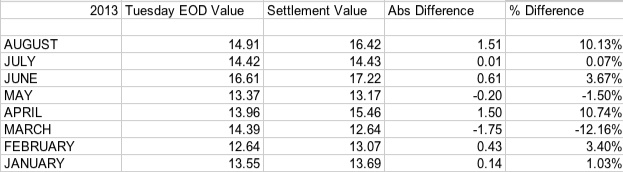

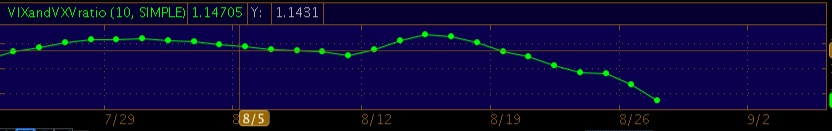

VIX Strategies: Trades below work better if VIX is higher (more value left in them on expiration day) Sell Naked Straddle on expiration Day (extremely high risk) - Sell the ATM straddle (closest strike to EoD price) on expiration Tuesday. - Unlimited loss beyond BE like any short straddle - 100% gain of credit received if VIX settles within Put Strike - credit received / Call Strike + credit received Sell Naked Puts on expiration Day (very high risk) - Sell 1 strike OTM puts on expiration Tuesday. - VIX tends to spike up, not down. Theoretically it's less risky to sell naked puts on the VIX than other underlyings. - You have unlimited loss if VIX settles below your short strike - credit received - 100% gain of credit received if VIX settles above your short strike - credit received Buy Butterfly on expiration Day (high risk) - Buy a butterfly and hold it through expiration - Max profit if settles at short strike point - Some profit if settles within profit zone - 100% loss on debit if settles beyond profit zone http://vixandmore.blogspot.ca/2009/02/vix-butterfly-play.html Long Iron Condor on or close to expiration Day (high risk) - Same thing as butterfly but wider profit zone. can buy it on the Monday or Tuesday. - Hold until expiration - 100% gain on credit if settles within profit zone - Max loss if settles beyond profit zone Here is my own data for settlement risk you might experience this year. These trades are highly speculative in nature and i don't recommend them. They are however quite fun and can be a good replacement for roulette or blackjack. I have data going back all the way to 2008 if anyone's interested i can share it. VIX 16 Put Calendar - Open 16 strike put calendar when VIX is low (for me it's when VIX < 15) - Front month = 16 strike put closest to expiration - Back month = 1 or 2 months out. I prefer 2 months because if VIX rises the back months will be affected less if it's further out. - When the VIX is low, especially at extreme lows < 13, you can often open these for a credit. I have seen it from 0.00 debit to 1.25 credit depending on how long the VIX has been at extreme lows - Wait for a spike that will eventually happen due to the mean reversion tendencies of the VIX, exit for profit. Trade Mechanics - when you short the 16 put when VIX is low, it is statistically likely that VIX will rise. If it does, you profit on your short 16 put. It also benefits from time decay. When the VIX does eventually rise, your back months futures will not rise as much as the front months, so your gain from your short will be higher than your loss from the long. Risk - VIX continues to stay low or drops even lower. Keep in mind VIX cannot go to 0. Why 16? I'm not sure, but Kim and other smart people have figured out 16 is the lucky number to go with. If you dislike 16 you can go with 17,15. Warning: do not do VIX call calendars when the VIX is low and do not do put calendars when the VIX is high, they do not work like normal calendars because the long leg of your calendar is based off the futures pricing, not a single underlying like regular calendars. you are trading off 2 distinct underlyings where the price are related but does not move in unison and you can lose ALOT of money. please be careful. imagine this scenario: vix is at 30. you decide to put on a calender shorting october 30 put, long nov 30 put. 10 days later, VIX drops to 20. your short is based off october futures, which drop more than your nov long (based off nov futures). so your loss on your short position is more than the gains made on your long position since they are not based on a single underlying and the magnitude in price change is different. VXX Strategies: DITM Put - Take advantage of the roll decay when VIX term structure is in contango (which is about 70-75% of the time). What to do? - Buy when a deep in the money put when VXX spikes. How do i know its a spike? - Look at the VXX 6 months chart and compare current levels to higher levels OR watch the VIX when it goes over 20-25 (the mean of VIX historically is around 20, so when it spikes over 20 or goes below 20 it's statistically likely that it will eventually revert to the 20 level, key is eventually because no one knows how long the spike will last). How far do I go out? - Personally i would go out at least 90 days to reduce theta decay, but this is up to you and should depend on potentially how long you want to have your capital tied up. What strike do I pick? - Deep in the money, so pick puts with deltas > -0.9 Risk? - Remember 100% of your risk is undertaken at order entry. Position sizing is your primary way to limit risk. Market crashes, extended market downswings, VIX continue to go up for a long time, you must either take loss or roll further out (which is the same as taking a loss and opening a new position). Broken Wing Butterfly - Take advantage of the roll decay when VIX term structure is in contango (which is about 70-75% of the time). What to do? - Put it on at anytime (DITM put you should wait for the spike) the VIX term structure is in contango. Trade Mechanics - Strike Selection - DTE Selection - Risk - Remember 100% of your risk is undertaken at order entry. Position sizing is your primary way to limit risk. VXV/VIX Ratio Strategy: Marco and some other members discussed this before. It comes from a Tony Cooper paper called "Easy Volatility Investing". You don't need to know everything about all the volatility ETNs and math behind it but if you are interested you can read the full paper here: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2255327, the trade and concept itself is very easy anyone can do it. But there is a few things you do need to know: 1. What is contango/backwardation for VIX term structure. If you google this there is tons of resources, study it a bit so you understand. (www.vixcentral.com will show you the VIX term structure right now) 2. VXV is the 3 months version of the VIX 2. VXX - Goes down when VIX term structure is contango because it is designed to sell near term futures contracts and buy back month futures contracts. This is called roll decay. 3. VXX - Goes up when VIX term structure is backwardation for the same reason as above 4. XIV - Suppose to mimic the inverse of VXX gains or loss. so 1% decay in VXX = 1% gain in XIV and vice versa. So in summary: When VIX is in contango: VXX down, XIV up. When VIX is in backwardation: VXX up, XIV down. So how do we trade this? Well the logical thing is to figure out what term structure the VIX futures is in right? So just go to vixcentral.com and check it out. it will take you less than 5 seconds everyday. But it's not so simple, ideally you want to be LONG VXX when the backwardation is strong, and long the XIV when the contango is strong. but how strong and at what point do i switch the ETNs? Basically you should ask yourself, how can i be more precise and methodical? Tony Cooper and others have identified some specific ratios to optimise this kind of trade. So through some backtests and calculations various people have come up with a magical ratio that should in theory optimise your P/L. So you want to know the magical ratio? Turns out, the magical ratio to determine when to switch the ETNs is 0.917 with a 10 day SMA The idea is very simple: You take the VXV / VIX ratio. IF VXV/VIX is > 1 this means the term structure is in CONTANGO. Why? It's very simple, VXV is the 3 months version of VIX so if you the 3 months of the VIX over VIX itself and the value is higher than 1 that is telling you VIX spot is lower than 3 months version of itself, so the future is more expensive than spot. so obviously that means the structure is in contango right? IF VXV/VIX is < 1, this means the structure is in BACKWARDATION. Do i really need to explain this again? If you want to optimise your P/L you can use 0.917 instead of 1 (and take the 10 day moving average of the ratio chart). The downside is you have to do more trades. Long XIV shares (no options) if ratio is above 0.917 OR if you have a DITM PUT in VXX keep holding it Long VXX shares (or call options) (or short VXX puts) if ratio is below 0.917 OR if you have a DITM PUT in VXX you need to unwind now Another bonus of this strategy is now you can trade volatility in your retirement accounts. In Canada and US at least... sorry don't know about European stuff. Additional Resources check VIX term structure at a glance: www.vixcentral.com Has a good overview about all VIX based ETN's / ETF's http://etfdb.com/etf...ory/volatility/ good blog about vol products: http://www.volatilityanalytics.com another good blog about vol products: http://sixfigureinvesting.com great website on trading vol products: http://www.tradingvolatility.net/ apparently you can manipulate vix settlement price: http://onlyvix.blogspot.ca/2011/10/how-to-manipulate-vix-settlement-price.html broken wing butterflies: http://www.probabilityofsuccesstrading.com/?page_id=841 what is high IV: http://vixandmore.blogspot.ca/2008/04/what-is-high-implied-volatility.html vix can spike alot without market dropping much in value: http://vixandmore.blogspot.ca/2013/02/all-time-vix-spike-11-and-treasure.html And one of the best volatility sources: www.sixfigureinvesting.com Covering: Volatility—Historical / Backtest Data The VIX index from 1986 XVZ Backtest to 2004 VIX Volatility Futures Data from 2004 Volatility Rolling Indexes from 2004 ZIV Backtest to 2006 VQT Backtest to 2004 When a Hurricane Messes with a Volatility Index How Meaningful are the VIX’s Percentage moves? Volatility—Long Investing in the VIX—CVOL & TVIX are Close How to go long on the VIX / VXX Volatility—Short Going short on VIX Going short on VXX Inverse Volatility—the Winner is XIV Is XIV Behaving Correctly? IVOP and XIV Termination Events Taming Inverse Volatility with VIX/VXV Volatility—Term Structure The Cost of Contango—it’s not the daily roll SPX 1 to 3 month term structure at historic highs VIX Mid-term Futures contango at historic highs Live VIX term structure chart with VIN, VIF, VXV Volatility—Underperforming/ Dead ETNs What’s Wrong with XVIX—A Matter of Contango XXV—The First ETN with Nowhere to go TVIX—Not Recommended Volatility ETNs—Under the Hood C-Tracks’ CVOL Barclays’ VQT Barclays’ XVZ

-

you can also trade bond futures directly but that requires a bit more capital since the margin requirements are very high.

-

Hi Dustin, you can short JGBs by proxy through a inverse ETN by longing powershares ticker: JGBS alternatively if you want more leverage you can do the 3X leverage version of the ETN through JGBD unfortunately there are no options available and the volume is quite low, since most retail traders are not familiar with trading bond futures. so the best bet if you want leverage is still shorting the yen through FXY.

-

Hi Gary, i trade currency but through ETFs because there is NO volume on currency pair options. i only trade Yen vs USD so if you look on the currency pair index option on ISE ticker YUK there 0 volume. whereas if you trade the ETF version, ticker FXY you can trade options and the volume is decent. easiest trade of the year is just buy a DITM put on FXY going out to March 14. (i own the Jan 102 put). Everyone knows Yen is going down so just hold the put. Pretty soon BOJ is going to inject some more cash since they still didn't meet their inflation target and we all know what that means you can also sell calls against your put if you feel like it but the extrinsic is pretty dry. but you can squeeze a bit more performance out of the trade