SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 04/03/22 in Posts

-

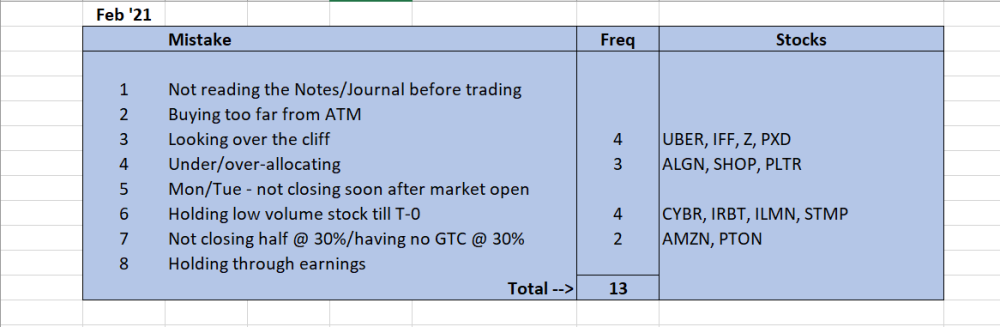

Over the years, I've made many mistakes when trading calendars - some really silly and basic ones, some I'm proud of, but most I'm ashamed to admit. Basically, I screwed-up often and consistently. So, one of the things I started to do to reduce this, was to actually keep a track of my mistakes. Emotionally, it was very easy to just "overlook" the mistakes I made and move onto the next trade. I think this is called Avoidance or Denial. I did both. And I did them very well. But writing down my cock-ups was tough, because I was looking in the mirror and having to answer to myself. Not an easy task, as the ego would get in the way, but it was a task which I found immensely useful. Sometimes, in trading, as in many other things, simple and basic tweaks can have a significant impact on results. So, I created a simple page in my Excel journal, just for my errors. I display below the entry from Feb '21. It's nothing ground-breaking; it's simply a list of the types of mistakes I made, how often I made them and what stocks were involved. (This is just for Calendar trades.) Just for clarity, the descriptions are as follows : 1. Not reading the Notes/Journal before trading. I keep a journal not just for the trades I take, but I include a section where I describe what my experience was with that stock for that cycle. A summary, if you like. And the aim is to read the journal summary before I open a new trade the next cycle. 2. Buying too far from ATM Self-explanatory. 3. Looking over the cliff. If I have a cal at say the 250 strike and the stock moves up to 260, then I'm still OK. The stock moves up to 265 a day later and I'm still kinda okay-ish. But I'm now getting close to the "tipping point" - any further rise in the stock price now will accelerate the loss in my cals, asymmetrically. By not taking action when the stock is at 265, I'm "looking over the cliff". Looking at large impending losses if the stock continues its upward trend and if I take no action (eg closing for B/E or small loss; opening a new leg at the higher stock price etc). 4. Under/Over-allocating. Self-explanatory. One of the best practices in trading (I found) was proper position sizing. 5. Mon/Tue - not closing soon after market open. This is a personal observation - if the T-0 was Mon or Tue, I found that my cals often fell in value as a day progressed. So, I felt it important for those situations to close early in the day. 6. Holding low-volume stocks till T-0 As mentioned in other posts, it's possible to get "stuck" with cals on T-0 where there is very little volume/OI. So, the aim for me, is to try and close them by T-1. 7. Not closing half at 30%. Oh yes, good old fashioned Greed. A classic case in Feb '21 was AMZN - my cals were 30%+, but I held on - the next two days, the market shot up, AMZN moved a lot, IV fell sharply, and my cals were now showing a -5% loss. Nice. I had grabbed defeat from the jaws of victory. 8. Holding through earnings. This is a cardinal sin which I committed many times by forgetting to close the trade on T-0. To get around this, nowadays, every time I enter a trade, I immediately put a 'Close' alert in my MS Office Calendar. As you can see, I made a total of 13 mistakes on my calendar trades in that month - that's waaaaay too large a number, and this resulted in me making a loss of the whole month - my first loss after 14 consecutive profitable months. Even just doing the basics right - eg. allocation - would have eliminated 3 mistakes. And closing the AMZN calendar for 30% profit, instead of -5% loss would have made a $$$ difference to my final returns. This list is not definitive by any means - it's just my own personal list. Every trader will have their own one. And that list will be different for different types of trades (eg. straddles will have their own peculiarities). I thought I would share the importance of keeping some sort of written records of the lessons learnt - it's not a sexy part of trading, and it's never easy admitting our mistakes (even to ourselves), but the more we can make trading mechanical, logical, mathematical and the less we make it emotional, egoistical and impulsive, the more chance we have of being profitable. Happy trading!7 points

-

The most important trading rule is to ensure that the RV at entry is good. Normally, I look to enter if the RV is below the average, but will sometimes enter at a higher RV if the VIX is much higher than normal. I trade mainly the tried-and-tested cal candidates; if I find a new stock I will only commit a small amount of capital as a trial. Yes, I scale up gradually. I rarely enter the cal trade all at once. It's in drips and drabs - buying a few lots here, a few more there. (We, as individuals, have an advantage here over the official SO trades - we can buy a couple of contracts at the 510 strike, another 3 lots at the 500 strike, etc etc.) I often have multiple strikes, a combination of calls and put cals on the same stock. Eg for NFLX, GOOG, AMZN etc, I can often have cals on 5+ strikes. Closing some, opening some others, closing some more etc. It's a fluid thing. Timing the entries - again it's mostly RV based, rather than time based - there's no particular day that's better than others. So, I have lots of orders open and sometimes none of them get filled, and sometimes I'm lucky and can buy something at a good price. Never had a hard-stop on calendars. The wide spreads, and wildly fluctuating mid-price on some of these can kick me out of a trade un-necessarily. On IB, I've often seen my cal show an unrealised -20% loss and then a 10% profit a couple of hours later, because of the way TWS calculates the unrealised profit/loss. My criteria if the stock moves too much is - "Can I close the current cal at B/E? or a small loss?" If Yes, then do so. If No, then consider opening a new cal at the new stock price (if RV still good). If I'm at T-1 or T-0, then I'll just take the loss and close. Adjustment (by opening a second cal) becomes less of an option the closer we get to T-0. Often though, I will start reducing the position size as I see the cal heading towards a loss. See above comment about have cals at multiple strikes and opening/closing cals fluidly. Other than opening a second cal, I don't hedge. I haven't added any put/call verticals - not that I don't agree with them, just that I haven't looked at the possibilities. I don't want to complicate the trade. Yes, every time. I never exceed 10% on any one stock. It's temping, but a lot of red ink in the past has shown me the importance of position sizing. Not sure what you mean my 'scaling up'. Right now, I have no cal trades open at all. But within a couple of weeks, a lot of stocks will have confirmed earnings and then I will be looking to enter - again the main thing is the cal RV. IV rises and falls in any medium level time period (say a month), and there is no way of knowing which way it will go. It doesn't prevent me entering cals. Also, with cals, as you know, it's the IV backwardation that's important - which is a fancy-shmacy way of saying "The main thing is not so much the IV, but the DIFFERENCE in the short IV and the long IV". The general market IV can fall, but if our short IV falls much more than our long IV, then we can still make a profit. (I think falling IV is more of an issue for the straddle trades, where we don't have shorts.) @SureTrader, all of this is for SO earnings calendar trades. You trade a lot of non-earnings/Index-based double cals. If you are happy to post your current/next trade on your thread (https://steadyoptions.com/forums/forum/topic/6757-weekly-double-calendars-on-indices-spx-ndx-djx/ ), then maybe we can discuss the specifics of dbl cals on there.2 points

-

Like many other new members, I went through a frustrating time on Steady Options. I almost gave up on it very early on, but luckily, I hung around. Having been here a while now, I’ve seen other newbies come full of enthusiasm and leave full of disappointment, walking the same frustration-filled path that I left behind. I’ve examined my own journey, and can break it down into various stages. So, here they are. Other peoples’ journey may be very different, but I hope that my pathway may shed some light, or give some hope to others who find themselves shouting at the cat for no reason, like I once did. 1) Initial Enthusiasm I joined full of hope and excitement, lured by the mouth-watering annual returns, thinking “If I can make even half of those returns, then I’ll be a happy-chappy”. Motivation Level : 10/10 2) Frustration with Fills Okay, I’ve been a member for a few weeks, and have tried to enter a few trades, but each time, I cannot even get close to the official entry price. I give up on many trades and enter others at the wrong price, resulting in more losers than winners. Motivation Level : 7/10 3) Frustration turns to Fury (well almost) It’s now many trades later and the fills are not getting any easier. It’s getting annoying seeing others open trade after trade and close it two days later at a profit, whilst my GTC order to buy is sitting idle on some exchange gathering dust. I’m a mild-manner guy, who wishes no ill-will on anyone, and thought I didn’t have a dark side, but the ugly monster of jealousy is tapping me on the shoulder and saying “Damn, there’s another guy who’s just closed the GOOG calendar for 30% ….AND….he’s gone in and out twice already this cycle, whilst you can’t even get in once?”. I'm anything BUT a happy-chappy. Motivation Level : 3/10 4) “I’ve had enough” Months have rolled on, my SO portfolio is not showing any gains whilst the official portfolio is showing a healthy number. I don’t even bother trying to enter any SO trades now, and hardly logon to the forums. I’m bitter and just waiting for my membership to expire. Motivation Level : 1/10 5) The last Attempt Over a year has gone by, and the anger and frustration has turned to “Let me give this lousy service one last chance, before my membership expires”. I register with one of the two charting services (ChartAffair/VolatiltyHQ), and spend the whole weekend reading up on old trades, and asking myself “Why did Kim enter this calendar at this price? How does he know that it should be a 1-week or a 3-week calendar?” I look at the RV charts and start to see that the official trades are entered at very low RV’s and every time I over-pay, I’m reducing my chances of profitability. I’m seeing patterns in the calendar RV charts – a ramp up as we get to earnings, a zig-zag pattern that allows others (who I envied) to go in-and-out of trades multiple times. Same for the RV charts for straddles. I’m starting to see why Yowster thinks something is a good buy or not. My head is filled with little “ah-ha” moments and learnings, and the next few days I watch live prices and then I do the un-thinkable – I open my own calendar trade on PANW for 0.89. The very next day, Kim opens the same Put calendar for 1.05 – Bingo! I feel a sense of un-controllable excitement, not just cos I received validation that my trade was correct, but that I actually got a better price than the official. (https://steadyoptions.com/forums/forum/topic/4106-trades-panw-november-2017-calendar/?tab=comments#comment-87397) Motivation Level : 7/10 6) Creating my own Trades I spend Nov and Dec ’17 coming up with tons of my own trades – calendars and straddles. I'm not really too sure of what I'm doing, so some are winners and many are losers. I’ve started doing something else – I’m now keeping a proper journal. Every trade is logged together with the rationale behind it. If it goes wrong, I try to understand why. I’m trading full-time and this has become all-consuming, but I am enjoying it. My knowledge and skill level is rapidly increasing. For the first time, I make a profit for the month (12.9% for Nov ’17). I’m on a high. I still try to enter official trades, but don’t get upset if I miss many. I do this for a few months, averaging around 6% monthly profit overall. I also increase my portfolio size. Motivation Level : 8/10 7) Consistency at Last Two years later, and I have traded several earnings cycles, done literally hundreds of my own trades, and I rarely take the official SO trades. Fills are not a problem, as I’m normally in the trade already, and I’m also trading stocks which are not on the SO list. Profits are decent, but I get some big losses, and the occasional losing month. I don’t like those, so I ramp-up the commitment. I decide to REALLY focus on this from 01-Jan-20. And then a dark-cloud-with-a-silver-lining comes along – COVID lockdowns. They suit me just fine: 7-8 hours a day – just me, the PC screen, charts, Excel sheets, Word documents detailing my ups/downs, cups of Earl Grey tea…..trade after trade. Total immersion. I love it. The wife has become a trading-widow. The cat is happy to be around me, cos I am no longer shouting. My profits rise to new levels, the March crash comes and goes without a dent to the bottom line. As we head towards the end of the year, I can finally say to myself that I have matured into a proficient SO trader – my risk management has improved enormously, my position sizing is as it should be, and my ability to distinguish between good/not-so-good trades has improved. I still screw up, but I keep a list of the mistakes I’ve made each month, and it’s satisfying to watch that list become smaller as the months roll on. I have finally found consistency – I’ve made a profit every single month this year. And my SO portfolio is far more profitable than my other ones. But the learning never stops – every week I read some post on the forum and think “Oh, wow, I didn’t think of that.” I’m no longer a SO member for the trades, but for the ideas and the discussions on the forum. They are gold. And I’ve learnt skills that I’ve been lacking for a long time – patience (no more “FOMO”), discipline (sticking to the rules, no doubling-down etc), no emotional trading (no revenge trades, not getting upset when a trade loses etc) The next stages are to get to grips with different trade types, like ratios. Motivation Level : 10/10 I’ve written this not with the view of “Hey, look at me”, but in the spirit of “If a dunce like me can become a competent trader, then anyone can”. If you’re a frustrated newbie, then rest assured that many of us have been there, many others are still in that place, but with determination and dedication, it’s possible to come out of the pain barrier, and see the sunshine on the other side. Happy trading.1 point

This leaderboard is set to New York/GMT-05:00