We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

650 -

Joined

-

Last visited

-

Days Won

12

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Mikael

-

I'm not used to trading on IB, can someone tell me why my short flies do not all say -10 on position? i am 100% sure i put on all short flies (in fact i called them and verified), but no one can tell me why some position says +10 and some says -10. what's the deal with that? it's very confusing! especially since I have to set GTC buy orders differently as well. attaching screenshot below. thanks for the help!

-

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

for AAPL most weeks you can get about $3-4 credit if you open monday. so your max loss is 10$ (wing width) - credit. but that only happens if you hold until expiration and apple closes right on the spot. but you should basically close the trade off before thursday 12pm or so (definitely before 2pm) for whatever it costs. the reason for that is the Market makers have to deflate the IV to compensate for the overnight theta decay which is huge (if you read Jeff's Augen's book he explains this in detail), they tend to start killing the IV around thursday 12-2 (definitely by 2) -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

i have good experiences with aapl, goog, amzn, nflx, pcln. $10 wings are pretty decent for those stocks -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

i don't have a max loss, i usually set my buy back at 30-35% of credit received. if i don't get that filled i take it off before thursday 12pm for whatever it costs. thursday to friday have such a huge negative theta it's not worth keeping the trade on if the stock hasn't moved yet. but the win rate on these trades has been so high, i think out of the last 20 or so trades i have lost money 4 or 5 times only. and the losses weren't big either. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

Sam if you recieve 2.5$ credit for the short fly, you cannot lose $7.5 unless you let it expire exactly at your middle strike (that is highly unlikely even if you let it expire). if you close it off before closing on friday you will never ever lose the full $7. ToS is telling me for a 500 strike aapl short fly expiring this friday, the loss on friday if appl stays at 500 exactly is about -1k for 10 spreads. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

sam what stocks have you been doing it on? because the spacing between the wings are important depending on the stock. but yes you are right, commission drains the profits quite a bit. you mean you have lost $7/spread on a $10 short fly? that's a bit hefty, you held until expiration right? otherwise there's no reason how you can lose the $7 if you got $3 credit. also you can take profits less often. commissions kills you if you take profits at 10% of credit everytime. i try to do it at 30% or 50% depending on what's coming up. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

Temper thats a great webinar. i actually have been doing something similar on expensive stocks that moves around alot for cheap gamma plays. Amzn, aapl, goog, tsla, pcln are good candidates. Cheap stocks the commission is too expensive to do it. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

also i would cap the naked calls with a 5 cent otm long call. so you end longing a DITM call, and short a call spread. -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

In general short straddles on expiration friday is a terrible idea. how do you know the pinning will not decouple and price spike? you can easily be facing a huge loss with no time to adjust. however i think he mentioned in one of his books of using ratio trades to take advantage of the IV collapse from 1pm onwards. that makes more sense because it is at least buffered against a modest price spike upwards, and if you got a credit on the trade you have no downside risk. i did a few of these ratio trades on AAPL and GOOG on expiration fridays but they are quite unnerving because if the price does spike over your short calls you could be looking a pretty substantial loss. so you definitely need to monitor the trade very closely and not put on too high of a ratio. i found 1:2 is a good trade-off instead of 1:3. being more delta neutral does help stabilise the p/l over time. problem is you really have to get into these ratio trades before 12. after 12 the IV drops alot and you'll have a hard time collecting enough premium for shorting a OTM call even if it's just 1 strike away. -

not sure if you ever tried using IB's iphone/android app. it's not very good but you can place/take off trades at least... as long as you have 3G or some kind of data service on your phone it should work.

-

so might be better to take off the IC before earnings and put on a hybrid iron butterfly to go through earnings.

-

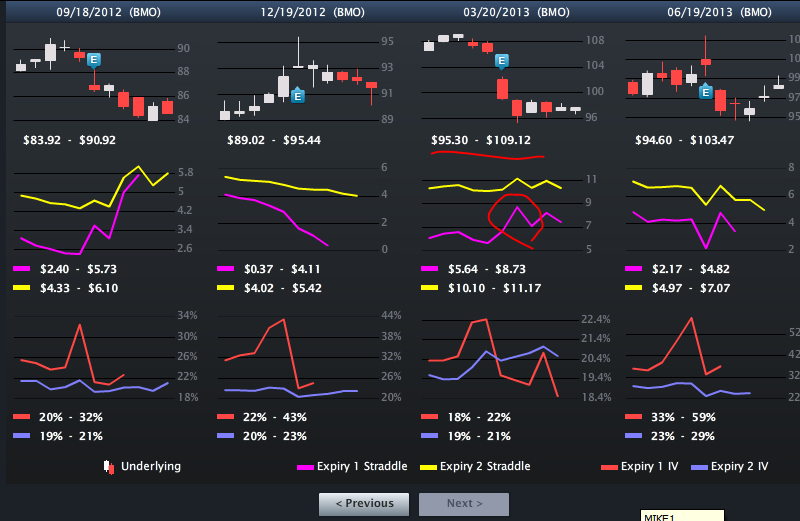

also notice how the last time that the short straddle lost money (march cycle), the HV and IV was very close to together. everytime it made money HV and IV were further apart. and look at the divergence between HV and IV now...

-

yes, maybe tightning the strikes will be a better in case of outlier moves. here's the atm straddle pricing against IV for the past 5 cycles of FDX. shorting the ATM straddle made money 3 out of 5 times. turns out FDX can really move. look at the 2 times that the short straddle lost money, the stock moved alot. 1 of the two losers had IV which is sigificantly lower than now. below 23%

-

yes that makes sense as well. what do you think about a hybrid iron butterfly then. basically selling the front month ATM straddle and hedging both sides with back month OTM strikes. eg. something like this for PAY. (not suggesting to do it but just an idea, not sure if i would want to do it on PAY seeing how they move quite alot past few cycles)

-

thanks marco.

-

I agree. I should start doing more condors haha. Marco one question, if you are short a strangle/IC for an earnings event. do the vol crush after earnings get applied to all the strikes equally? in other words, there are lots of data on the internet for how atm earnings straddles performed, but not for other strikes. so can we extrapolate that reduction/increase in price of the straddle to the strangle as well. for instance if the ATM straddle went from 2 to 1 dollar after an earnings event, (50% reduction in value), can we extrapolate this 50% reduction to the other strikes. (ie a .2 delta strangle should go from 1 dollar to 50 cents?)

-

i took your advice and bought the .05 delta as insurance on both sides lol. i wasn't old enough to be trading when eron was around but i heard enough horror stories

-

thanks marco, i decided to short a strangle first and maybe condorize if the stock starts moving in a certain direction.

-

depending on how the stock moves i think i might close the strangle before earnings. or if the stock doesn't move may hold a small allocation through it. FDX doesn't seem to move much during earnings.

-

i sold the 95 / 115 oct strangle a few minutes ago. filled at nat for 1.99 credit.

-

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

Mikael replied to Mikael's topic in General Board

I think i might just buy a 80 to 90 delta call on the VIX 4-5 days before the meeting. so that'd be the 12 or 13th of Sept. -

Yowster excellent analysis, let's keep track of this tomorrow and see how the stock/IV moves. i'm leaning towards your DC idea on a side note, is there some pending news coming out before earnings? i did a quick google search and yahoo finance search and found nothing to explain the unusually high IV 2 weeks before earnings.

-

anybody watching FDX? IV is at 96th percentile YTD. with earnings on 09/18/13, so 2 more weeks to go. not seeing the vol dropping much before earnings is announced, thinking about a) since it has weeklies, earnings cal and holding it through earnings, but putting it on and getting some more time decay out of it just a regular calendar, take some time decay and get out before earnings. c) sell some puts at the 103 support level. credits are good with vol this high and that resistance level look hard to break through. ideas?

-

Trading and getting fills with Interactive Brokers

Mikael replied to cwerdna's topic in General Board

Hello, got an email back from LiveVol regarding questions posted above: Hi Michael, Hope you had a nice weekend. 1) For the account you are opening, the clearing will be done by Interactive Brokers. We do allow APEX accounts but those can only be opened by USA citizens. Additionally, APEX accounts are typically geared for extremely knowledgeable and experienced traders who plan to fund the account with a substantial amount. 2) This is essentially the same answer as above. For your account, the trades will be placed through Livevol X but the actual execution will be handled by Interactive Brokers. For APEX accounts, it is Instinet. 3) The rebates will be handled by Interactive Brokers so any amounts that you see on their site, you can expect those same amounts for your account. 4) We don’t match IB’s rate on the options below a dime but if we see you’re doing a lot of volume after you open the account, we can certainly take a look at your overall rate and possibly give you a lower one. Thanks and let me know if you have any more questions. -

Trading and getting fills with Interactive Brokers

Mikael replied to cwerdna's topic in General Board

Yes I agree. ToS still has the best analysis tools but the IV historical data and the way it's presented on livevol is unmatched by ToS or TWS.