They're selling options to traders looking for big wins, and when those options expire worthless, the seller of the option gets to keep the premium he collected.

Many traders use these spreads to trade range-bound markets, where there’s a sustained technical range with well-defined support and resistance levels. These are winning trades should the market remain within the defined range through the life of the trade.

While Iron Condors and Iron Butterflies both take advantage of the same market dynamics, there are situations where it makes sense to use one over the other.

Selling Options: Shorting Volatility

Both Iron Condors and Iron Butterflies are non-directional, limited risk option spreads. Instead of trying to profit by being bullish or bearish, these option spreads are tools to make money from options you think will expire worthless.

If you had the chance to look at the options market during the GameStop madness in 2021, you witnessed insane option prices. So many traders wanted to bet against the stock but didn't want to get destroyed in a short squeeze, so they preferred to buy puts. This made put options insanely expensive to the point where you could be right on the trade and still lose money.

As a result, selling puts was a prevalent strategy to take advantage of overpriced options. These situations occur every day to varying degrees.

When you short an option, you're selling it to another buyer. For example, let's say you sell a call with a strike price of $20 on a $15 stock for $1. The stock is still at $15 at expiration, and the option expires worthless. You get to keep the entire $1.

It's well-known that most options expire worthless, so this is a compelling trade to many traders. However, the downside is your unlimited risk when shorting options. Suppose the stock in the example above was $30 at expiration. The option is now worth $15, and you're $14 in the hole.

For this reason, many traders use spreads like Iron Condors and Iron Butterflies to cap their downside. These spreads involve shorting options but buying further OTM options to limit risk.

What is an Iron Condor?

If you're familiar with other options spreads, an iron condor combines a short vertical call spread and a short vertical put spread. Put another way, it's a short strangle where you buy "wings" (OTM options) to cap your downside.

If you're unfamiliar with the dictionary full of the lingo we options traders use, an Iron Condor involves shorting an out-of-the-money (OTM) put and call and buying a further OTM put and call.

These extra OTM options we buy are used to cap our downside. Because shorting options comes with an unlimited downside, the Iron Condor has the benefits of shorting options with the added benefit of limiting our downside.

An iron condor is an option spread that involves using options to profit from a stock staying within a certain price range. Put simply, the iron condor enables traders to make profits even when a stock doesn’t move at all.

The iron condor is composed of four options, a long put and call, and a short put and call. Here’s an example of an iron condor spread:

- BUY (1) 394 PUT

- SELL (1) 400 PUT

- SELL (1) 420 CALL

-

BUY (1) 426 CALL

As you can see, you’re selling an inner options spread, and protecting the unlimited loss by buying cheap out-of-the-money (OTM) “wings” that backstop the losses if your trade idea is wrong.

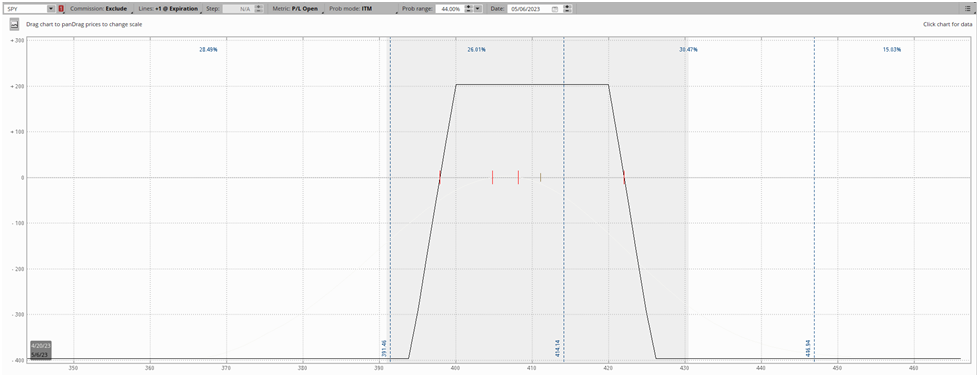

Here’s what the payoff diagram for this trade looks like:

The goal of this option spread is for the underlying stock price to remain within the range you define with your short strikes. Because we’re selling a $400 strike put and $420 strike call, we want the stock to trade within that price range. Should it remain inside this range, we make our maximum profit at expiration because the options expire worthless.

However, as you can see, our long OTM options cap our downside, mitigating the biggest risk of selling options: the unlimited losses. Of course, because there’s no free lunch, this costs us money because we have to buy options that we hope ultimately expire worthless.

Characteristics of the Iron Condor

The Iron Condor is Market Neutral

The iron condor is market neutral, meaning it doesn’t take a directional price view, and instead profits from the lack of directional price movement. Traders often refer to this characteristic as “short volatility” because you’re betting that the stock price will move less than the options market is pricing in.

You would use an iron condor when you expect the underlying stock to stay within a tight trading range and not bounce around a lot.

The Iron Condor is a Theta Decay Strategy

Because iron condors collect a net credit and are hence net short options, it is a positive theta strategy, meaning it benefits from the passage of time.

Iron Condor Payoff and P&L Characteristics

Iron condors have limited maximum profit potential as well as a limited maximum loss.

The maximum profit is equivalent to the net credit collected from initiating the trade. You can easily calculate this by subtracting the cost of your long OTM wings from your short options.

Let’s use our previous example:

- BUY (1) 394 PUT @ 2.28

- SELL (1) 400 PUT @ 3.20

- SELL (1) 420 CALL @ 3.45

- BUY (1) 426 CALL @ 1.47

First, let’s sum the prices of our short options.

Our 400 put costs $3.20 and our $420 call costs $3.45, meaning we collect $6.65 for selling these two options.

Then, we simply add together the price of our long options, giving us a debit outlay of $1.47 + $2.28 = $3.75.

Now we just subtract the debit from our credit to find our net credit, $6.65 - $3.75 = $2.90. Our maximum profit is $2.90

The maximum loss of an iron condor is simply the “wing width” minus the net credit received. Wing width refers to the distance between the strike prices two calls or two puts. In this case, we’d just subtract the 426 call from the 420 call, giving us a wing width for $6. Now we just subtract our net credit of $2.90 giving us a max loss of $3.10.

Iron Condor Pros and Cons

Pro: Low Capital Requirements

Because the iron condor is a limited risk strategy, you can execute it with significantly less margin than selling the equivalent short strangle (which is the same trade, except without the long OTM options capping your losses). This makes it a very popular way for undercapitalized traders to harvest premium.

Pro: Structure Trades With High Probability of Profit and No Huge Downside

Many option traders approach the market with a systematically short-volatility positioning. They’re constantly selling options and rolling them out further if the trade goes against them. This is a strategy that can print money for a long time until you’re on the wrong side of a volatility event. Many traders, like James Cordier of OptionSellers.com have blown up as a result.

For this reason, some traders take a similar approach using iron condors, avoiding catastrophic losses. However, this strategy has significant drawbacks as you’re harvesting significantly less premium because you’re buying the OTM options and reducing your net credit.

Con: High Commission Costs

The iron condor requires four options per spread, making it twice as expensive to trade compared to most two-option spreads like straddles, strangles, and vertical spreads. Unlike the stock market, where commissions are zero across all retail brokers, option commissions still leave a dent in your P&L, with the standard introductory rate being $0.60/contract, which you have to pay to both open and close, bringing it to $1.20 per contract.

So even for a one-lot, you’re paying $4.80 to open and close an iron condor, which is typically structured with a low maximum profit, meaning that your commissions can be a hefty percentage of your P&L when trading iron condors.

Con: Less Liquidity

The combination of requiring simultaneous execution of four different option contacts usually means it takes longer to get filled on these trades, making active trading more difficult.

What is an Iron Butterfly?

The Iron Butterfly is like an Iron Condo with a higher reward/risk ratio but a lower probability of profit.

The primary difference is the short strikes. In choosing your strikes in an Iron Condor or Iron Butterfly trade, you’re defining the range you expect the underlying to remain within.

Iron Condors are more forgiving, as that range is much wider. Iron Butterflies, on the other hand, short puts and calls at the same strike, making your defined range narrower and making it less likely that you'll profit on the trade. You will, however make more money if you're right on the trade.

Iron butterflies and iron condors are sisters. They express very similar market views and are structured similarly. The primary difference in practice is that the iron butterfly is a far more precise strategy. It’s harder to be right, but if you are right, you make much more money.

The iron butterfly is composed of four options: two long options and two short options at the same strike. Here’s an example:

- BUY (1) 404 Put

- SELL (1) 412 put

- SELL (1) 412 call

- BUY (1) 420 call

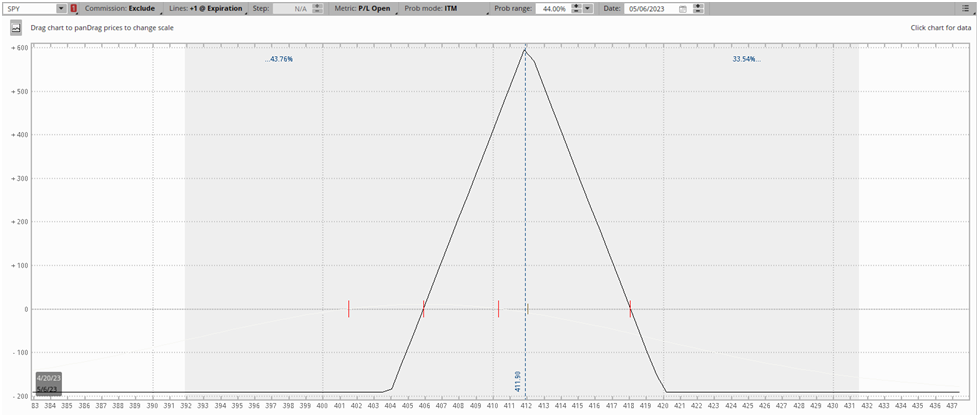

And here’s what the payoff diagram for this trade looks like:

As you can see, the character of the trade is quite similar to the iron condor except for the fact that it has a more narrow opportunity to make profit. However, when the trade is in-the-money, the profits are much higher.

So while most iron condors have relatively low reward/risk ratios and high win rates, iron butterflies are the opposite. They have a lower chance of success with a much higher reward/risk ratio.

In this way, you can have the same view (the market will stay within a relatively tight range) and structure dramatically different trades around it. The iron condor will probably work out and net you a small profit, while the iron butterfly is a more confident approach giving you the chance for fatter profits.

Like everything in options trading, it’s all about tradeoffs.

Characteristics of the Iron Butterfly

The Iron Butterfly is Market Neutral

Just like the iron condor, short strangle, and short straddle, the iron butterfly has no directional price bias. It doesn’t care which direction the underlying stock moves. Instead, the iron butterfly is concerned with the magnitude of the price move. It profits when the underlying stock stays within a narrow range and doesn’t make any significant price moves.

Due to the iron butterfly using just one short strike, the underlying stock must stay in a much more narrow range than with the iron condor. Whereas the iron condor has the freedom to define a wide range using a short put and call, the iron butterfly is short only one strike, leading to the cone-shaped payoff diagram.

For this reason, the maximum profit is much higher with the caveat that the probability of reaching the maximum profit is far lower than that of the iron condor.

In this way, the iron butterfly enables you to express a market-neutral and short-volatility market outlook with a high reward/risk ratio that would usually be a trait of a net debit strategy.

The Iron Butterfly is a Theta Decay Strategy

The goal of the iron butterfly strategy is for the short option to expire worthless, or at least with less value than you initially sold it for.

As with any short options strategy, much of the profit comes from the stock price not moving, resulting in the option rapidly losing time value due to theta decay.

Iron condors capitalize on the same phenomenon but with a different trade structure.

The Iron Butterfly Has Limited Profit and Risk Potential

The max profit and loss math for the iron butterfly is quite similar to that of the iron butterfly.

The max profit is the net credit received when opening the position

The max loss math works similarly to simply shorting a call or put. The further away the stock is from the strike price, the more the losses build until your long option hedges kick in and cap the losses.

Iron Butterfly Pros and Cons

Pro: Short Volatility With High Reward/Risk Ratio

In general, market-neutral strategies that capitalize on theta decay tend to have poor reward/risk ratios, only making up for this drawback with a high win rate. The iron butterfly turns this on its head and instead has a much lower win rate than traditional short-volatility strategies with a higher reward/risk ratio, giving you the potential for asymmetric profits.

Pro: Selling Options With Limited Risk

For many traders who lean towards selling premium, the potential for unlimited, catastrophic losses keeps them up at night. Despite the low probability of an extreme price move, black swans seem to creep up more than anyone expects.

The iron butterfly allows traders to mimic the payoff structure of simply selling a put or call while capping losses with long options on either side of their short option strike.

Con: Narrow Range of Profitability

An iron butterfly has a narrow range of profitability compared to the iron condor because there is only one short strike. This means there’s a far greater margin of error for strike selection, whereas the iron condor allows you to choose two strikes and define as wide of a range as you’d like.

Summary

Iron Condors are made up of both a short vertical spread and a short vertical put spread.

:max_bytes(150000):strip_icc()/IronCondor2-16a0be248c6949438b44ad617011a0f5.png)

Iron Butterflies are made up of two short options at the same strike and two long "wings" that protect your downside.

:max_bytes(150000):strip_icc()/dotdash_Final_Iron_Butterfly_Jan_2020-01-ee7129aab2dc4dfcbf8ab95f6d600e4a.jpg)

Remember that option spreads are trade constructions, not trade strategies. There's no inherent edge in trading Iron Condors or Iron Butterflies. They're just tools to apply to market dynamics where its more likely for markets to stay range-bound.

Related articles

- Trading An Iron Condor: The Basics

- Butterfly Spread Strategy - The Basics

- 4 Low Risk Butterfly Trades For Any Market Environment

- Using Directional Butterfly Spread

- Options Trading Greeks: Gamma For Speed

- Options Trading Greeks: Vega For Volatility

- Why You Should Not Ignore Negative Gamma

- Iron Condor Vs. Iron Butterfly

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now