SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/17/20 in Posts

-

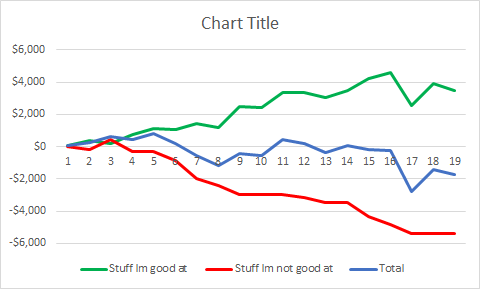

Hi @yalgaar the approach I took was to dump all of my trades out of ONE into a spreadsheet and categorise them by strategy (ie. hedged straddle, earnings calendars) and origin (SO or myself).....closed trades only. From there I looked at the weekly and cumulative P&L of each strategy+origin combination. I used this to get a sense of consistency. From there I grouped the different strategies into 'stuff im good at' and 'stuff im not good at'. I continued doing the stuff Im good at and moved to paper trading the stuff Im not good at. Taking this approach allowed me to focus my learning. I learnt that Im good at executing SO Earnings straddles but I burn money when I try to do them myself. This caused me to focus in on the differences to which I identified that my entries suck. This has lead me on a path of learning thats improved my entry skill on all trades. TLDR: You would have done a lot of stuff my now....pick through what has worked and what hasnt. Focus your energy on improving one thing that hasnt been working...then move onto the next thing.5 points

-

Hello @yalgaar First of all, this post is not to contradict you or criticize in any way, most of all is to describe my personal experience with the service. I subscribed in September last year after two years of trying to be profitable at my options trading and did not went live until late January of this year. So far I've been profitable (not by a great amount) but at least is much better than my previous two years. I've had have no trouble getting in trades at official prices but some of my exists had not been as good also, I've missed a couple of alerts that made my profits be not as good. What I am trying to say is that experience has a lot to do in the options trading business and that if you expect to be proficient in your first year, even using SO, that expectation is a little to high. Many books and people I've read suggest paper trading for at least 6 months before putting real money on this business also, read as much as you can because knowledge is your main advantage in this game. Finally, what has worked for me is: 1. Don't chase trades. 2. Set GTC orders to get out. 3. Try to make at least one trade a week on your own, If you fell that you are at a dead end and really frustrated, take a break from live trading and start from scratch on paper trading until you get used to trade the strategies. Is better to not make money because you are paper trading than loose real money out frustration at the markets. Best.3 points

-

I wanted to start this thread to discuss what and if I am doing something wrong and maybe even suggest some positive improvements that can be made. I will first start this with declaring I am not making any money using Steady Options so far. As a matter of face I am down around 10-15% of my funds since I started. This is absolutely not intended to criticize this service. The intention is to get to the root of the problem and understand what could be going on. That said, I am going to list the following observations and would love your thoughts about the same: 1) So we all understand this is not an alert service and should not be used that way. I would like to confirm this again since when used as an alert service, it's very unlikely to make money from it. My P&L confirms this. My understanding is that when you are following official trades....you are not getting the same fills as the official trades. In order to get a fill, you end up giving away more money so you end up never matching the performance of official trades. If/when you choose not to offer more money to get the fills, you will more often not get filled at all. I have raised this concern few times but I have been told there is enough liquidy for the underlying that we should be able to get filled at official prices or better.....but it evens out. I personally do not believe this. I have attempted to take every single official trades within reasonable time of it being announced and either do not get filled at all at official price or I just end up spending more to get filled. This happens for over 70% of official trades (my best guess) I am just emphasizing the importance of setting up expectations that Steady Options just cannot be used as a "Alert Service" It will not make you any money. Most likely you will lose money. 2) Ongoing Cost: I find it quite frustrating to have an ongoing cost of closer to $300 a month for the service itself and bare minimum tools required to understand the trades and the dynamics of those trades. That spend would be justified if you could even create returns close to it by investing/risking 10K. But I have not been able to even create ROI for a 10K account even to be able to break even with the cost involved. 3) Learning: I sure have learnt a lot in last 3 months of being on this. I have spent countless hours going through hundreds of articles and thousands of posts here but honestly I still don't find myself having an edge to create a positive returns for my capital. I sure do understand a lot of things better about Options trading before I had joined. But I believe I still can't convert this acquired knowledge into money even with decent funds to invest. 4) Continuing the last point....is it really so difficult to make money Options trading? I mean with 100s of members here with all the great knowledge, why am I not able to still make money? Is it just me? I am really curious how many members here are able to make decent returns. What are they doing differently? I don't claim to be the smartest person....but I do have basic sense to judge what I am capable of and what my weaknesses are. Why do I still not make money here? @Kim Again I would like to clarify that this post is not intended as a complain but an attempt to understand what I could be doing wrong and how I can improve on it. I still believe that by making some changes somewhere (I don't know) any and all members here can achieve same or even better performance than the official trades. I would like to achieve that but I am still not able to figure out how.2 points

-

Last point first - yes it is very difficult or a lot of people would be doing it. Whats even stranger is that this is one thing you can be fantastic at and still there will be moments you lose money. The psychology of options trading is possibly one of the hardest things to cope with before you start earning money. I did 20 official trades since June 1st and made 1.12% on those trades in total - so you are not alone in finding it challenging at times. If I include my own trades partially SO inspired I actually lost some money -2.05% in this period. It was a challenging time but due to work issues also had less time to devote to trades and this showed immediately in the losers - the loss is caused by a couple of big losers. The fact I also happened to trade the two big Yowster losers of the past 1.5 months is coincidence. There will be moments like these and the thing to do is to maintain discipline both in terms of risk, entering prices and sticking to your strategy. You havent really said what you have learnt - for me what I learnt and how much more refined my own trading became is what I am happy to pay SO for. This extends beyond just my own knowledge - others have selflessly given their time and effort to do stuff I can understand but not do on my own. I can however use what they made and this has helped me do trades on my own - in fact most of my trades are not official SO trades though many are inspired or variants of them. Certainly I never understood the volatility instruments and their usefuless for options trading until I came here. The cost is a consideration - I belayed joining SO until I felt my portfolio could justify such an investment. Whats more the moment I joined I realised the usefuless of Vol HQ and ONE and so wound up spending even more than just the SO fees. The key thing is that through SO I figured out that those really are KEY resources. There is a million for pay stuff on seekingalpa - I never could figure out whether any one of those services is really worth it or just someone getting paid to publish their trades. On a 10K portfolio the SO price is a pretty penny but then again - personal opinion once more - I find 10K not enough to have a real options portfolio. Better start with stocks and have some patience. For a variety of reasons I didnt have more than 10K kicking around for years and so though I traded options since the eighties there was a hiatus of more than a decade in which I didnt trade a single option at all. You simply need to have the liquidity to cover losses and adapt positions at times - like I said above - you will lose money at times sometimes weeks and weeks in a row. The fills question - if you dont like the fill change the position to one where the fill is better or wait. I find this as tough as the next guy and will usually pay a 1-2% more but really that should be the limit - SO doesnt try to hit 25% all the time so if you lose 2% on entry and 2% on exit you may wipe out any real profit of a trade. Better to wait for a good price or simply develop your own trade where you werent competing with the 100s of members trying to enter a position.2 points

-

Just my thoughts... SO Monthly Fee - You can certainly replicate the research that SO does. But I am sure you can not do the research at anywhere near the cost of the SO subscriptions. I am aware that this takes an inordinate amount of hours to accomplish oneself. In my opinion, the real time research and resulting 'Discussion' topics are worth the price of admission alone. Add to that that we get to follow 'Professional Full Time Traders' into and out of trades has proven invaluable to me. Add to that the discourse of the discussion topic where an active exchange is taking place regarding a detailed trade. Add to that the Strategy thought process and historical trades (and discussions). This is some of the best money I spend every month!! Tools - Over time I have adapted the trades and strategies to other symbols. In my opinion some type of Analysis software is a core requirement. ONE is excellent and overall a small price to pay for the capabilities it provides. The historical data and visualization capabilities are first rate. Execution - Every time the service opens up to new members the first thing we here is 'I can;t get the fill'. Search and you will see 100's of posts on this topic. They all generate essentially the same response. Patience, Learn the strategies, Make you own decisions. I don't take every trade. Sometimes I was not at my computer when the alert came out. Sometimes I can't get the fill that day and neglect to keep tracking for a potential fill in the following days. Sometimes I am just not comfortable with the trade. There are strategies and symbols I like more than others. Sometimes I am at full allocation. With that being said, I found that OS generates plenty of potential trade opportunities. Especially during peak earnings months. I think it often gets overlooked that you do not have to match Kim's prices to do very well. As is often mentioned when the 'How much more do I pay to get filled' question comes up. However much your comfortable paying. The guidance is given repeatedly to think in term of percentage of risk. A nickel is not a nickel without knowing the risk. So, It is a process!! But there are clearly a decent number of members hear that have gone through that process and are now making money.2 points

-

We had quite a few topics discussing similar issues. Here are couple topics I recommend reading: Best Practices/Tools Last 2 months Performance (your topic actually where you got some very advice). To address your points: 1) We recently started tracking trades where members could get a [BETTER PRICING] than the official trade, on entry, exit or both. Please take a look at this list - this is from the last few weeks alone and not a full list. 2) As I mentioned on several occasions, I believe that looking at SO subscription cost (or the cost of any tool or course) as percentage of your account is a mistake. You invest in your trading education. You invest in your future. You expect that what you learn will help you to improve your trading and your profitability going forward. In the same way as people who pay $5-10k for educational course or mentoring program don't expect an immediate return on their investment. 3) This is related to 2) I'm sure nobody expects to become proficient in any area in life in 4 months (engineering takes 4 years to study). It's a process that takes years not months. In no way I'm comparing SO to what is offered at University, I'm just comparing the time it takes to become proficient in any area. 4) Yes, it is difficult and it takes time. If it wasn't, millions of people would become very rich very quickly. But again, why would it be different from any other area in life? To answer your question more specifically: I don't think you doing anything wrong. Just give it more time, and don't forget that those are very challenging and uncertain times, and even much more experienced traders struggle (just to remind you that July was our first losing month since last June). Add some inevitable mistakes you will make trading new strategies (this is why we recommend starting with paper trading) - and here is your answer2 points

-

My two cents: I've traded options off and on for over 20 years, mostly spreads, lots of verticals, some singles. My work was always either all on or all off, I did contract work. So I would trade when I wasn't working and then stop when I got the next job. I've read tons of books, gone through the big McMillan book and study guide literally twice over the years. I've taken a couple of expensive mentoring courses. I am profitable on the SO trades and profitable (not as good) on my own trades done in the styles that I've learned here. I don't think I can improve on the points other SO members posted above. I just want you to understand that as a non professional, even though I've had lots of experience and education in options trading, I still spent the first month trying to understand some of the SO vernacular and style. I still don't get some of it. Options trading is a massive subject. If you are starting out, SO should not be your only educational resource. As far as the SO add ons as I call them. I hope I don't make anybody mad at me but I like thinkorswim better than ONE. And since I'm colorblind, the RV graphs on VolHQ are useless to me. SO I'm not paying for any of the other add ons and I agree that 300 per month is too much for a 10k account. My original options classes back 98 or so only lied to me about two things: I could do this in my spare time and that it was easy. So, don't quit your day job, give yourself time to learn.1 point

-

@yalgaar I had the chance to find Steady Options just before August 1st before the door was closing for new members... I am a "newbie" here but I have traded for many years. Concerning points 2, 3 and 4... I can tell you already that I am sure that I personally have learn enough to pay for my first year of subscription in 3 weeks... In this cost I account for the money I have made and mostly what I save by "avoiding bad trades". You can lose 1000$ in the blink of a an eye with a bad trade. Steady Options is offering the chance to learn limited risk strategies (priceless), discover new trading tools, new ways to assess the edge on possible trades (RV to trade straddles for example), a deeper understanding of the greeks and the chance to read opinions and suggestions many options experienced traders with a passion. Trading can be very lonely... As for the cost of trading (Point 2) I have learn with time that "If you think Education is costly, try Ignorance!"... From what I have seen so far, I am 100% certain you more than you pay for at Steady Options but by when I did decide Steady Options membership I understood that I was the captain of my own ship... On the other end (and it is not a critic) if you spend 300$/month on a 10000$ account it means that you have to make 36% a year and then you start to be profitable... It's not an easy job if you only see the short term ... I have seen enough so far to tell you that what Steady Options has to offer is a very valuable set of tools to make me (and you) profitable. No doubt in my mind. Now we need to learn how to use the tools we are provided and make sure I don't hurt myself " by misusing the tools..." FYI I already started to make my own trades with the minimum number of contracts because I know I will make a couple of mistake. I just want to make sure that the mistakes I will do will not be too costly... paper trading never offered me the same psychological challenge as real trades. We, as trader, are almost always the weakest link in a trading system... I would add to what @vitalsign0 mentioned i.e. "Options trading is extremely difficult" by saying that trading is puzzling. As Alexander Elder mentioned in one of his book “To win in the markets, we need to master three essential components of trading: sound psychology, a logical trading system, and an effective risk management plan.” Steady Options offers, no doubt in my mind, basics for a logical trading system and an effective risk management approach. We, as trader, have the very tough job to have "a sound psychology" and it is the true challenge to be consistent. Keep in mind that I am only beginning to grasp how to trade the "Steady Options way" but I am convinced that the methods and the education offered here are worthy and I rest assured that Steady Options method has an edge. The track record don't lie.... I would suggest you to stay patient as the system here requires practice and patience. To finish with your first point, I just want to share that in the past weeks I already had the taste of what it is to be unable to have good fills. On the entry and on the exit.. I know I paid a too much at least three times to get in a trade. I also got out of a trade too early. I also kept one trade open too long... and finally I have been completely unable to get a good fill on one the trade I was trying to take... I finally never took that trade... Honestly It's frustrating but since I have been trading for years ...I see this a part of the learning process. No doubt @Kim and @Yowster know their stuff! I can only suggest to be patient and follow the "house recipe" i.e. "Understand the trades and try to make them your own.". Good luck!1 point

-

Very sad that as Canadians we pay more for the same item almost everywhere. Cars are much more expensive here, the internet and cell phone plans are pricier and even Amazon.ca has prices far more than Amazon.com for the exact item. As a positive note, I contacted Tasty Works and they gave good News of coming here soon.1 point

-

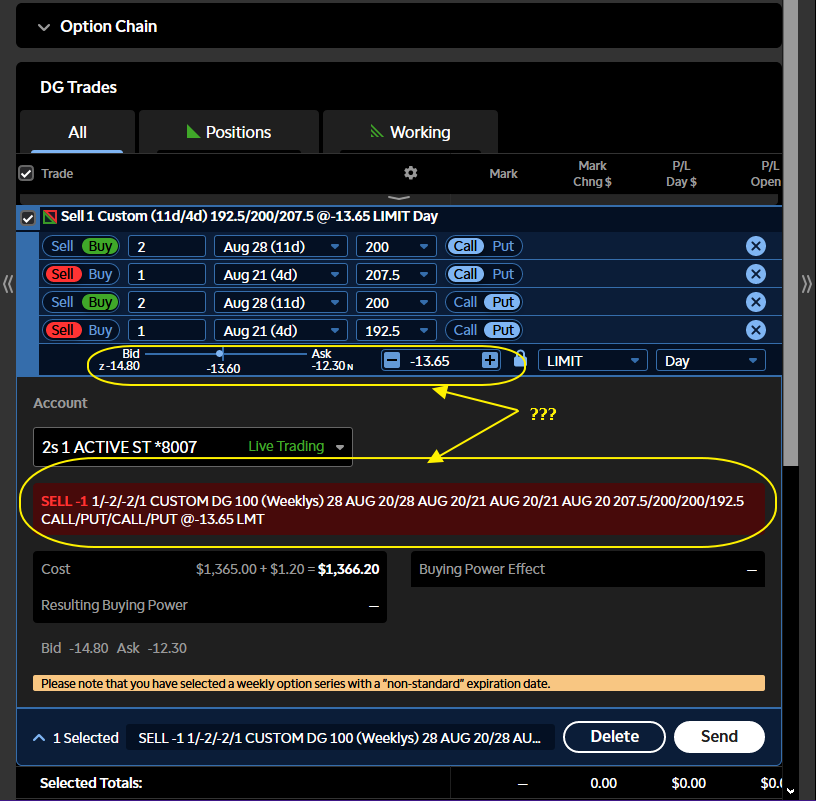

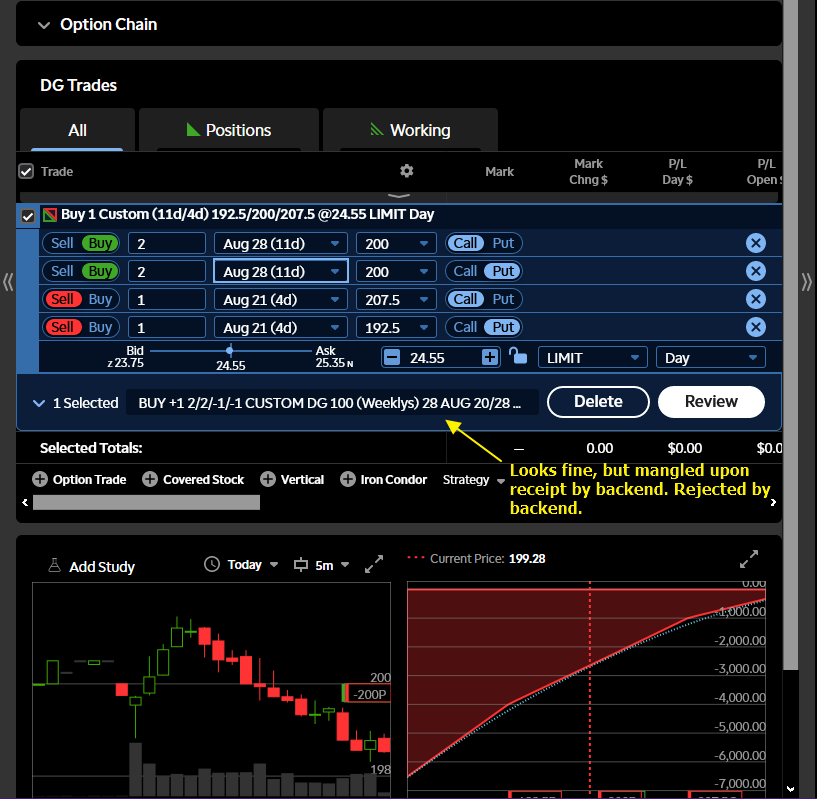

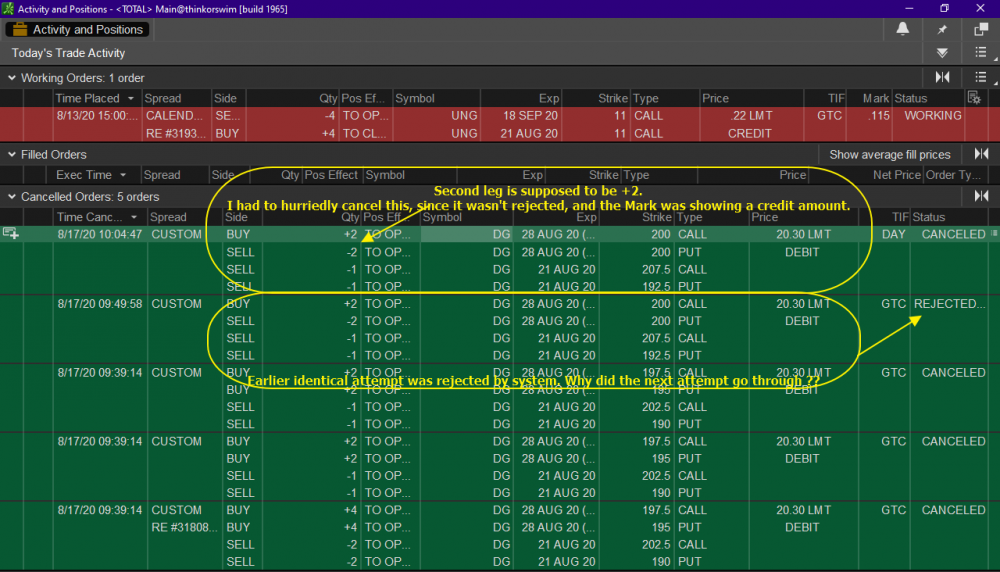

The desktop did come up, but it went back and forth. It's down again. About the web-based app. Be careful - IMO it's horrendously over-simiplistic and over-prettied. I tried to use it and it was extremely wrong and inconsistent in how it constructs the order ticket, and how it's received by the backend. I called tech support, and they were able to replicate it. To give you an idea, see these screen shots.1 point

-

An additional insight that Id throw in is that trader 'skill' in entries/exits/ market common sense is a very underated factor amidst all the focus on strategies and set ups. In A Trade to Fade the VXX Im doing well enough but even though its my trade my returns are lower than some other others trading just simply because theyre more experienced and have a better sense of when to get out/when not to get spooked. Ive learnt a tremendous amount by flying blindly into unsafe conditions or being too conservative (and seeing how others have reacted and why).......so I 100% upvote @Patricios recommendation to do at least one trade a week off your own bat. The official trades can give you a good set up but they dont nessesarily help you build your entry/exit/market sense and I suspect that is equally if not more important than the setup/strategy.1 point

-

I've been trading options for 5 years and the first 3 were not profitable. Only within the past 2 years have I made any money. Trading options is the hardest thing I've had to learn, which is partly what I like about it, the challenge. The hardest thing I've had to learn is patience. The Steady Options service was a critical part of learning that. For a long time I was addicted to selling at a loss out of panic. If you just want to make money, go buy the SPY and enjoy other things in life. Options trading is extremely difficult. Services like SO will help you learn, but will not guarantee you money. Although I have made money using the service and following the trades.1 point

-

For what its worth, I joined the service a few weeks back after educating myself in the basics and to practice I spent the last couple of years trading simple (directional) set ups such as cash covered puts, LEAPS, synthetic longs, bear/bull spreads (And I still do). I am sure that had I joined a couple of years back I would have been hopelessly lost. I now feel I have a few handles to begin to understand some of the discussion and subject matter, but my learning curve here is indeed quite shallow, SO is challenging my mental faculties, I’ve learnt more (Tried to anyway) in a month than half a year prior. My advice to any new/aspiring members would be to make sure you’ve got the basics covered very well, ideally before joining. It’s the only way to be comfortable with entering and exiting trades ‘on your own’ which is the intent I think. Until then, and this has been emphasized in the must read sections: Learn and paper trade until you’re comfortable (or be comfortable with some losses as part of the learning experience).1 point

-

Yes. We discussed actually Spitznagel's returns here."Spitznagel included a chart in his letter showing that a portfolio invested 96.7% in the S&P 500 and 3.3% in Universa’s fund would have been unscathed in March, a month in which the U.S. equity benchmark fell 12.4%. The same portfolio would have produced a compounded return of 11.5% a year since March of 2008 versus 7.9% for the index." This is not exactly apples to apples comparison. I assume the fund itself would be losing money all years, but the mix is what makes it so attractive. It's some kind of hedge, but the one that doesn't lose in up markets. (off topic. You can comment on Spitznagel fund in the original topic)1 point

-

Same here. iOS works, and also their new web app at thinkorswim.com is working on PC (but whole new interface to learn).1 point

-

1 point

This leaderboard is set to New York/GMT-05:00