SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/28/20 in Posts

-

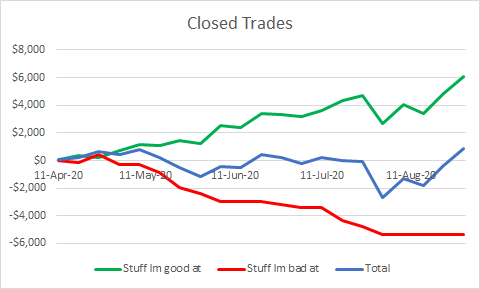

With the month virtually over I thought I'd give an update of my results since I stopped doing the stuff Im bad at (8 Aug to today): 7.8% return on capital including commissions 27 trades with 77.8% win rate Worst loss of 27.3% and best return of 30.2% with an average of 6.8% My trades consisted of most of the official trades along with a number of unofficial trades/strategies that I've learnt directly from the SO forum/members. The official trades that I missed were usually good ones (like BILI) and I whiffed a number of otherwise good ones (BBY was a 1.2% return after I hit BUY rather than sell and had to quickly unwind that mess). Id put the total result down to a combination of focus and luck. Focus in that I used my results to tell me what I seemed to do well and what I wasnt getting the hang of...then eliminating what wasnt working and focusing single mindedly on getting good at the one or two strategies I continued to trade. I cant emphasise strongly enough the benefits I got from just focusing on one thing at a time and relentlessly focusing on improving at it. Luck in that the outcome of each trade is random..so its kind of illogical to think that one or two trades is going to be consistently profitable...but applying the law of large numbers to a strategy with an established edge -ie do it a lot- and the numbers work out in your favour. Its been mentioned that an important step in the learning is putting on your own trades. Through having to identify my own potential stocks, identify my entry points, plan and execute my own exits countless times....well....the learning multiplies. One other thought: trading is the most honest task Ive ever experienced. There is no room for delusion, bias, negativity, optimism, excuses or blame. It demands total honesty of the self. Ive worked in jobs where the majority of the role involved wearing a suit, being likable and appearing to know what was going on...actually generating money for shareholders was an optional extra and could be frowned upon if done in a way that made others feel inadequate...ie most of the job was playing 'dress ups' as a busy business men in business. Trading couldnt be further from it. If you make a profit; thats on you. If you make a loss; thats on you. If you waste time not focusing on how to make a profit; thats on you. So without being provocative -and with the non-existant authority of someone who had a couple of lucky weeks in a row and still has too much to learn- if you're not making money then it stands to reason that its your fault. Putting aside the emotion this statement would conjure up in any human with a pulse, the correct response is to ask yourself what can I do to improve. I dont know if the discussion has moved on or not but I unfollowed the thread when there was a lot of finger pointing about commissions and impossible fills...it was bumming me out and screwing with my mental. The only thing that matters is how each of us can improve; blame is a waste of time. My biggest loss this month was on a low open interest CIEN ratio where the MMs immediately jacked the IV after I entered; the previous me would have bitched and moaned about how it was rigged or unfair. The me that's developed during my time with SO instinctively thought that sucked...how do I reduce the risk of it happening again in future. So I pulled some data, identified some micro structure behaviour, got a sense of where the punji traps were and adjusted my approach. Im still nervous as hell about it happening again and Ive by no means gotten to the bottom of it but the adjustments in my approach allowed me to close out a position today for a overnight gain of 16% all off the back of RV change in a low liquidity/wide spread market. I wouldnt have been able to do that had I not been punched in the face a week earlier and resolve to minimise its future frequency. Iago said whats done is done and John Galt said what is, is but a less esoteric boss once told me that its not how many times you get knocked down that counts, its how many times you get back up. As this last point is becoming a bit abstract but I'll try to bring it down to earth by summarising that a critical part of trading seems to be having an appropriate mentality; specifically one of complete honesty, resilience and self ownership of all outcomes good or bad. If you feel the urge to blame then youre probably on the wrong track. If you feel the urge to find a way to avoid that happening again then youre on a more profitable course. What that one improvement is going to be different for everyone but look at your trading log -you have been keeping one havent you?-, pick only one thing that will make a difference and ignore everything else until you've improved it.10 points

-

@gf58 I went ahead and ran my numbers and I thought they looked good: So for the month of August with just one trading day to go I have closed on 8 SO trades----for me there were 7 winners and one loser. Overall performance after commissions was 8.75%--please see explanation below as I have already closed 2 active open SO trades. I have already closed out CPB and KR for my profit targets and they are still open trades with SO---the main reason for closing these early is I will be spotty next week at being able to monitor the trades--my big winner this month was the TLT trade. In addition using SO trade theses and using smaller allocations ( because I am still learning ) for these trades I added another 1.3% after commissions with 7 winners and 2 losers and actually the 7 winners came after the 2 losers--so 7 in a row. If I had used the usual allocations I use for SO official trades the gain after commissions would have been 6.3%. My losers on my own trades were: BYND through earnings hedged straddle X 2, Winners were ZM pre-earnings calendar, PTON pre-earnings calendar, BBY earnings straddle, ZM pre-earnings calendar #2, ZM pe-earnings calendar #3, and CRWD pre-earnings Cal, and PTON pre-earnings calendar #2 Obviously I am more comfortable with the pre-earnings calendars than the straddles, but my comfort level is growing with time on screening for the straddles. Next to try to learn better over time is the ratios--note I have not traded any of these on my own as I do not feel I have studied them enough to really understand how to pick high probability winners. The real reason for my post is not to boast but to show other new members what learning the strategies and being patient and selective with entering trades can do to increase the odds of winners and add to overall returns/success So overall a gain of 10% on the month--not bad for an amateur.....I think many others probably did better than this.... P.S> I am also in the Anchor Trades on EFA, IWM, and SPY and these are also doing quite well3 points

-

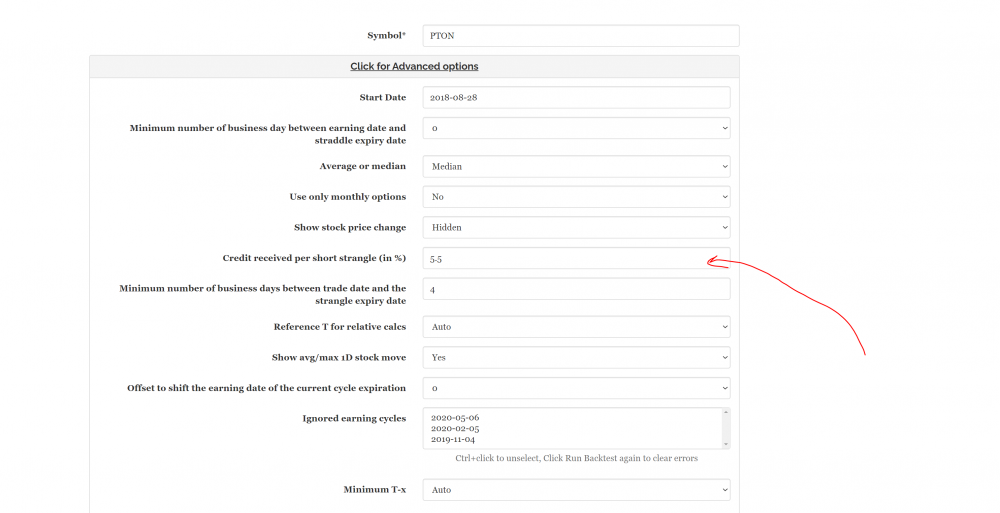

The horizontal blue dashed lines? If so, these are meant to simulate where the RV would be if you were able to sell strangles to reduce the cost of the straddle (i.e. the hedged straddle). I think the default is set at a 5.5% or 6% credit (you can check by opening up the Advanced Options - see image). I was confused at first on how this was calculated as I thought it was looking at actual strangle prices for each option but its not that sophisticated (sorry djtux), rather, it just takes a straight X% deduction for each week where you can sell a strangle and it plots the blue dashed line at that new adjusted RV level. If its a low IV stock and the blue dashed line is below most of the RV lines at T+0 than that usually means its a good candidate to sell a hedged straddle but then you have to really look at the option chain to see how much credit you can get and how far out the wings are.1 point

-

If I may post a contrasting experience to @yalgaar's... I am the newest newbie when it comes to options trading. After being a long stock investor for decades, I decided this year, after the crash, to figure out what options could do for me to provide a hedge. I did some free online courses, listened to a lot of podcasts, and then managed to lose thousands of dollars buying puts on a stock in an industry I am intimately familiar with, learning the valuable lesson (again, but with options this time) that the market doesn't care what a fair valuation is, and that it could stay irrational much longer than my options' expiration. I now realize this is a fairly typical entry for many a new options trader. I then sampled a few trade advisory services and then ended up here, intrigued of course by the returns, but also by @Kim's articles here and on Seeking Alpha. I joined SO in July. Since then I've done 7 trades: 6 official (BYND, UBER1, UBER2, LOW, BBY, BILI) and one unofficial (XLNX). Only one has been a loser (UBER2) My tips, all of which have been gleaned from advice from members here: 1) As everyone here seems to repeat Ad Nauseum, "Don't chase the entry!" For me, this means that if I can't get in within 2-3% of margin on official, I let it sit. From a post here I learned how to plot the strategy price so I can see it move during the day. I might place a day order for the first day, or even 1-2 days after the official notice, at the official price (or within 3% of margin if it looks like it will not go down), and then I just wait. If it doesn't get filled, I just walk away from the trade. As Kim has pointed out, the prices do sometimes go well below the official. 2) Once I get a fill, I immediately set a GTC close order because I'm on the other side of the world, and I can't be bothered to sit in front of the computer all night. For an earnings trade, if it doesn't get filled prior to the earnings announcement, I would plan on walking up before market close to close it, but I have not had to do that yet. My average GTC target has been around 10% return on risk, but I'm not stuck on that. Apart from SO, I'm playing with both VolHQ and ChartAffair, and I realize now that I'm going to need OptionNet to visualize potential trades better. I use IB but their option "Performance" visuals are lacking. But that is all I plan on getting. I am now reading books by Wolfinger and Augen, and I'm fully aware that this journey is going to take years. The more I learn, the more I realize how little I know. My results thus far: for the 6 winning trades I have averaged around 10% (unsurprising I guess given my target, but very surprising to me given that the average time in market was around 3 days per trade), and I lost 0.5% on the one loser. I'm glad to report that my first 2 months have more than paid for my subs! More importantly, I've learned A LOT in just a few weeks, and the curve remains very steep, but here I feel there's a culture of mentorship, something I'm going to need.1 point

-

I don't mean to sound indifferent as I remember feeling like this too. I remember getting so excited about the official SO performance and I was day dreaming about all that money I was going to make. Each time I saw Yowster and other make profits when I was losing money felt like a knife being jammed into my heart. It sucked. I get it. Based on my own journey - the sooner you stop trying to duplicate the official trades and admit to yourself that you cannot duplicate them the better. Unsubscribe from the SO alerts and just follow the unofficial trades and the trade discussion group to see what people are looking at (many times you find these trades before the official ones giving you a chance to get in early). Are Kim and Yowster trying to pull a fast one on us? No - but you also cannot replicate their trades exactly because some of these trades have low liquidity. As soon as any market maker sees 100s of orders coming in at the same strike they are going to raise the price of the options. This means you will always get filled on the losing trades and maybe get filled on some % of the winning trades. This can easily flip a strategy that makes 50% a year to one that makes 0% per year. So - once you admit that to yourself you have two options: 1) Give up. Move onto the next guru who claims they can make you a millionaire. 2) Figure out how you can make this strategy work. Whenever you miss a trade you can complain which won't change anything or instead ask Yowster what exactly he was looking for when he entered. Learn from him so you can spot your own trades and maybe get in before everyone else. I went from complaining about SO and quitting here to just closing out several calendar trades for 30% each. None of them were official trades or even mentioned on the board here. Just used the information Yowster teaches us and VOLHQ to find my own setups.1 point

-

I've read this whole thread . . . nice to see it kind of come full circle - back to more of a constructive tone. It is very hard to have good "context" when using remote "conversations" via the WEB - so we all need to have a flexible and empathetic attitude when discussing ideas, Pros/Cons, issues, etc.. Good to see that most of us really do want a positive and productive discussion (even if we have to circle around a few times). In addition to your two points above, I'd like to add a third one (with some background): One of the lessons I've learned (and the hard way - as always) is that it is VERY easy to actually get into trades . . . and it is a lot harder to get out of them. This is especially true when things aren't going your way. Most non-professional traders tend to put too much hope and blind optimism into their trades - they don't manage their risk well (getting into and especially getting out of trades). It is easy to be emotionally involved with a trade - and not let it go and move onto the next. Overall trade and risk management is KEY to making money in the equity markets - all of them. I've learned to manage my trades a LOT better due to what I've learned on SO --- and this applies to general stock picks as well as options plays. To me (outside of good entry strategies), it is the most important thing I do. When something isn't working, get out of it, stop doing it, re-group, review your trade logs, seek help, etc.. Don't keep riding a three-legged horse, hoping it turns into a four-legged horse. Also, we have to remind ourselves of the fundamentals --- did we have a good setup/strategy, has anything changed in the overall market or context that requires us to adapt/morph what we do? These last few months have caused me to constantly review/analyze what works FOR ME and what doesn't. In the end, we are all responsible for adapting what we learn on SO to our style of trading - given our time allotments, account size, technology we use, mindset, emotional makeup, etc.. I give @Kim, @Yowster and many others credit for showing their ugly babies, discussing what isn't working - in THIS market and being willing/able to adapt and change. This is key . . . Anyway, too much coffee on a Saturday morning . . . . hope you ALL have a fantastic weekend and a very successful next week in the markets!1 point

This leaderboard is set to New York/GMT-05:00