We’re there going to go what they are, where they came from, how they are used and some of the theory (yes, sorry) that you need to know to understand them.

Also there’s more info on Options Greeks.

In the meantime let’s start with looking at exactly what options are…

What Are Options?

Options in their current form are recent inventions, but the basic options form has a long history. We’ll define exactly what an option is in a minute, but first let’s try a bit of a thought experiment.

Imagine an oil company about to invest in a new oil field. They have a good idea how much oil there is, how much it will cost to extract it etc, but unfortunately they don’t have certainty on the future price of the oil produced. This is a problem because they know they need to obtain at least $80/barrel for at least the next 3 years for the new field to be profitable.

How can this company mitigate the risk of a drop in the price of oil? Well, they could go out into the futures market and contract to sell oil at a pre-set price in the future. However they would have to enter several contracts spaced over the 3 years. And they would have to take whatever price was on offer now; which could prove costly should the oil price actually rise over the next few years. So this is unlikely to be a good choice.

But what if the company was able to purchase a $2/barrel insurance policy giving it the right to sell its oil at $80/barrel anytime in the next 3 years? Should the oil price rise they have only ‘lost’ the $2 premium on the, unused, insurance. Should price fall the company would know it could get the minimum price it needs to be profitable (less the insurance cost of course).

Well the above policy is actually an example of an option; it gives the right but not the obligation to sell at a predetermined price ($80) within a set period (3 years).

Stock options

Let’s concentrate now, and for rest of this course, on options on stocks. For a price (the ‘premium’) they give the right but not the obligation to buy/sell 100 shares at a predetermined price (the ‘strike’ price) within a set period (until ‘expiry’).

Options to buy stock are call options; options to sell are put options.

Here’s an example using Apple(AAPL): a Mar13 500 Call @ $40. For $4000 ($40×100) a trader could give themselves the option (pun intended) to buy 100 Apple shares for $500/share (ie $50,000) anytime between now and 20 March 2013.

Now, let’s say AAPL rises to $600 in March. Fantastic. The trader can ‘exercise’ their option, buy the shares for $50,000 and sell them back immediately for $60,000. A profit of $10,000 (less the original $4,000 premium). Notice here that the only upfront outlay was $4,000 to ‘control’ $50,000 worth of stock. Notice too that this $4,000 could all be lost, but no more – if AAPL falls below $5,000.

(We have a more detailed explanation of put and call options here).

This is an example of the ‘leverage’ available from options: they can be used to make huge profits on minimal outlay. But a trader can lose all their money.

Option selling

We have concentrated thus far on the trader who buys an option (either put or call). But for every purchaser there is a seller; which (subject to broker approval) could be you. Why would you want to do this? To receive the options premium. An options seller acts just like an insurance company. In our AAPL example they receive the $4,000 premium which they get to keep should AAPL be below $500 in March.

The risk is, of course, that it is higher whereby the option they have sold is likely to be exercised, requiring the sale of 100 AAPL shares for $500 (i.e. less than the market price) to the option purchaser (like our trader in the above example).

Either you have the shares already, and now have to give them up for a lower than market price, or you don’t, and have to buy them in the open market for more than the $500 you’d get on their sale to the owner of your sold call. There’s therefore unlimited risk: your loss is the market price (which, theoretically, could be infinitely high) less the $500 strike price (x100).

Elements of an Option

As we have seen, for every stock option, there are the following elements which need to be defined for each contract:

Underlying

This is the stock the options relate to (AAPL in the above example) Call/Put Does the contact give the right to buy or sell shares?

Strike Price

At what price can an option be bought/sold

Expiry

When do the option owner’s rights expire?

Monthlies/Weeklys

Most options, until recently anyway, were available in monthly series. There would, for example, be an Apple January series of calls/puts at different strike prices, and then another series for February, March etc. All options would expire on the same date in the month and so, should someone talk about January AAPL options, we would know they expired on 25 January (as per the CBOE’s options timetable).

This changed a few years ago. Monthly options still exist, and are still popular, but they have been joined by weekly options.

Highly traded stocks now have weekly options available with, as the name would suggest, shorter expiry times. Options expiring every week for the next four weeks are therefore now available for these popular stocks.

Therefore, in addition to the Jan/Feb/Mar etc series, AAPL has options expiring at the end of the week, and for the 3 weeks following. This has enabled several shorter term strategies, which will be covered in more advanced lessons. Most of the examples in these lessons will be using the monthly options, for clarity.

Using An Options Broker

Options are available to buy and sell at several options exchanges, such as CBOE (the largest), via options brokers. These options brokers, such as thinkorswim, tradeking and etrade, allow retail investors to buy and sell just like the pros.

If you haven’t yet set up an account yet google them, choose your favourite, and sign up. Most of them are very easy to use and used to beginners as well as more experienced traders.

A couple of tips:

Sign up for a paper trading or virtual account allowing you to trade without money changing hands. A good way to learn.

Don’t be put off by all the fancy tools brokers provide, they are for more experienced traders and are often not too useful anyway.

Options Chains

All brokers display options prices in a so-called options-chain. Let’s look at an example (from the yahoo website):options chainYahoo.com options broker chain

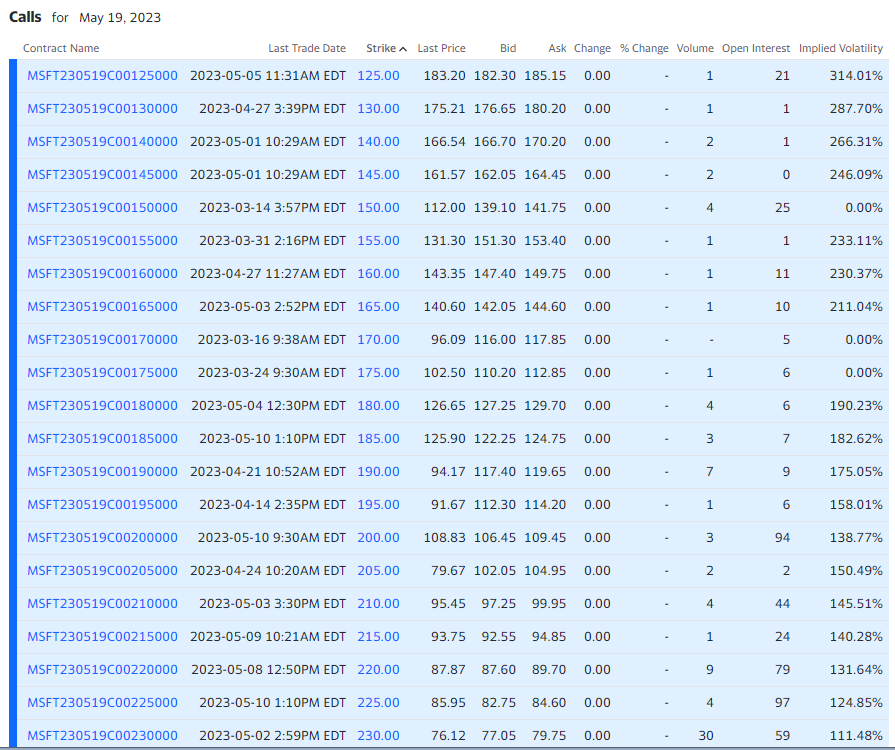

This is Microsoft (MSFT)’s call options chain for May 2023 (similar ones are available for other expiry dates too). Options chains usually include the last trade for each option, the bid and ask spread (ie the quoted sell/buy prices), volume and open interest. Some brokers also include the options Greeks.

Other data such as this option’s open interest is there too. The actual process of buying and selling options is broker specific but as long as you can read an options chain you can, with the broker’s support, learn pretty quickly how to buy and sell options contracts.

Options Pricing Models

Market Pricing

The prices for options are solely driven by supply and demand: what someone is willing to buy and sell them for.

Traders input the price they are willing to sell (the ‘bid’) or buy (the ‘ask’) the option. The best prices on the exchange are then displayed as the bid-ask spread; the bid always being lower than ask.

In our options chain above, we can see that the Oct13 108 BA put’s bid-ask spread is 0.62-0.67. In other words a trader could sell this option for 62c or buy one for 67c.

Black Scholes Model

Although prices are set by the market, traders have always been interested in knowing what they should pay for an option. And in particular how do various factors, such as movements in stock price and the length of time left on an option, influence this decision.

Up until relatively recently, the 1970s in fact, this was still largely an unknown question. Then work done by Fischer Black, Myrton Scholes and Robert Merton came up with a relatively simple method to come up with an option’s price. And here it is for a call option:

See, told you it was simple. OK, so we’re probably not that interested in the math.

Here’s an online calculator that uses the math to come up with an option valuation. Options brokers have them too. For our purposes at this stage I just want highlight the key inputs:

That is, a reasonable estimate of the fair value of an option can be determined by just the following factors: the stock price, strike price, numbers of days to expiry, volatility, interest rates and dividend yield. That’s it.

Perhaps the only tricky variable there is volatility; but for now just see this as a measure of how much the stock moves around.

Uses of an Option

So now that we know what an option is, what are its uses? Why would we want to buy and sell these things? Here are the main ones:

Insurance

The main use for options, originally, was as insurance. If you are exposed in some way to price of a stock or (more likely in the past) commodity, options can be used to insure partially, or fully, against this outcome.

We’ve already seen an example of this above.

The oil company used a bought put option – giving the right to sell oil at a pre-determined price – to ensure against a significant drop in the oil price.

Alternatively, an airline could insure against its rise by buying a call option – giving the right to buy oil at a particular price – to protect against its rise.

Similar examples could be constructed for other commodity producers/users; options can reduce or even eliminate the price risk of a key output/input (for the cost of the premium).

But what about stock options? What insurance uses do they have?

Their main use is to insure, via a put option, the value of a stock portfolio. Say you had 500 IBM shares at $200/share ($100,000), were approaching retirement but concerned about your exposure to the IBM share price before then.

You could, reasonably cheaply purchase 5 three month $180 put options, say, ensuring that whatever happened in the next 3 months, your shares could not fall below this $180.

Leverage

Options can be used to reduce the capital required to put on a trade.

Let’s say you believe Google (GOOG), at $750, will rise over the next month. You could buy 100 shares for $75,000 which, using margin, would require $37,500 of capital.

Or you could buy a 1 month call option, giving the right to buy the 100 shares at $750 anytime in the month for about $20/share.

This would require much less capital: $2,000. Now there are other pros and cons to this which we will cover later in the course – the $2,000 is completely lost should GOOG fall; but this is the most that can be lost even if GOOG fell heavily etc; the option’s value decays over time – but it is a great way to ‘control’ 100 shares for a small outlay. Finance professions call this ‘leverage’.

The percentage return, or loss, on capital is much more sensitive to the share price. A $50 rise in share price would result in $5,000 gain; a 13% increase on the $37,500 share investment.

But a similar rise represents a massive 150% gain on our $2,000 options outlay. Unfortunately this works in reverse. A $50 fall would result in a $5,000 (13%) share loss, but would cause a 100% options loss.

Speculation

This is the use we’ll be focusing on: options use in speculating on the direction of one or more financial variables.

One of these variables could be the share price, as above, but sophisticated traders can use options to ‘bet’ on other things such as volatility, time decay or the effects of earnings (we’ll look at these in more detail later on).

It is this flexibility that makes options so popular.

Think that a stock will fall? An option trade can be constructed to take advantage. Or that earnings will cause a stock to fall rapidly? Again options can be used.

Or even that a stock won’t move very much? Well, there are several options strategies that can profit from this.

Well respected options trader Jared Woodard likes to say that options are a sophisticated language that can be used to express more opinions on the market than any other financial instrument.

That explains it well: there are so many more ways to profit using options.

Common Options Trading Terms

Below are some of the common options trading terms that will make it easier to understand options:

Call option

The right to buy an underlying security with a specified timeframe

Put Option

The right to buy an underlying security with a specified timeframe

Exercise

Taking up the option to buy/sell a call/put option is known as exercising it.

Strike Price

The ‘specified price’ at which an security can be bought when exercised

Expiry

The last date an option can be exercised.

Implied Volatity

How much a security’s price moves up and down

In the money/Out Of The Money/At The Money

A call(put) option where the strike price is below(above) the current stock price is said to be In the Money.

A call(put) option where the strike price is above(below) the current stock price is said to be Out Of the Money.

An option where the strike price is at the current stock price is said to be At the Money.

Debit/Credit Spread

Option spreads are the combination of bought/sold options traded for a net cost (debit spreads) or credit (credit spreads).

Conclusion

Knowing how options work is vital to be able to learn how to trade them.

Now that we’ve learnt some of the basics we can look in more detail at some of the main types of options, call and puts, and some options spreads.

About the Author: Chris Young has a mathematics degree and 18 years finance experience. Chris is British by background but has worked in the US and lately in Australia. His interest in options was first aroused by the ‘Trading Options’ section of the Financial Times (of London). He decided to bring this knowledge to a wider audience and founded Epsilon Options in 2012.

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now