SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 12/14/21 in Posts

-

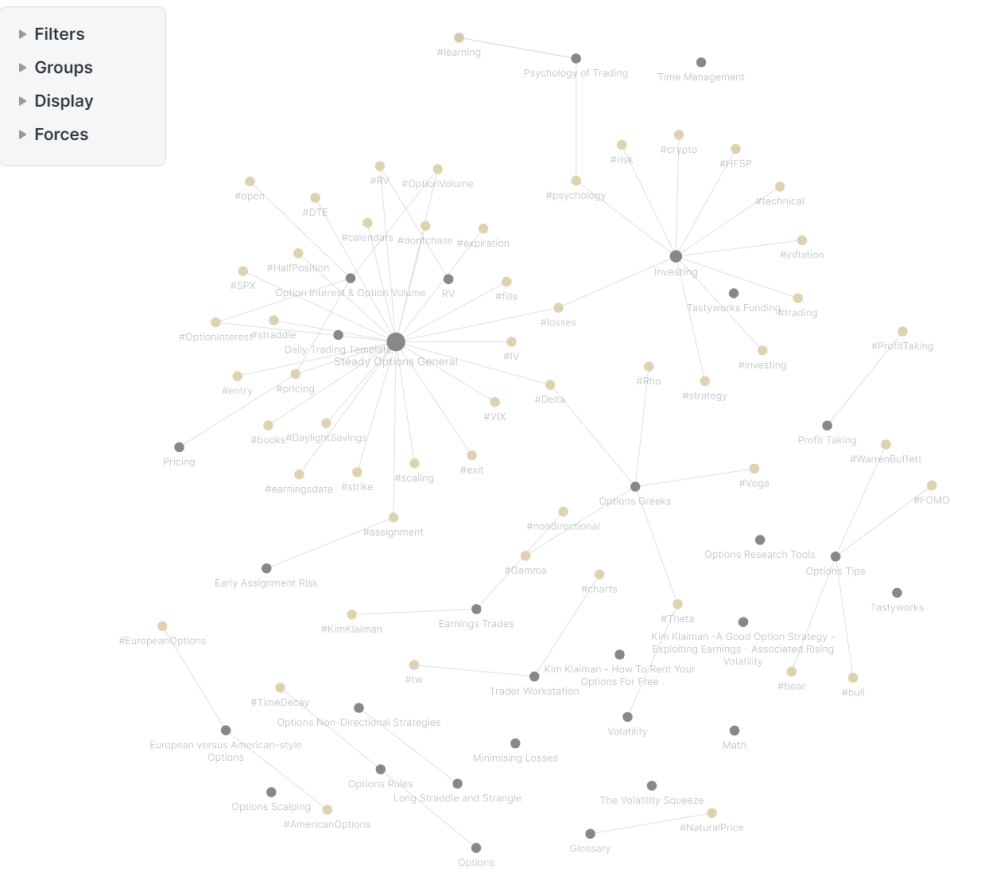

Thanks for the response Ringandpinion. I do understand the aim of Steady Options is to teach us to fish. I also understand the barrier to entry has to be high or else everyone would be trading options successfully. To be clear I'm not asking for a Wiki. At the rate I am going I'm pretty much building my own Wiki, between my Steady Options Notion database and my tagged Obsidian vault (below). As I said I am painfully aware that I am not effectively leveraging the data that VolatilityHQ provides. A simple video capture with voice over could demonstrate the functionality of VolatilityHQ in a few minutes and would be easy to produce. It's just a suggestion 🙂1 point

-

SteadyOptions FAQs What is SteadyOptions? SteadyOptions is a Premium Options Education service. We offer a combination of a high quality education and actionable trade ideas. My goal is to share my experience and to help you to become a better trader. The trading notifications are based on my real trades that I'm sharing with subscribers in real time. SteadyOptions is not a trade recommendation service and I am not a financial adviser. I see my first mission to educate you about options. Ask questions. Concentrate on your education, not on a short term performance. Please read Welcome to SteadyOptions post for more details. How do you recommend to start using the SteadyOptions? If you are new to options or to those strategies, my first recommendation would be: start with paper trading. Then start with small positions and increase the allocation gradually as you gain more confidence. How much can I expect to make with your service? It is important to set realistic expectations, but it's ultimately up to you. I never make any promises or guarantees. You can visit the Performance page to get an idea about our results. What is your trading style? We trade a variety of non-directional defined-risk strategies. I'm a big fan of the "slow and steady" approach. We aim for many singles instead of few homeruns. Our first goal is capital preservation instead of doubling your account. Think about the risk first. If you take care of the risk, the profits will come. How do I get the trade notifications ? We will post a topic in the SteadyOptions Trades forum (members only) when I enter, adjust or exit a trade. If you want to get notifications about the trades, you should follow this forum (by clicking "Follow this forum" button on the right upper corner of the forum page). If you follow this forum, you will receive an email when a new topic (trade) is posted. If you want to follow that trade, you will have to follow that specific topic in order to get notifications about the new posts in that topic. To get notifications from any forum, you need to follow that forum and then each topic individually. Read more in here. All open trades are listed under SO Open Trades. I also send the notifications on Twitter, at protected account SteadyOptions. In addition, there is also an option to "follow" a member to get his content, so you can follow all contributors who post trades. When the trade notifications are sent? All trade notifications are sent during market hours. You don't need to be glued to the computer all day, but you should be able to place trades during the market hours. We provide a full follow up on all trades (open, adjust and close). Do I have to wait for your trade alert? No. In the Earnings Trades Discussions forum (members only), I will start a topic to discuss every trade. I provide my entry and exit guidelines and profit targets. I strongly recommend that you follow that forum to see the rationale behind the trades and also to get some heads up before I actually make the trade. I encourage members to set their own profit targets and follow them. Which strategies do you use? We use a mix of non-directional strategies (members only topic): earnings plays, straddles/strangles, Calendar spreads etc. We always trade defined-risk strategies, never naked options. The focus will be on pre-earnings plays. The strategy is based on my Seeking Alpha articles Exploiting Earnings Associated Rising Volatility and How To Rent Your Options For Free. I encourage you to read those articles before trading any earnings related trades. This strategy is based on aiming for consistent and steady gains with holding period of 2-5 days. We will always close those trades before the earnings announcement to avoid the IV collapse. Please note that you will need a margin account to trade most of those strategies. Can those strategies be implemented in IRA accounts? It depends on a broker you are using. Most brokers will allow trading risk defined spreads in IRA accounts, but it's better to ask the broker. Please read more details here. How many trades do you typically have and how long do you hold them? We usually have 2-4 earnings plays with holding period of 2-7 days. In addition, we might have 2-3 theta positive trades like Iron Condor, butterfly and/or calendar spread, with holding period of 3-4 weeks. From time to time, we also trade other instruments, like GLD, VIX, VXX, SPY, TLT, UNG etc. to take advantage of special situations. How do you calculate your performance? We use a model portfolio of $10,000 and allocate $1,000 (10%) per trade (some trades have half allocation or 5%). Since we usually have around 6-8 trades at any given time, this method reflects the growth of the entire account even though we don't have more than 60-80% of the account on risk most of the time. Please remember that posted returns exclude commissions. Please read How We Calculate Returns? for more details. What is the minimum account size to trade those strategies? I recommend at least $5,000 account to start with, $10,000 is better. I do NOT recommend trading accounts larger than $100,000 due to potential liquidity issues. Are commissions important? Commissions are important for any strategy, and they are especially critical when trading multi-leg options strategies. If you are paying more than 1.0-1.5% commissions (as percentage of the trade value), it is time to change broker. See more details here. I missed the trade notification and the price is now higher - should I pay it or wait? I recommend to be patient and let the price "come to you". Most of the time, you should be able to get a similar fill as I do. In fact, in many cases, by being patient members could achieve better fills. As a general guideline, if the stock is still near the price where I entered and the trade price runs and then comes back, I still consider it a valid trade. How much should I allocate to any given trade? It is up to you and based on your risk tolerance. I discussed the importance of position sizing here (members only topic). Since most of the trades have a low risk (typical loss is in the 10-15% range), it is possible to allocate 10% per trade and still risk only small percentage of the account. Why you don't offer auto-trading for SteadyOptions service? SteadyOptions is an educational resource. I want my members to be in full control of their trading. In addition, SEC considers newsletters that engage in auto-trading to be investment advisers, and I am not licensed to be an investment adviser. So most newsletters that engage in auto-trading are breaking the law and are exposed to lawsuits like this one. You can read more details here. When you issue a trade notification, wouldn't all our orders affect the prices? It is important to use limit orders and not to chase. However, since spreads are already hedged or partially hedged, they are always easier for the market makers to handle, and they prefer those trades to single orders - there is less urgency for them to 'get flat'. The market makers must trade to make money, and no reasonable order should be difficult to fill. However, I also limit the membership to ensure the best fills for our members. I work full time, will I be able to benefit from the service? We have a lot of members who work full time. You don't need to be glued to the computer all day long, but you do need to have access to the trading platform during market hours. Usually it is okay to place the trade within few hours after the trade alert. Please refer to General FAQs for questions relevant to all services. If you have any questions related to services, subscriptions etc. please PM me or use the Contact Us form. For any trade related questions, please post on the relevant forum. Click here to subscribe1 point

-

I'm asked many times how I choose between Straddle, strangle or RIC for my pre-earnings plays. It's always a balance between risk/reward. As we know, those trades are supposed to be sold before earnings. They benefit from IV jump and/or price movement. The biggest (and basically the only) enemy is the negative theta. When buying a strangle, we are buying calls and puts with different strikes. The strangle will have the largest negative theta (as percentage of the trade value, not absolute dollars). Further you go OTM, the bigger the negative theta. If the stock moves, the strangle will benefit the most. If it doesn't it will lose the most. I found that if I have enough time before expiration, deltas in the 25-30 range for both puts and calls provide a reasonable compromise. For lower priced stocks, I would prefer a ATM (At The Money) straddle (buying the same strikes). For example, strangle on a $20 stock might be very commissions consuming, plus the negative theta might be too big. Please note that when I'm talking about the theta being larger or smaller, I'm always referring to percentages, not dollar amounts. In absolute dollars, the theta is always be the largest for ATM options. However, since those options are also more expensive in dollar terms, percentage wise the theta will be the smallest. For higher priced stocks (over $100) I will usually do RIC. Since you sell a further OTM strangle against the purchased strangle, this reduces the theta of the overall position. It might be the least risky position and still benefit from IV jump like AMZN trade. I prefer to have spreads of $5 for RIC. Since I don't know what will happen with the stock I play, I prefer to have a mix of all three. In case of a big move, strangles will provide the best returns. When IV is low, RIC will provide some protection against the theta while still having nice gains from time to time. Remember: those are not homerun trades. You might have a series of breakevens or small losers, but one down day can compensate for the whole month. This is why I want to be prepared when it happens. In August I had 4 doubles in two days (but I played mostly strangles). Generally speaking, RIC is the most conservative trade due to lower negative theta (the sold strikes reduce the negative theta). But if the stock moves sharply, strangle will produce the highest gains. It also might lose the most if the stock doesn't move and IV increase is not enough to offset the theta. Let me know if you have any questions. This post has been promoted to an article1 point

This leaderboard is set to New York/GMT-05:00