Often, these same investors don’t have several million dollars to invest in commercial real estate,lack experience in evaluating real estate deals, and don’t have experience navigating real estate transactions. Managing a rental portfolio of homes is also outside the experience of many. Further, it’s quite a bit more complicated to invest in a construction deal, buy a commercial building, or run rental homes than it is to buy Apple stock.

Over the next several articles, readers will see various types of real estate transactions and the basics of how to evaluate them, andbe presented with opportunities to participate in such transactions. These include (a) construction from the ground up, (b) value add, and (c) cash flowing. This week will review construction project investing using a real-world small multi-family development as an example.

All real estate, at one time or another, is built from the ground up, and the process from that beginning point is fairly simple:

- Identify land (or property that has a building to tear down);

- Decide what is going to be built on it (e.g. multi-family townhome development);

- Build financial model to decide if the project is worth doing;

- Identify the developer for the project;

- Design the buildings;

- Secure financing/investors for the project;

- Permit the project;

- Build; and

- Exit – whether sale or rental.

Lorintine Capital is currently working on a multi-family townhome project with a development company named Ace Development in Dallas, Texas. Ace Development identified a plot of land, in the medical district, right off Maple Avenue, near two major hospitals. Ace Development perceived a current shortage of housing for doctors, residents and nurses in the area, saw that a recent nearby townhome development sold quickly, and noticed the only decent apartments nearby are fully rented.

Ace Development, with the help of an architect, proceeded to design a 13-townhome development and to conduct a market analysis of likely sales price for 2,500 square foot townhomes.

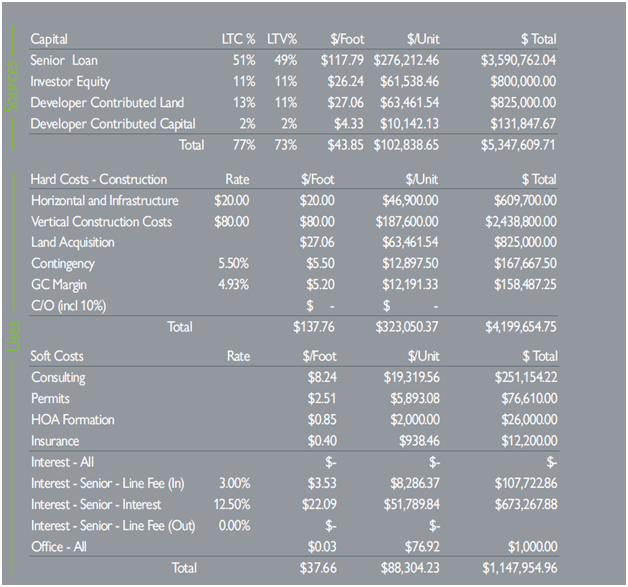

At this stage, a pro-forma needs to be created. A pro-forma is simply a financial analysis of the sources and uses of capital. In this particular transaction, the proforma looks like:

This may look complex, but it is not. The top section is an anticipated source of capital for the project. It includes a bank loan (senior loan), investor funds (investors equity), and what Ace Development will put into the project. The next two sections are broken into hard costs and soft costs. Hard costs reflect costs relating to actual construction, land acquisition, and any infrastructure that needs to be built, such as sewage and electricity. Soft costs are those that don’t have a physical component – such as the cost involved in obtaining permits, insurance, attorney’s fees, and interest or fees paid on any loans.

Hard costs are entirely developer driven. The more experience a developer has with a specific market and this type of project, the more accurate the cost projects are likely to be. Soft costs are easy to define in a fixed manner. The interest cost of a loan, the costs of permits and legal fees are known numbers. A good developer can easily and accurately build out a very reliable hard cost and soft cost projection. The difficulty and variability arise from projecting income.

Once the costs side of the transaction is built out, the developer (and his financing team) need to ensure the project can be profitable, as well as stress testing the projections and investor returns. The importance of stress testing cannot be over emphasized. Stress testing evaluates how well the investment (in this case the construction of the townhomes) will weather negative market occurrences and external events. It can also reveal hidden vulnerabilities in the returns.

On this particular transaction, Ace Development looked at the last townhomes that sold in the area and noted they sold for between $258-$270 per square foot with an average price of $265 per square foot. Recent single-family homes in the area sold for an average of around $250 per square foot. Ace Development then contacted several real estate brokerage firms and asked what they would anticipate the sales price to be. They confirmed the projected sales price to be between $255-$265 per square foot. A local bank who had funded a similar project was also asked for input, and they estimated a price of $255-$260 per square foot.The townhomes will likely be listed at the $255 per square foot price.

With this many independent sources evaluating residential space at $260 per square foot, some confidence can be felt in that number. However, one must always plan for inaccuracies. In this case, when building the pro-forma, Ace Development discounted the $260 estimate by 7.5% to come up with $240 per foot. If the project can be profitable at $240 per square foot, then the project should receive a green light.

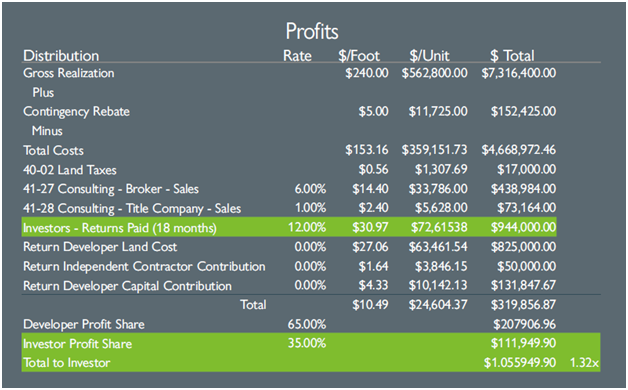

In the present case, sales at $240 per square foot would result in gross proceeds of $7,316,400.

With hard costs, soft costs and proceeds known, the next step is to start contacting lenders to see what terms can be obtained. A hard money lender made a firm commitment at 12.5% interest, which is the rate used in the pro-forma, as it is the “worst case” interest rate on the project. Obtaining traditional financing from a bank would lower this rate significantly (likely into the 6.5%-7.5%). Using worst case scenarios in projections helps minimize a possible negative variance to investors.

Next is to put together an investor “offer” and include that in the model. In these markets, I like to see investors “average” about 15% per year. This can be accomplished through any combination of (a) preferred returns, (b) investor loans, and (c) profit sharing. Typically these rates are up for negotiation if there is only one or two investors. If there’s a larger pool of investors, this needs to be held constant to treat the investors the same (and avoid complaints/lawsuits down the road).

Ace Development was targeting a twenty percent return on its investment. This allowed the developer to put an investor package of a 12% preferred return and a 35% profit share together for the investors, leading to:

The project must make sense and realistically look good “on paper.”

Once the pro-forma evaluation is done, the legal evaluation begins. This includes:

A. Reviewing the company agreement (or operating agreement if it’s a partnership or bylaws for corporations);

B. Review title to the property, closing documents, loan documents, and any other financing documents;

C. Review subscription agreement, private placement memorandum (or offering memorandum), and other investor documents; and

D. Reviewing permitting, insurance, and construction agreements.

This step is when most investors trip up. Paying a lawyer to do the above can cost tens of thousands of dollars (if not hundreds of thousands). No investor is going to put $50,000 into an investment that has $50,000 in upfront costs.

This is when investment advisory firms step in. Firms (such as Lorintine Capital and hundreds of others), put the investor packages together. As a registered investment advisor, these firms owe fiduciary duties to their clients requiring them to act in the clients’ best interest at all times. They must know what they’re doing, do good jobs on the due diligence, and be able to make competent recommendations.

This is why investors should stick with registered investment advisors over brokers. A broker’s only obligation is to sell products and to make the commissions. Registered investment advisors owe that fiduciary duty to their clients through the entirety of the project.

If any reader has interest in learning more about the above project, how to invest in deals similar to this, or just wishes to learn more about real estate investing in general, please reach out and contact us.

Christopher B. Welsh is a SteadyOptions contributor. He is a licensed investment advisor in the State of Texas and is the president of a small investment firm, Lorintine Capital, LP which is a general partner of two separate private funds. He offers investment advice to his clients, both in the law practice and outside of it. Chris is an active litigator and assists his clients with all aspects of their business, from start-up through closing. Chris is managing the Anchor Trades portfolio.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now