SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/31/20 in Posts

-

Before I cancel my SO subscription for now I want to thank everybody who participates in the forum but especially @Kim and @Yowster for the fantastic learning experience and all the precious trading advice and ideas. Due to a lack of time and I will have to pause my participation. All the best!4 points

-

There are two "bad" scenarios for Anchor. The worst is also the most unlikely, which is a what I call a whipsaw stair down. If we have a market that looks like: 1. Over a three week period the market drops 2%-4% and we have to close the short puts for a loss; 2. Over the next three weeks the market goes back up 1% to 3% -- so our short puts gain, but we don't gain as much as we lost over the last three weeks 3. Steps 1 and 2 repeat for an extended period of time In that scenario, we "bleed" on selling options, but the long puts keep losing time value because things are staying basically flat. We expect one or two periods like the above per year, but it's when we get a LOT of them in a row that problems happen. The second bad scenario is markets that stay generally flat and volatility keeps declining. In that situation, our long calls actually will lose some value (they're not a 1 delta, so there is some time value), or long puts will lose a lot of value, and we won't gain very much from selling short as volatility is declining. What's interesting is that we can't just say "flat markets over the year are bad." Go look back at this spring, where the markets collapsed, then rushed back up. We actually did well during that period. It's when they are truly flat -- not just a flat result after a six month period. This will happen to Anchor sooner or later. When I went and reviewed the history of the markets, about 15% of them are what I would call "flat." It is ENTIRELY possible, if not probable, that if the market is up 3% on a year at a rate of 0.25%/month, that we'll be down at least 3%, if not more (depends entirely on amount of leverage). However, that's a trade-off I'm willing to take. If in bull markets, I out perform, and in bear markets I out perform, I'm willing to underperform in flat. Last thing, be careful about general rules like "outperform in bull markets," it is possible to design a bull market where we DONT outperform. But that depends on the amount of leverage and how the gains occur. If the market is flat, jumps 10% in a day, is flat for 4 months, then jumps 10% in a day, we might actually end up lagging the market a bit. (We'll still be up). The great thing about Anchor is we can model exactly how it will perform in any market condition -- excel is great for that.4 points

-

Thanks all. I had some own goals through poor execution of the officials, missed some officials through not being able to get in but also got headwinds from some better prices on the officials and earnings ratios/VXX Fades. I count those as part of it because the value of SO is so much more than just the official trades, its also the unofficial ideas and most of all the feedback from other traders in the forum. I think that countless others hit the nail on the head that the best way to implement the SO strategies is to learn them like the back of your hand and execute them on your own. So perhaps its not a big surprise that some of my best winners have been ones I've done on my own. So @Kim I've probably done slightly worse than that on the officials but the learning I've gained from them/forum discussions has enabled me to add in some great additional trades....and because I'm only looking towards my own positioning that has allowed me to approach some less liquid situations which has expanded my universe of opportunities further. Great work @porgie! 10% for a month is fantastic by any measure. I find it very very helpful mentally to go through the numbers on a weekly/bi-weekly basis. I've said elsewhere that the key for me is on focusing on executing the plan as well as I can and letting the plan/edge in the plan take care of the result. Regular reviews give me the confidence to do this. It also helps give a bit of a learning plan of what I want to focus on next. It looks like you've identified areas that you're more comfortable going out on your own. I'm much the same, I haven't had much success with earnings straddles...my official ones are fine but my self generated ones are not so good. Drawing from my experience with some of the less liquid ratios + other unrelated discussions, I suspect that the gap for me on earnings straddles is due to poor entries...my hunch is that because the avg gain on a successful straddle is much lower than other strategies, a good entry price is much much more important for consistent success. The learning opportunity will be different with everyone but until you review your numbers you cant begin to know where to focus your attention. I don't know how the education system works elsewhere but in Australia its not uncommon for kids from fancier schools really stumble in their first year of uni. High school can be an environment where their devoted teachers are structuring the lessons for small class sizes to teach them exactly what they need to know to get a great result on the end of year exam. Uni on the other hand features massive classes where the unpaid tutors arent exactly motivated to throw a life preserver to an individual student who's falling behind. Its a bit of a culture shock as all of a sudden you realise that -syllabus aside- you've got to take charge of your own learning, assess your own abilities and develop a study plan specifically for you...no one else is going to save you from drowning if youre not prepared to try to tread water yourself. I couldnt ask for a better set of resources to learn from than those available at Steady Options...but if you only put in the contact hours and dont do any study outside of class then you're not really getting your full money's worth. Analogy aside: I couldnt recommend more strongly that members review their own numbers and set your own study plan based on this. @zxcv64 unfortunately my approach wasn't all that exciting. I pulled some 5 second data from TWS via the API and worked up a bid/ask of the spread across a couple of sessions to get a feel for what the true mid might look like. I noticed that certain low liquidity legs have some really strange behaviour...The ask might be 1.95 and then all of a sudden the MM with blow the ask out to -say- 4.00 and then lower it back down to 1.95 by a cent per second...and this could be happening to multiple legs at the same time in the spread (occasionally cancelling out the apparent movement). I also noticed that putting in an ask at the right level would cause them to immediately update their ask their real level/skip the countdown. I have no idea why this occurs but it it took some of the unknown out of it...or at least made me a little less trusting of the true/ONE generated mid particularly with low liquidity chains. I noticed that these random spikes could throw the real mid off by 10-20% in one session...so although the mid might look stable in ONE the real price might change as soon as you put an order in. The best solution just seemed to be to throw an order for a single combo in several dollars below the mid/down at insult prices and then patiently step you way up..once you get a hit/establish the actual market mid you can then scale in from there. Not rocket science but its an improvement I never would have captured if I hadn't been launching my own trades and making myself focus on one thing at a time.3 points

-

Assume you are talking about straddles? It should always be the expiration immediately after earnings. However, there is a major problem/flaw when you are looking that far out (more than T-10). In real-time the earnings dates are not always announced that far out. So you may see a beautiful looking backtest or RV chart at T-15 but in reality you would never be able to trade that because you may not know when the confirmed earnings date would be. LULU is the perfect example, they only announced their upcoming Sept 8, 2020 earnings date on August 25 (two weeks before earnings). So anything on the backtest or RV chart prior to T-10 is misleading and dangerous. Not sure if there is a way to show that but its something I have learned the hard way.3 points

-

1) The model portfolio is based on $100k. I believe the minimum is $50k 2) You will build the portfolio based on detailed instructions (the long calls, the long puts and the short puts) and then you will start rolling the short puts every 2-3 weeks based on market conditions. 3) No. Anchor trades SPY, diversified Anchor you can add IWM, QQQ and EFA. All of them have the most liquid options, so no issues with fills at all. 4) If the indexes go down, depending on the magnitude and the speed of the decline, Anchor can lose money, but almost always it will lose less than the indexes. 5) @cwelsh can explain better, but I think in case of sideways markets Anchor might underperform.1 point

-

@gf58 I went ahead and ran my numbers and I thought they looked good: So for the month of August with just one trading day to go I have closed on 8 SO trades----for me there were 7 winners and one loser. Overall performance after commissions was 8.75%--please see explanation below as I have already closed 2 active open SO trades. I have already closed out CPB and KR for my profit targets and they are still open trades with SO---the main reason for closing these early is I will be spotty next week at being able to monitor the trades--my big winner this month was the TLT trade. In addition using SO trade theses and using smaller allocations ( because I am still learning ) for these trades I added another 1.3% after commissions with 7 winners and 2 losers and actually the 7 winners came after the 2 losers--so 7 in a row. If I had used the usual allocations I use for SO official trades the gain after commissions would have been 6.3%. My losers on my own trades were: BYND through earnings hedged straddle X 2, Winners were ZM pre-earnings calendar, PTON pre-earnings calendar, BBY earnings straddle, ZM pre-earnings calendar #2, ZM pe-earnings calendar #3, and CRWD pre-earnings Cal, and PTON pre-earnings calendar #2 Obviously I am more comfortable with the pre-earnings calendars than the straddles, but my comfort level is growing with time on screening for the straddles. Next to try to learn better over time is the ratios--note I have not traded any of these on my own as I do not feel I have studied them enough to really understand how to pick high probability winners. The real reason for my post is not to boast but to show other new members what learning the strategies and being patient and selective with entering trades can do to increase the odds of winners and add to overall returns/success So overall a gain of 10% on the month--not bad for an amateur.....I think many others probably did better than this.... P.S> I am also in the Anchor Trades on EFA, IWM, and SPY and these are also doing quite well1 point

-

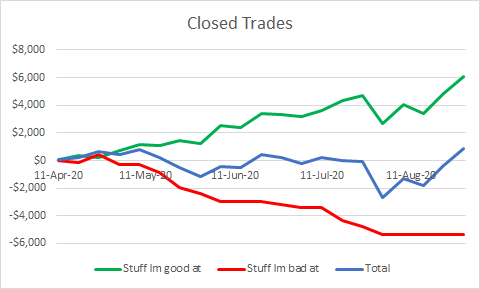

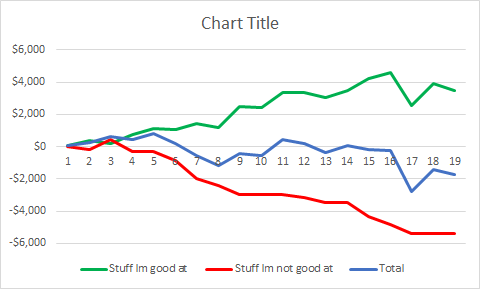

With the month virtually over I thought I'd give an update of my results since I stopped doing the stuff Im bad at (8 Aug to today): 7.8% return on capital including commissions 27 trades with 77.8% win rate Worst loss of 27.3% and best return of 30.2% with an average of 6.8% My trades consisted of most of the official trades along with a number of unofficial trades/strategies that I've learnt directly from the SO forum/members. The official trades that I missed were usually good ones (like BILI) and I whiffed a number of otherwise good ones (BBY was a 1.2% return after I hit BUY rather than sell and had to quickly unwind that mess). Id put the total result down to a combination of focus and luck. Focus in that I used my results to tell me what I seemed to do well and what I wasnt getting the hang of...then eliminating what wasnt working and focusing single mindedly on getting good at the one or two strategies I continued to trade. I cant emphasise strongly enough the benefits I got from just focusing on one thing at a time and relentlessly focusing on improving at it. Luck in that the outcome of each trade is random..so its kind of illogical to think that one or two trades is going to be consistently profitable...but applying the law of large numbers to a strategy with an established edge -ie do it a lot- and the numbers work out in your favour. Its been mentioned that an important step in the learning is putting on your own trades. Through having to identify my own potential stocks, identify my entry points, plan and execute my own exits countless times....well....the learning multiplies. One other thought: trading is the most honest task Ive ever experienced. There is no room for delusion, bias, negativity, optimism, excuses or blame. It demands total honesty of the self. Ive worked in jobs where the majority of the role involved wearing a suit, being likable and appearing to know what was going on...actually generating money for shareholders was an optional extra and could be frowned upon if done in a way that made others feel inadequate...ie most of the job was playing 'dress ups' as a busy business men in business. Trading couldnt be further from it. If you make a profit; thats on you. If you make a loss; thats on you. If you waste time not focusing on how to make a profit; thats on you. So without being provocative -and with the non-existant authority of someone who had a couple of lucky weeks in a row and still has too much to learn- if you're not making money then it stands to reason that its your fault. Putting aside the emotion this statement would conjure up in any human with a pulse, the correct response is to ask yourself what can I do to improve. I dont know if the discussion has moved on or not but I unfollowed the thread when there was a lot of finger pointing about commissions and impossible fills...it was bumming me out and screwing with my mental. The only thing that matters is how each of us can improve; blame is a waste of time. My biggest loss this month was on a low open interest CIEN ratio where the MMs immediately jacked the IV after I entered; the previous me would have bitched and moaned about how it was rigged or unfair. The me that's developed during my time with SO instinctively thought that sucked...how do I reduce the risk of it happening again in future. So I pulled some data, identified some micro structure behaviour, got a sense of where the punji traps were and adjusted my approach. Im still nervous as hell about it happening again and Ive by no means gotten to the bottom of it but the adjustments in my approach allowed me to close out a position today for a overnight gain of 16% all off the back of RV change in a low liquidity/wide spread market. I wouldnt have been able to do that had I not been punched in the face a week earlier and resolve to minimise its future frequency. Iago said whats done is done and John Galt said what is, is but a less esoteric boss once told me that its not how many times you get knocked down that counts, its how many times you get back up. As this last point is becoming a bit abstract but I'll try to bring it down to earth by summarising that a critical part of trading seems to be having an appropriate mentality; specifically one of complete honesty, resilience and self ownership of all outcomes good or bad. If you feel the urge to blame then youre probably on the wrong track. If you feel the urge to find a way to avoid that happening again then youre on a more profitable course. What that one improvement is going to be different for everyone but look at your trading log -you have been keeping one havent you?-, pick only one thing that will make a difference and ignore everything else until you've improved it.1 point

-

I'll make a general statement regarding SO strategies and a new members level of experience coming in. Understanding IV ramafications are a huge part of these trades, and if you are new to options or have only used simple strategies then jumping into many of the SO style trades are like jumping into Calculus but bypassing Algebra along the way. I can appreciate the learning curve, but knowing how IV changes affect trades and how the typical earnings IV behavior plays out makes it much easier to setup your own trades. If you make directional trades, you can more easily set things up to minimize IV effects (I think TV shows like Options Action do this on purpose with the simple directional veritcal trades where IV effects are minimized, so they don't have to get into the details of IV effects), but using trades that start out non-directional you really need to get a good knowledge of IV effects and behavior.1 point

-

Hi @yalgaar the approach I took was to dump all of my trades out of ONE into a spreadsheet and categorise them by strategy (ie. hedged straddle, earnings calendars) and origin (SO or myself).....closed trades only. From there I looked at the weekly and cumulative P&L of each strategy+origin combination. I used this to get a sense of consistency. From there I grouped the different strategies into 'stuff im good at' and 'stuff im not good at'. I continued doing the stuff Im good at and moved to paper trading the stuff Im not good at. Taking this approach allowed me to focus my learning. I learnt that Im good at executing SO Earnings straddles but I burn money when I try to do them myself. This caused me to focus in on the differences to which I identified that my entries suck. This has lead me on a path of learning thats improved my entry skill on all trades. TLDR: You would have done a lot of stuff my now....pick through what has worked and what hasnt. Focus your energy on improving one thing that hasnt been working...then move onto the next thing.1 point

-

Just my thoughts... SO Monthly Fee - You can certainly replicate the research that SO does. But I am sure you can not do the research at anywhere near the cost of the SO subscriptions. I am aware that this takes an inordinate amount of hours to accomplish oneself. In my opinion, the real time research and resulting 'Discussion' topics are worth the price of admission alone. Add to that that we get to follow 'Professional Full Time Traders' into and out of trades has proven invaluable to me. Add to that the discourse of the discussion topic where an active exchange is taking place regarding a detailed trade. Add to that the Strategy thought process and historical trades (and discussions). This is some of the best money I spend every month!! Tools - Over time I have adapted the trades and strategies to other symbols. In my opinion some type of Analysis software is a core requirement. ONE is excellent and overall a small price to pay for the capabilities it provides. The historical data and visualization capabilities are first rate. Execution - Every time the service opens up to new members the first thing we here is 'I can;t get the fill'. Search and you will see 100's of posts on this topic. They all generate essentially the same response. Patience, Learn the strategies, Make you own decisions. I don't take every trade. Sometimes I was not at my computer when the alert came out. Sometimes I can't get the fill that day and neglect to keep tracking for a potential fill in the following days. Sometimes I am just not comfortable with the trade. There are strategies and symbols I like more than others. Sometimes I am at full allocation. With that being said, I found that OS generates plenty of potential trade opportunities. Especially during peak earnings months. I think it often gets overlooked that you do not have to match Kim's prices to do very well. As is often mentioned when the 'How much more do I pay to get filled' question comes up. However much your comfortable paying. The guidance is given repeatedly to think in term of percentage of risk. A nickel is not a nickel without knowing the risk. So, It is a process!! But there are clearly a decent number of members hear that have gone through that process and are now making money.1 point

This leaderboard is set to New York/GMT-05:00